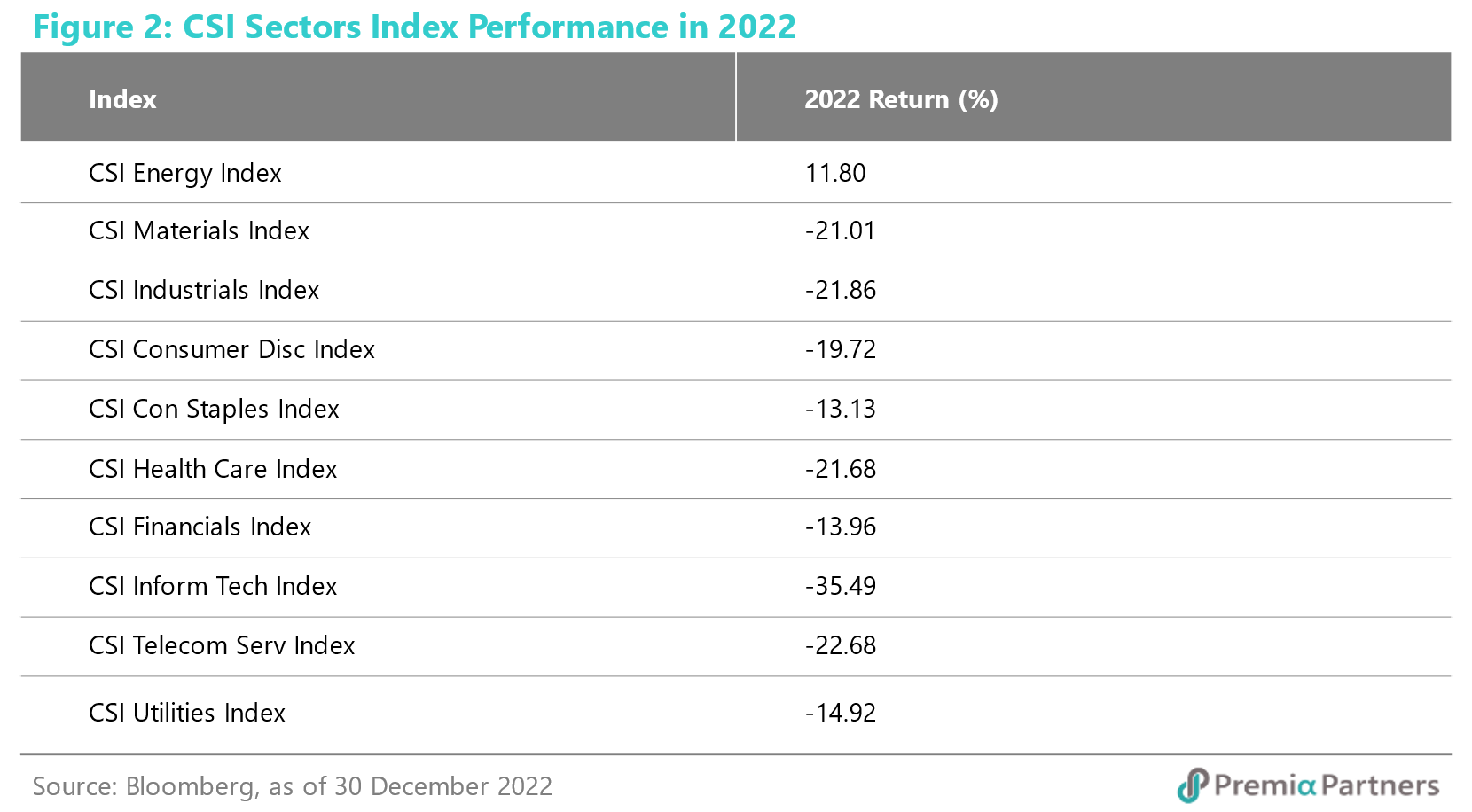

Energy was the only positive sector and coal names topped the list

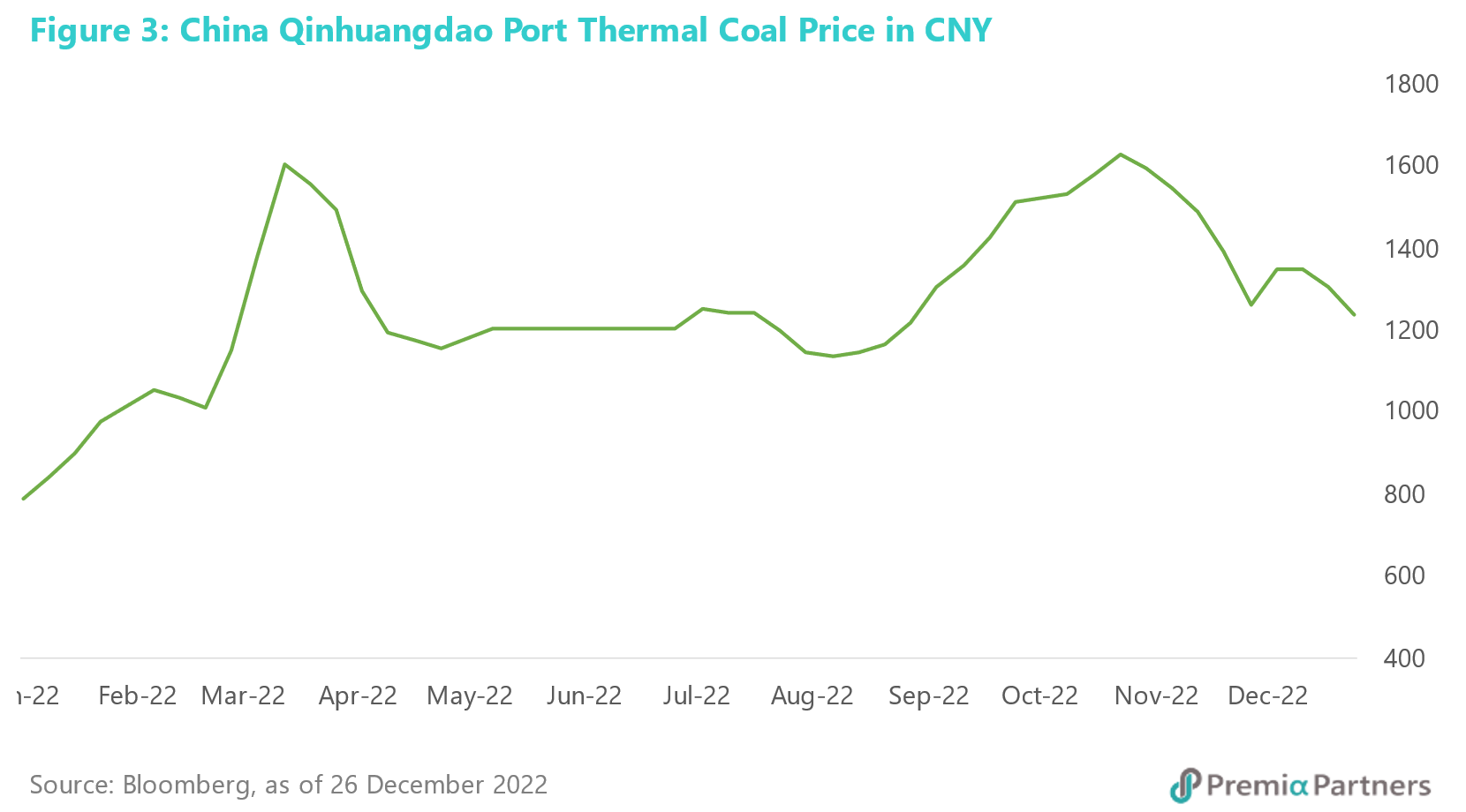

Among the CSI sector indexes, only Energy managed to stay above the watermark and the coal names which historically have also been trading at cheap valuation of around 6x PE are the main drivers. The ETF was holding coal names, such as China Shenhua Energy (601088 CH) and Shaanxi Coal (601225 CH), which rose more than 30% on average in 2022. Their returns were supported by fundamentals as their earnings were improving during the year, even though the government had imposed some price controls on the coal price. It demonstrates the effectiveness of China’s policy in balancing the interests of different stakeholders: controlling inflation while maintaining some margins for the miners by encouraging long-term contracts which are subject to a cap lower than the spot market. Although China has lifted the ban on Australian coal recently which may help increase the supply of coal in China, the coal prices may still be buoyant as domestic demand recovers on the economy reopening.

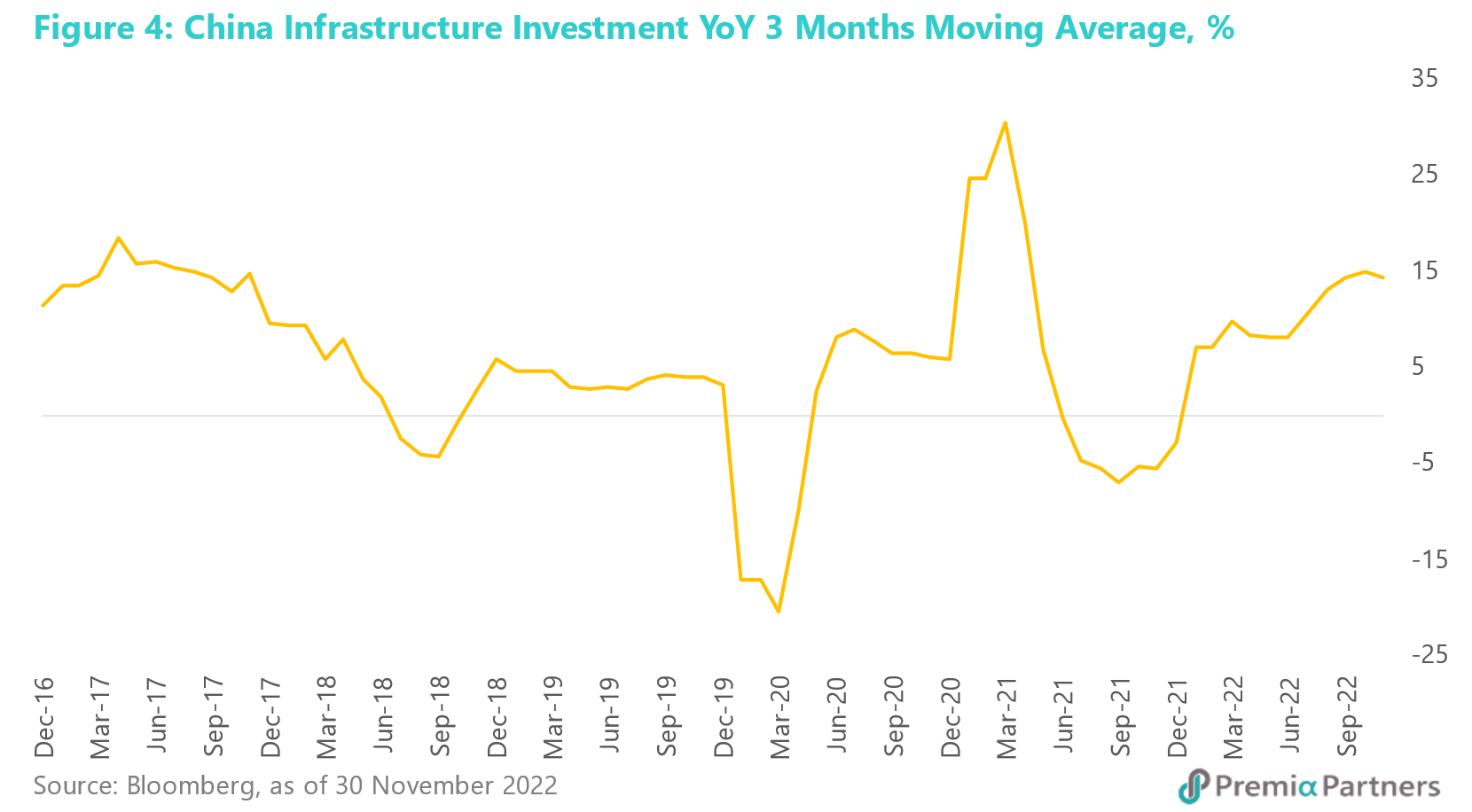

Infrastructure contractor shined amid policy support

Infrastructure contractor was another outperforming sector last year as President Xi made a bold commitment to spur infrastructure spending to boost the economy. Since then, officials discussed raising the quota for special local government bonds to finance infrastructure projects, and the PBOC injected record funds in policy banks to spur infrastructure construction. China’s infrastructure investment YoY 3-month average has been on a steady up trend since the start of 2022. In the Bedrock ETF, Infrastructure contractor, including China State Construction (601668 CH) and China Railway Group (601390 CH), accounted for more than 6% and rose around 14% on average as the market expected growth in revenue.

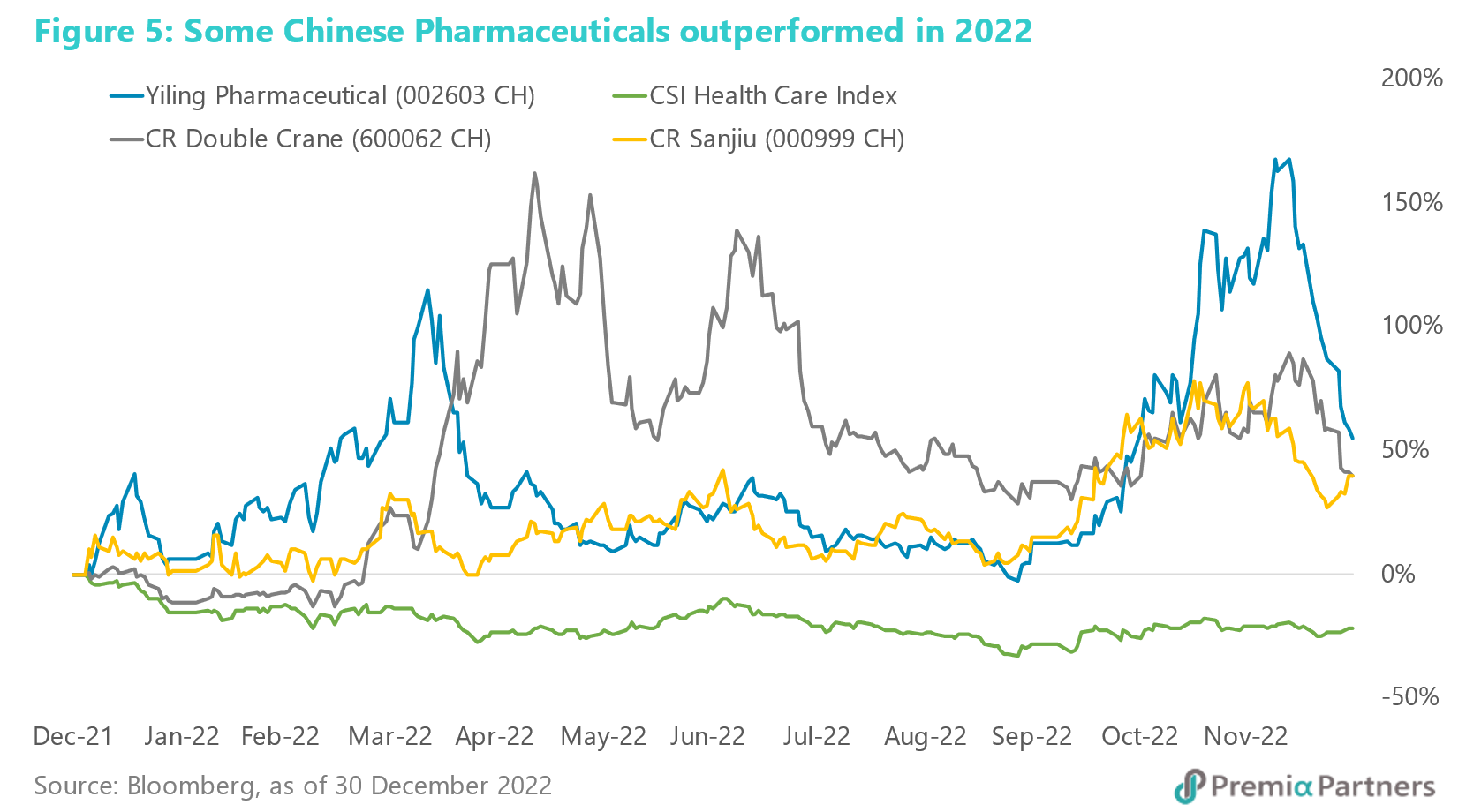

Most healthcare companies suffered but not all of them

While healthcare might have underperformed as a sector in 2022, this was not the case for companies that are related to traditional Chinese medicine or manufactures of COVID drugs however. In fact, the State Council published a five-year development plan in March to include traditional Chinese medicine in the National Reimbursement Drug List, which sent the traditional Chinese medicine shares on a rise. More recently, as China stripped COVID curbs, the need for medicine to relieve COVID’s symptoms rose and those companies that produce drugs recommended by the government surged. The Bedrock ETF was holding pharmaceuticals shares rising on average by 13%, such as Yiling (002603 CH) manufacturing Lianhua Qingwen, China Resources Double Crane (600062 CH) making dequalinium chloride, and China Resources Sanjiu (000999 CH) producing cough and cold medicines.

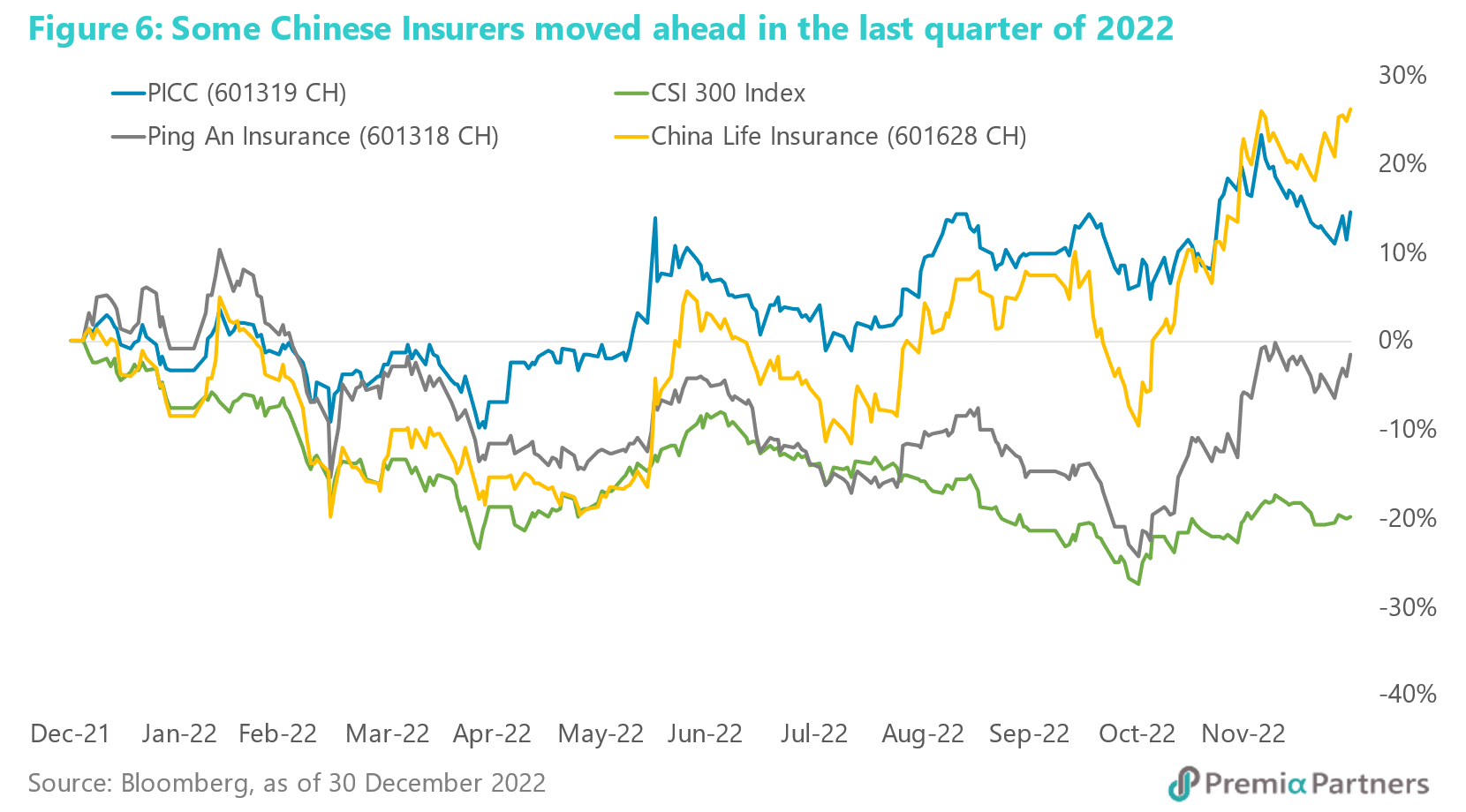

Telecommunication services, banks, and insurance also contributed to the ETF outperformance

Other than the above industries, companies with significant economic value can also be found in Telecommunication services, banks and insurance which accounted for a total of around 30% in the ETF. Telecommunication services include China United Network (600050 CH), China Mobile (600941 CH) and China Telecom (601728 CH) which have a stable business and dividend payout and play a safe haven role amid market turmoil. Banks are too big to fail and have low volatility even during the real estate woe. As China’s economy is reopening, investors are now more focused on the growth side, and smaller local banks have been outperforming the national banks, such as Bank of Jiangsu (600919 CH) and Bank of Suzhou (002966 CH). As Chinese stocks are stabilizing toward the end of 2022, it may help the insurers’ investment results, and investors were expecting the same causing the insurers’ stock prices to move ahead of the market.

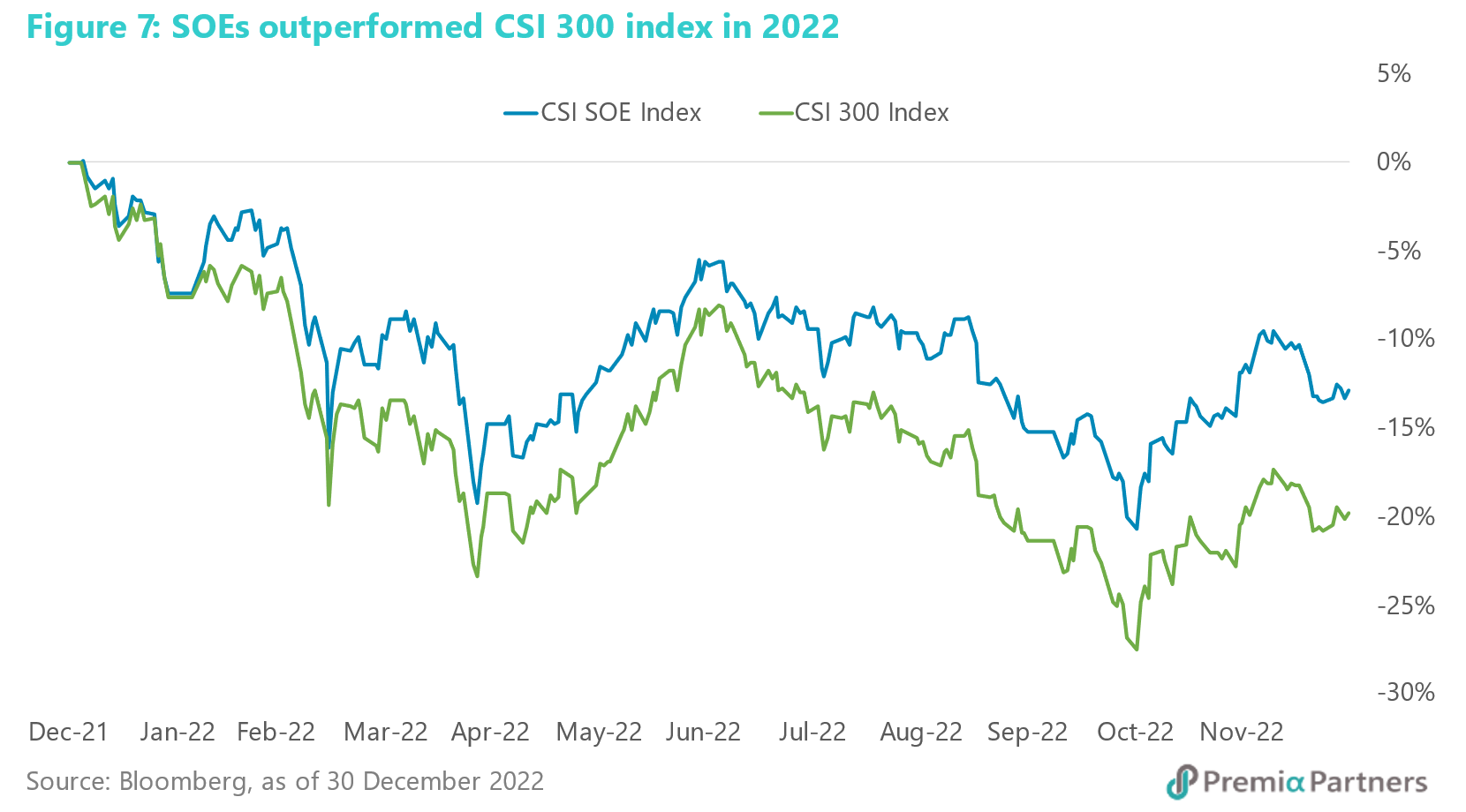

SOE reform and revaluation

Up till now, one may notice that many outperformers mentioned above are state-owned enterprises. That is not a coincidence as CSRC chairman Yi Huiman proposed a new method of valuing state-controlled firms, a “valuation system with Chinese characteristics”, indicating that the SOEs play a pillar role in the economy, yet they are often undervalued as conventional valuation models originated from the west might not sufficiently account for factors such as policy support and strategic alignments on growth and volatility, and the corresponding impacts on risk premium. The market expected that there will be more policies to promote and support SOEs to close the valuation gap. According to the CSI state-owned enterprise index, the SOEs have outperformed the broad-based CSI 300 index by around 5% in 2022. In the ETF, there are more than 200 companies that are classified as SOEs by CSI and accounted for more than 70%.

For international investors that might be used to thinking investing in private enterprise would always be superior to SOEs as innovators driving for business growth, this would be an important time to take note well managed SOEs with policy support, less volatile governance profile, access to low-cost resources and capital, and business scalability would indeed be well placed to lead especially in national strategic sectors and topics. In fact in many Asian countries, SOEs continue to be important and stable pillars of the economy. Meanwhile globally state-owned and private companies alike are increasingly operating under a more regulated, state influenced world. This would be a topic that would take a lot more thoughtful considerations, than as previously overly simplistic generalization.

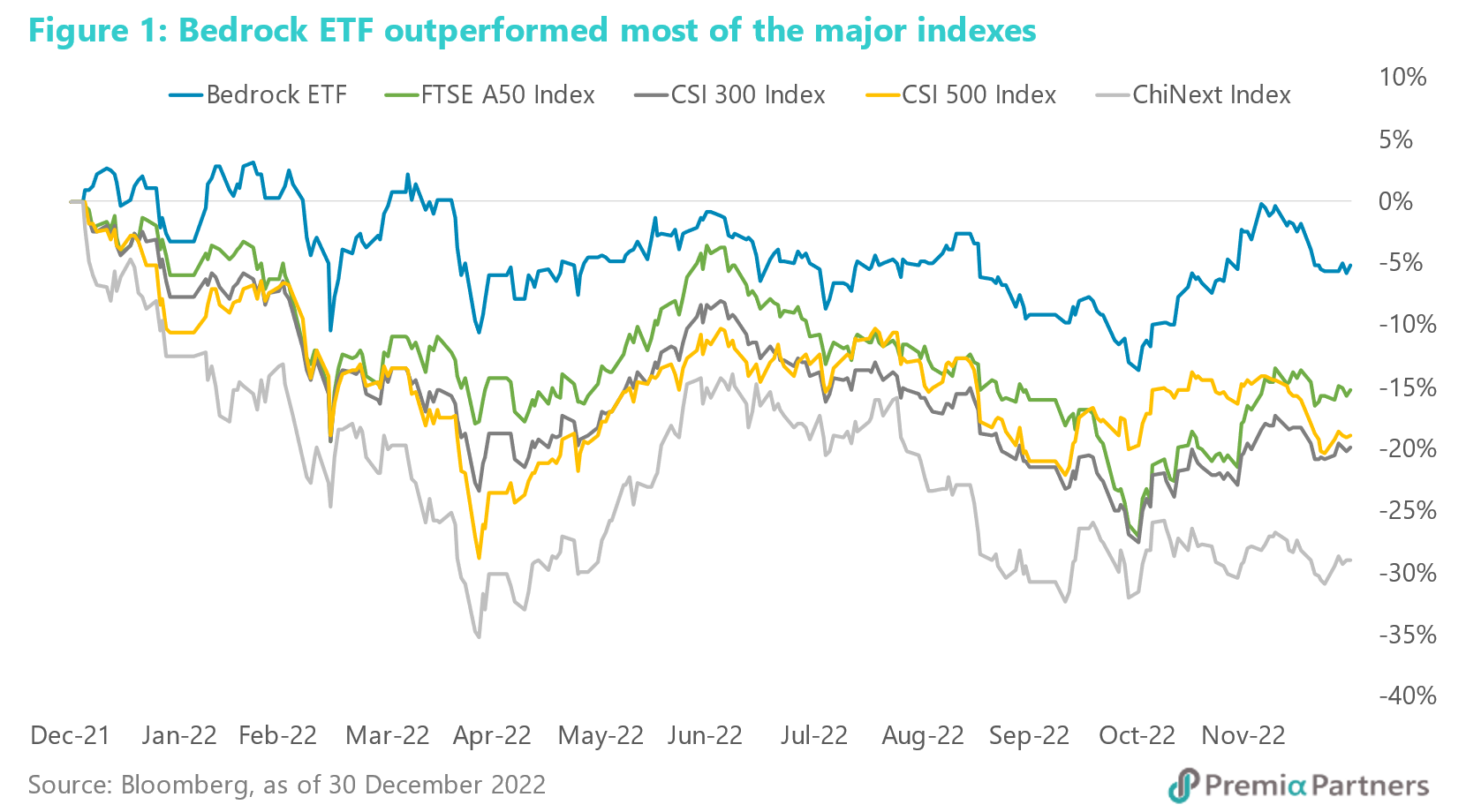

Bedrock as portfolio completion tool for less correlated risk adjusted return

Looking ahead, there is no doubt that some short-term factors, such as the surge in local coal prices and the demand for COVID drugs, may become more muted at any time. However, those long-term factors are mostly related to policy and would not change in the near term, e.g., the infrastructure investment plan to boost the economy, the inclusion of Chinese traditional medicines to the reimbursement plan, and the promotion of the SOEs’ valuation. Hence, we believe that our Premia CSI Caixin China Bedrock Economy ETF could continue to perform well in 2023 due to the structural changes in the regulation and economy. Investors who would like to invest along with China’s long-term policy may consider Premia CSI Caixin China Bedrock Economy ETF, which would be very complementary to other Emerging Markets or China exposure for less correlated returns, with more stability during volatile markets when investors swing through the risk-on/ risk off journey ahead. Meanwhile with higher allocation to SOEs and financials, the ETF also benefits from higher dividend yield, cheap valuation and gradual revival of the property sector and credit markets.