Most investors are familiar with the FAANGs and are giving increasing attention to the BATs as technology firms are disrupting traditional paradigms. Yet, one might be surprised at how significant technology-driven innovations have been reshaping the ecosystem we live in. I prefer the word “reshaping” over “disrupting” as a lot of the innovations and so-called “disruptions” have already proliferated into our blood and our everyday life – for instance, “Digital Revolution” is at the forefront of this transformation and is happening every minute around us.

The exponential growth in big data, artificial intelligence (AI), and internet of things (IoT) have led to innovations in various far-reaching implications beyond merely internet and information technology. In this piece, we explore the Asia innovation theme by discussing:

• State of Asia innovation

• What sectors are expected to be most affected?

• How are innovations disrupting traditional industry classifications and the investment landscape?

State of Asia innovation

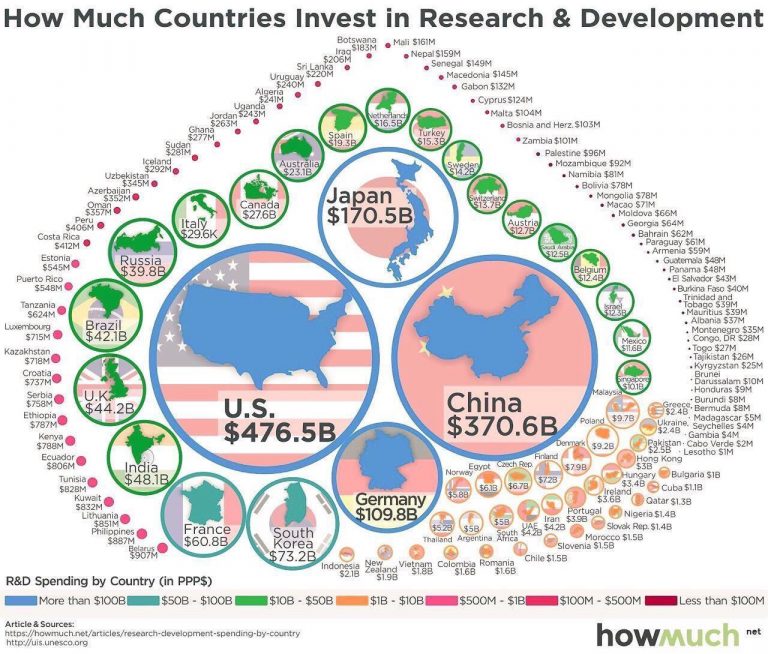

Asia is home to 50 percent of the global internet users, 1.8 billion of active social media users, and about US$75 billion worth of unicorn startups. According to statistics from UNESCO on countries’ R&D spending, 3 of the top 5 are Asian countries – China #2, Japan #3, South Korea #5. These 3 countries also collectively account for roughly 40% of world researchers and are among world’s largest robotics markets as well.

According to a white paper from Harvard Business Review, leading companies around the world are leveraging Asia’s liveliness and talent to develop new products, services, and business models that drive growth, with many finding or even building innovation ecosystems in Asia. Three commonly cited factors on how Asia differentiates itself from the rest of the world in the pace of innovation are: 1) the faster growing economies compared to the developed Western counterparts, 2) robust and growing demand for products and services not only from the deep and wide range of manufacturers domiciled in Asia but also from the region’s fast-growing middle class, and 3) strong support for the business community from governments that recognize the crucial role innovation plays in growing both companies and economies.

What sectors are expected to be most affected?

While information technology itself is a sector, with the technological innovation and development of times, technology is now more of an enabler in this modern era. Nearly every industry can find ways to benefit from innovative technologies in an effort to improve output or reduce costs. Apart from the technology sector (e.g. software, hardware), the industries that are at the forefront of experiencing tech-enabled exponential growth in Asia include:

Retail: Online retailing along with online-to-offline (O2O) offerings have made shopping easier and cheaper for consumers, which were made possible by lower cost structures and improved efficiency in delivery and logistics. In How is “digital revolution” in Asia transforming the way we live, we discussed how Alibaba’s Tmall and JD.com generated impressive single day sales. In addition, AI and big data are increasingly being deployed by online and traditional retailers to better identify trends and predict customer demands.

Industrials: The surge in robotics investment in Asia puts industrial automation at the forefront of Internet of Things (IoT) and implementation of AI in the physical world. With greater precision on the metal arms and an AI mind, advancement in robotics will create smarter, more capable machines to complement or replace the aging human workforce in many fields. Technology advancement will also enable better performance in other areas such as operations optimization and predictive maintenance.

Healthcare: The increase in aging population and rising middle class in Asia has led to strong demand for healthcare products. In 2017, about $40 billion dollars were raised for life science projects in the region. Advanced data analytics creates large benefit to pharmaceutical companies on drug discovery and clinical trials. Physiological simulation can accelerate product development, and a 3-D printed or virtual reality-based tissue modeling can help with assessment of potential concerns. AI has also been put into use in diagnostic imaging and robotic surgery. Furthermore, innovation has made patients to be more connected and engaged that now there’s digital pills or nanobots that can go into your body (and blood) to examine and respond real-time data to you and your doctor’s digital devices.

Transportation: The transportation landscape is transforming in many different ways and has affected many other sectors - I use “transportation” for the lack of a better word. In the sky, drones with intelligent sensors and accurate GPS positioning has enabled new ways of filing, package delivery, and farming. On the road, we see advancements in electrical vehicles and autonomous driving enabled by technologies in heavy-duty battery, image sensors, and AI algorithms. Further, the IoT era has also spurred the shared-economy concept in transportation from cars to bikes.

How are innovations disrupting traditional industry classifications and the investment landscape?

About 20 years ago, S&P and MSCI put their collective heads together and created the now commonly-used Global Industry Classification Standard, aka GICS®. Lately, there has been plans for extensive sector revisions, which will be effective toward the end of September this year. The revision hopes to better reflect how modern companies operate in the brave new world, but has also raised questions – for instance, should e-commerce companies like Amazon or Alibaba be Consumer Discretionary? Among the FANG gang, Netflix should also become Consumer Discretionary, while Facebook and Google into the new Communication Services sector along with other Media players like Disney?

Information Technology sector ETFs has been a popular and useful way to capture growth opportunities. However, with the increasing amount of technology-enabled innovation across virtually all sectors and industries, it is quite fair to say that investment vehicles indexed or benchmarked to the “GICS = Information Technology” pool has been significantly disrupted, and savvy investors have shifted away from these to thematic ETFs specifically on Robotics & AI, Social Media, Semiconductors, Biotech, etc.

While many ETF managers build products on top of broad GICS or ICB classification system, others, including us (Premia Partners), work with index providers to redefine classification, especially when approaching disruptive themes in the old-school industry classifications are slow to adapt to new economic realities. For our upcoming ETF themed on Asia innovative technologies, we work with FactSet to identify relevant companies based on their revenue segments into very detailed levels. The article Targeting Asian Growth Through Innovation gives a detailed discussion into the index methodologies, and you may learn more about the Premia Asia Innovative Technology ETF (3181 HK) at the product page.