Chinese government is reported to consider issuing an additional RMB 1 trillion in sovereign bonds to fund a new stimulus plan focusing on infrastructure investment such as water conservancy projects. The outcome may lead to increasing the annual fiscal deficit rate to above the official target of 3% set earlier in March. Economists, however, see this specific fiscal support should help broaden out the economic recovery. Part of the issuance could be used for the comprehensive debt restructuring plan that will eventually lessen the burden of the local governments, in which some of them have been struggling with the falling revenue in fewer land sales but a surge in Covid-related public spending in the past couple of years.

Regarding the mid-year revision of the general government deficit, China only did once more than two decades ago, when the economy was hit hard by the catastrophic floods nationwide and the Asian financial crisis. That should provide comfort to investors that Chinese government is very disciplined in maintaining its deficit target in the past. Goldman Sachs even suggested that it is unlikely for the Chinese government to choose this high-profile route of raising its annual budget deficit, given the remaining fiscal space available for the fourth quarter, the lengthy process for new quota approval and projects implementation. Excluding the RMB 6.5 trillion government bonds net issued in the first nine month of this year, analysts estimate that the fiscal policy room for the rest of 2023 is about RMB 1.2 trillion, including RMB 800 billion for China government bonds, RMB 100 billion for local government general bonds, and RMB 300 billion for local government special bonds.

In practice, the new proposal needs to be approved by the National Standing Committee and reviewed by the National People's Congress. Timing-wise, the issuance of the additional government bonds will be carried out in November or December at the earliest, and the actual use of the raised funds may be deployed in December or January of the following year. Taking the construction of water conservancy facilities as an example, industry specialists said that the northern rivers will be closed from November to January due to the cold weather. It is not rational to force starting projects amid the frozen rivers and unnecessary high labor costs.

In terms of market impact, most analysts see the merit of stronger fiscal support coming from the central government, viewing the timing and scale are appropriate. The major flip side is the enlarged issuance of government bonds may shift the demand and supply balance in the near-term. That said, it is undoubtedly that the People’s Bank of China will stick with its loosening stance to help boost economic activities. The central bank has cut both the medium-term-lending facility and the required reserve ratio for major banks twice so far this year. Unlike most other economies facing the high inflation, China can further lower interest rates and introduce more fiscal tools to increase its economic growth if necessary.

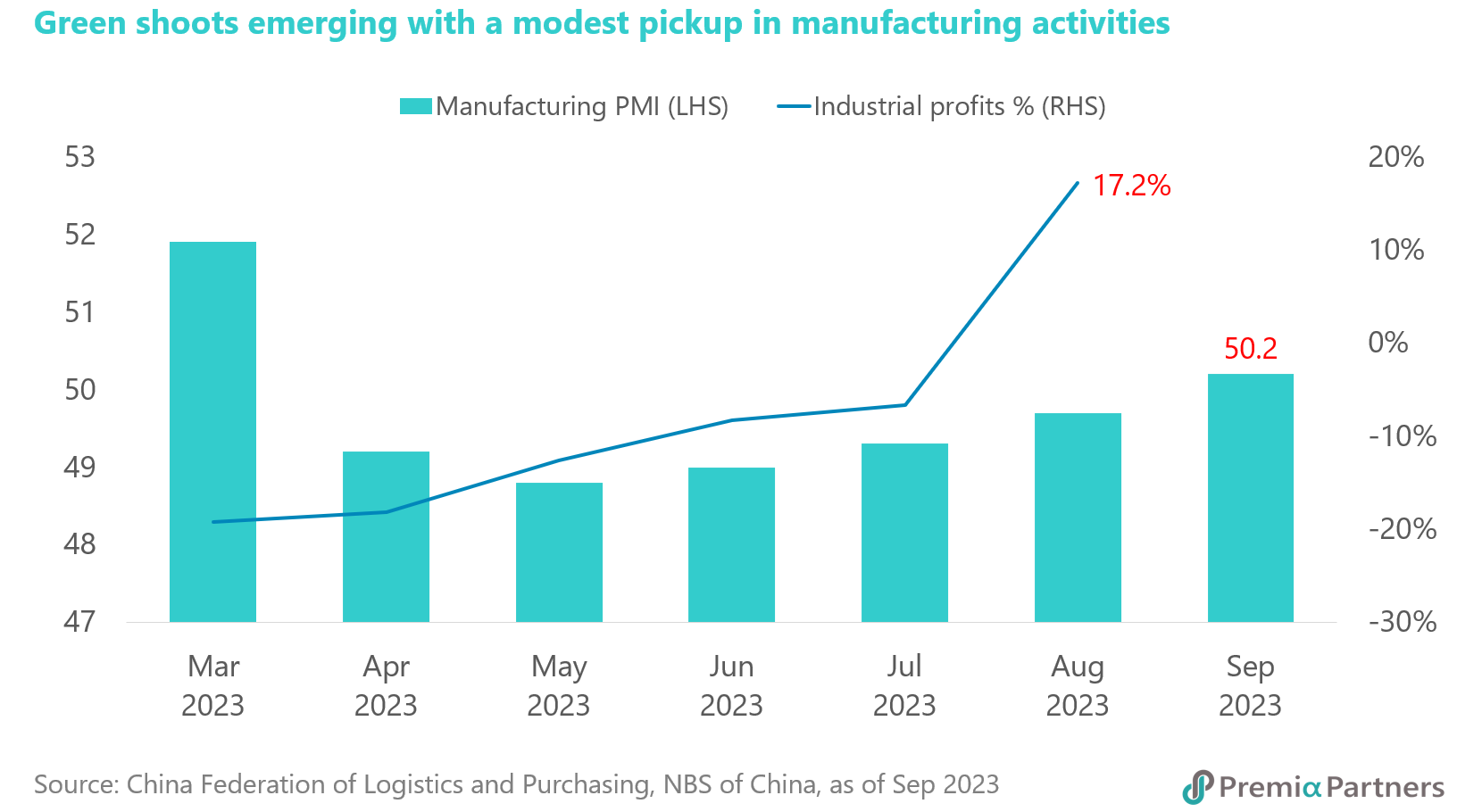

Fundamentally, the nation’s manufacturing activities saw a modest pickup with the official manufacturing purchasing managers' index (PMI) for September coming in at 50.2, up 0.5 points from the previous month. This is an encouraging sign that factory activities finally recorded an expansion. In addition, the overall industrial profits surged 17.2% YoY in August, marked the first increase since the second half of 2022. Profits improved for 30 of 41 major industrial sectors during the period, with the losses in the raw material manufacturing industry narrowing significantly on rising commodity prices and recovered demand. Economists believe the reversal was mainly driven by the rebound in market demand, improved prices of industrial products, the implementation of macro-support policies, and the low base effect.

Consumer confidence showed improvement during the Golden Week holidays. The number of domestic tourists during the holiday week was 826 million, an increase of 71.3% YoY, and up 4.1% compared to that of 2019; the domestic tourism revenue was 753.43 billion yuan, up 129.5% YoY, and up 1.5% relative to 2019. Data from the State Taxation Administration indicated that accommodation and catering sales increased 25% YoY, while online consumption continued to be enthusiastic, with the average daily delivery volume of express and parcels increased 20% YoY, and up 130% compared with the same period in 2019. This was also reflected in company data as Meituan, a food delivery and services app, reported daily average services spending was up 150% whilst dining sales were up 250% from 2019 levels.

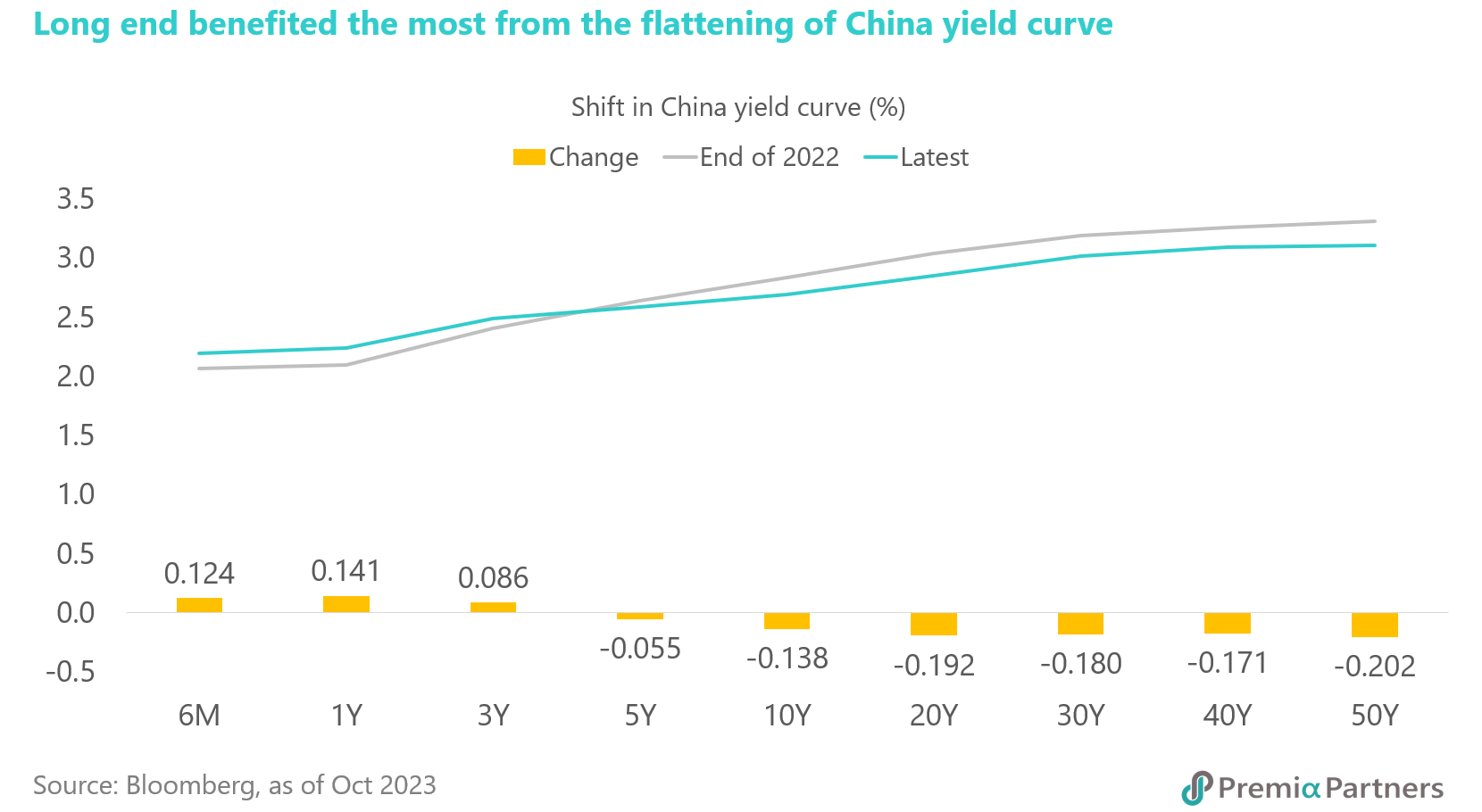

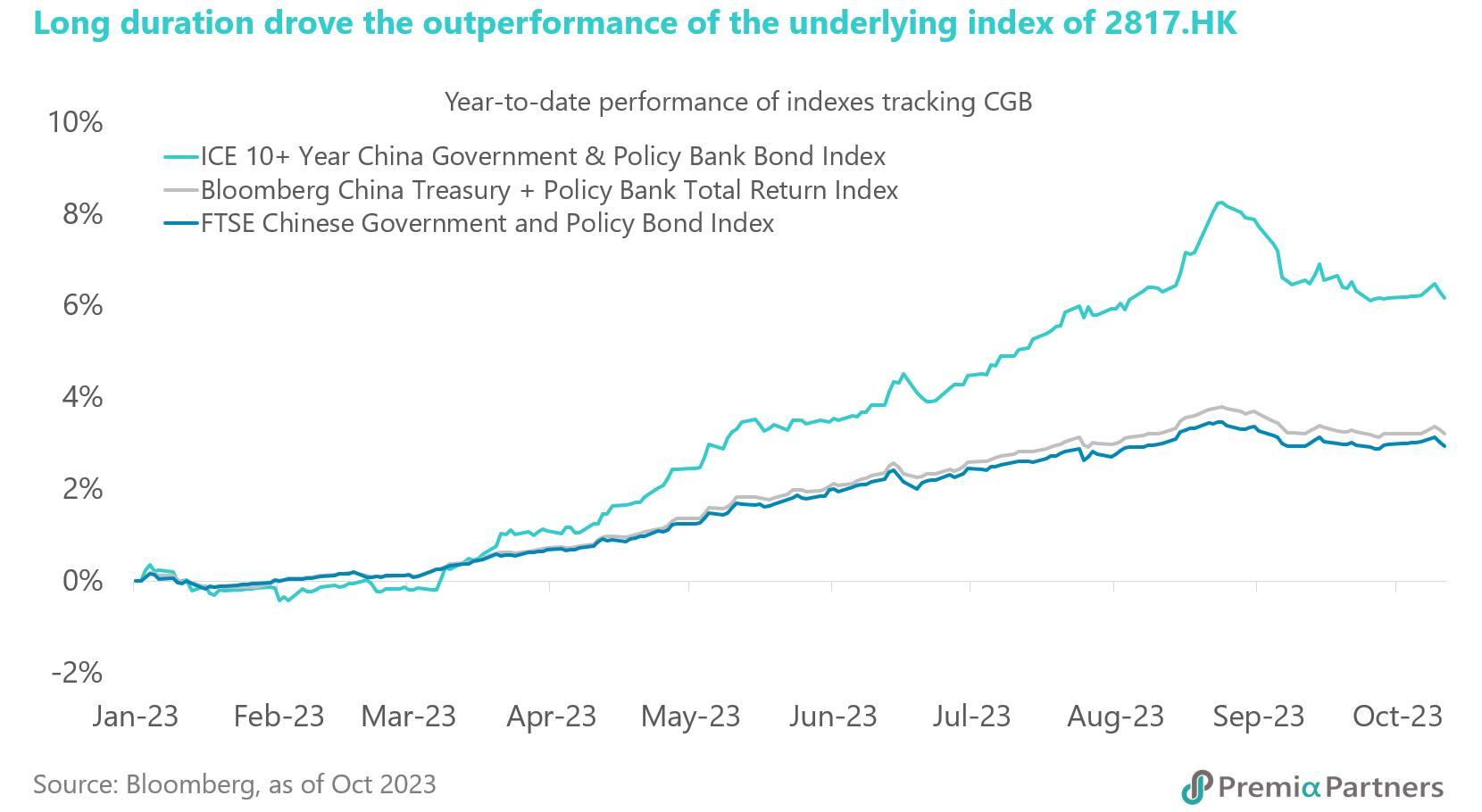

Investors need not overreact to the potential issuance of an additional RMB 1 trillion government bonds and the change in budget deficit. China remains disciplined in fiscal policy whilst the overall monetary stance stays accommodative. China government bonds have outperformed almost all other sovereign bonds this year due to rate cuts and low inflation expectations. The long end of China yield curve benefited the most year-to-date, with the yields on 10-year, 30-year, and 50-year falling 13.8bps, 18.0bps, and 20.2bps respectively. That explains the superior performance of the underlying index of our Premia China Treasury and Policy Bank Bond Long Duration ETF (2817.HK), as compared with its peers tracking China government bonds. For investors who would prefer eliminating the forex risk, the USD hedged unit class of the ETF (9177.HK) would be an option. Its renminbi exposure is fully hedged against the dollar, leading to a positive total USD return of 6.8% as of 18 October 2023.