Would price intervention for polysilicon upend growth trajectory for the photovoltaic industry?

Recent Bloomberg news reported that in China the Ministry of Industry and Information Technology (MIIT) is exploring potential price intervention to halt the skyrocketing polysilicon prices that started to suppress demand for solar panels. The photovoltaic (“PV”) industry is now at a crossroads. Will measures to control prices halt the decade-long rise in the PV industry and would the supposedly policy support sector face regulatory headwind as a result?

Although no further implementation details were disclosed yet, signal to curb prices inevitably cast a long shadow over the PV industry. To assess whether it’s a negative signal of upending industry trajectory or reforming the supply chain tilting for positive outlook, perhaps we can take reference from recent regulatory actions to rein in prices in last 2 years - for instance lithium in May 2022, coal miners in October 2021, industrial metals in May 2021 or even pork during 2020. All of them shared similar symptoms of abnormal fluctuations in prices, fundamentally strong market demand, and presence of speculative investments and improper charges, and prior to launch of the regulatory campaigns the topic was discussed in repeated high-level meetings across several departments within the government for concerted actions.

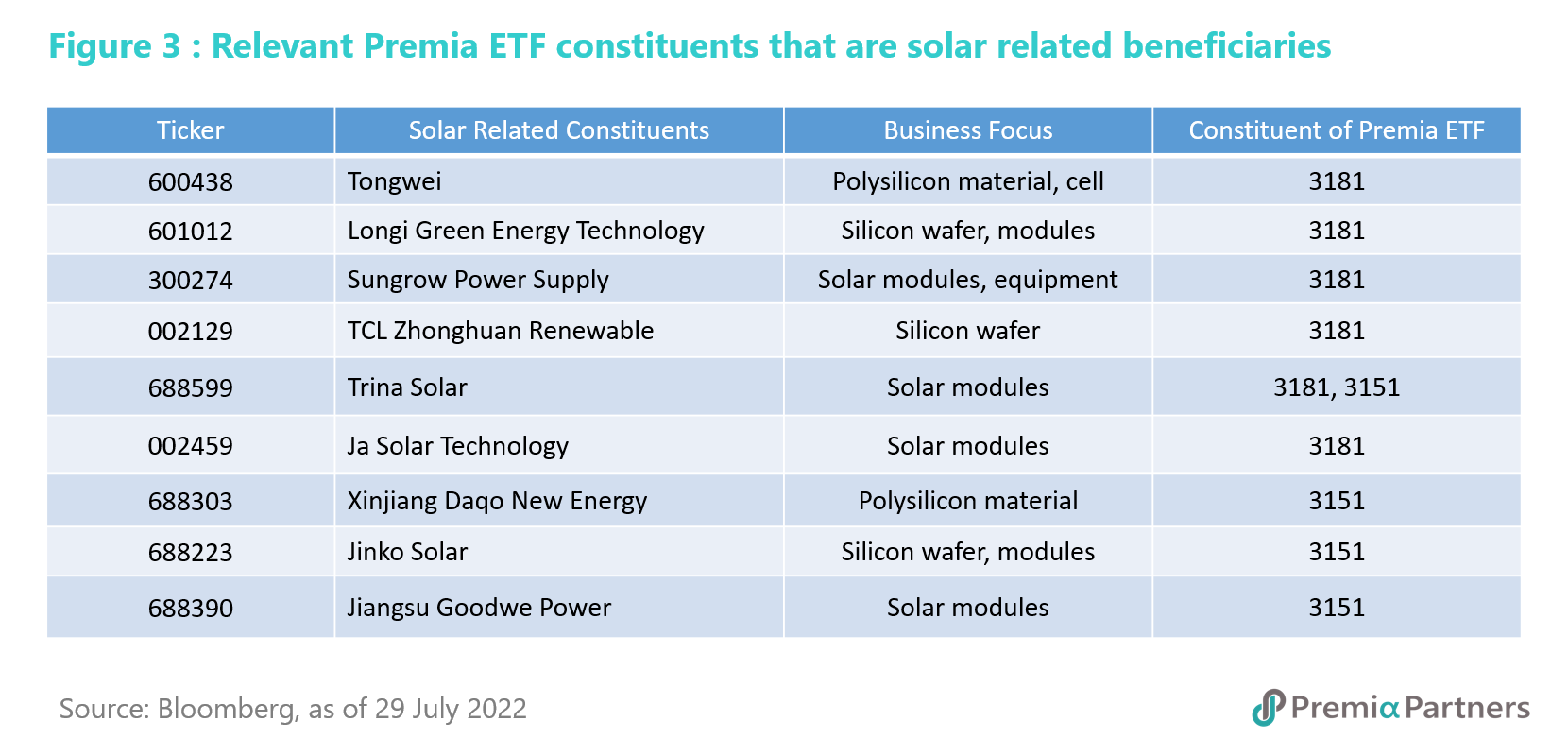

In such case precedents, prices intervention was proven to provide a healthy reset that did not crash the booming market, but instead signalled temporary cooling down for more healthy development of the ecosystem. In this case for the PV market, it would be conducive to industry growth as regulators rebalance the supply chain by calming upstream solar panel material price to a reasonable level, which has surged in past nine consecutive weeks, propelled by strong adoption of clean energy and supply constraints after four producers halted output for maintenance in June and shipping disruptions caused by overseas port strikes. In this regard, it is in particular important to differentiate this price control action from regulatory crackdown on the internet and platform companies regarding issues around data privacy, anti-trust and monopolistic practice since mid-2021.

The PV industry has been witnessing cost spike since 2020, which raised attention of policy maker for quite a long while. Echoing the "14th Five-Year Renewable Energy Development Plan" released on June 1 by the State Council together with other nine departments jointly, China has mapped out action details upon the dual carbon targets of “carbon emissions peak and carbon neutrality” by fulfilling the mission to restrain the proportion of non-fossil energy consumption about 20% in 2025. It is not surprised that China weighs on blockbusters of energy transition lead industry like PV from a high dependence on fossil fuel imports (traditional coal, oil, and natural gas) to self-sufficiency in clean energy, which is an undoubtedly national strategy scoped under Five-Year Plan.

Despite all concerns, the PV industry is driven by strong demand in global markets. Recently integrated leaders such as Tongwei and Longi both lifted prices, with Tongwei increasing the price for 182 and 210-type solar cells by 3.2% and 4.1%, while Longi raised monocrystalline silicon wafers P-type M6 and M10 by 4.1% and 3.3% respectively. This is the ninth time this year that Tongwei Solar lifted prices on cells and the eighth time for Longi, indicating pricing power of upstream. The downstream solar installations have more than doubled during the first half of 2022, eyeing to more than double renewables capacity to 1,200 GW by 2030, up from 635 GW at the end of 2021, according to the China Photovoltaic Industry Association (CPIA).

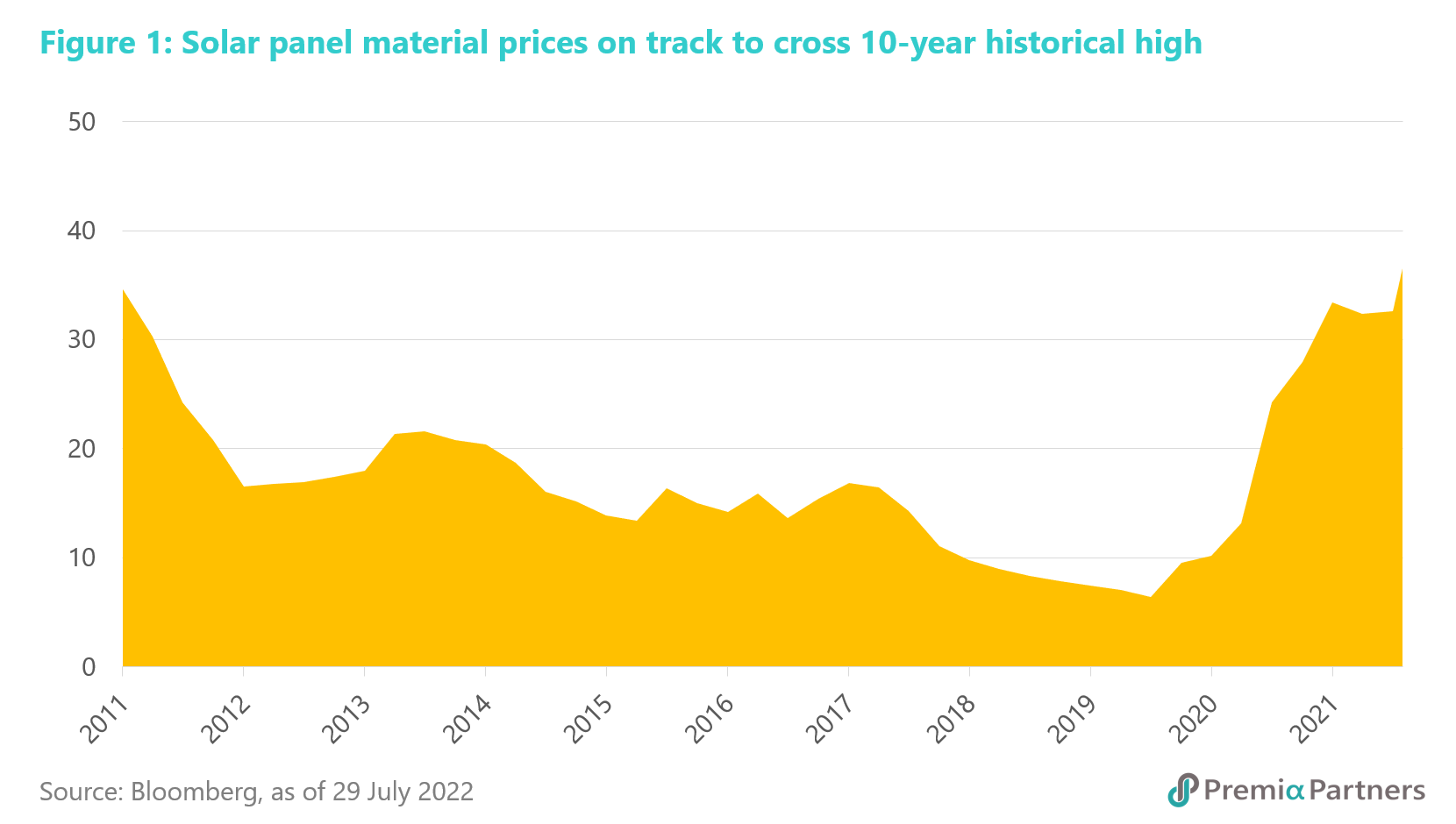

In overseas market, photovoltaic module exports were also on a spree, with the volume reaching 78.6 GW in 1H2022, up 74 % YoY, while the total export of PV products also hit a new high of around USD$25.9 billion, up 113 % YoY. Europe is the top destination with over 90% its solar component supply coming from China and the number continues to climb as demand for solar facilities surged in continental Europe to reduce reliance on Russian oil and gas. In Ukraine, small capacity solar power facilities are developed to avoid blackout and keep gas substations running despite destruction of electricity grid. According to the International Energy Agency (IEA), China's share in the production stages of polysilicon, ingots, wafers, solar cells and solar modules is over 80%; by 2025, China's share in polysilicon and wafers could increase to 95%.

Compared with global market with higher cost absorption capacity, high material prices in fact hurt more for domestic demand in China, especially for solar panels in the large utility projects that are cost-sensitive, such as centralized solar plants in China's north and southwest regions which are also important actors in China’s new/ green infrastructure plans for East Data West Computing and deploy significant volume of PV modules across the supply chain. Given the chronic mismatch between supply and demand along with incidental production disruption, the polysilicon market is expected to remain tight throughout the year before new capacity comes online in the coming months and slackens production bottlenecks. It is thus critical for the PV economics to stay at healthy levels, in order to roll out the domestic build out plans smoothly.

The gross margin of the PV industry historically shows a diminishing waterfall from upstream to downstream with upstream players enjoying the lion’s share of the industry economics. By curbing surging upstream prices, the government is trying to shift the industry dynamics from upstream pricing dictation to more balanced profit participation by midstream and downstream players. While top-tier material producers that have previously been milking through price lifts and surging export demand would not be impacted much, smaller players often are more susceptible to system shocks and struggle more in maintaining a profit margin. As the government scale polysilicon prices to healthier levels, given that overall market demand continues to step up, some upstream producers will trade volume for space to achieve more stable, sustainable growth. On the other hand, integrated sector leaders like Tongwei and Longi that are equipped with resource and production capabilities would enjoy great benefits from government pricing interventions that promote more sustainable industry growth, given their better management of unit cost, CAPEX, and fundraising capabilities.Whereas weaker players focusing on only a single segment or downstream assembly, in the process might face more headwinds and margin squeezes, and be more at risk of being weeded out instead.

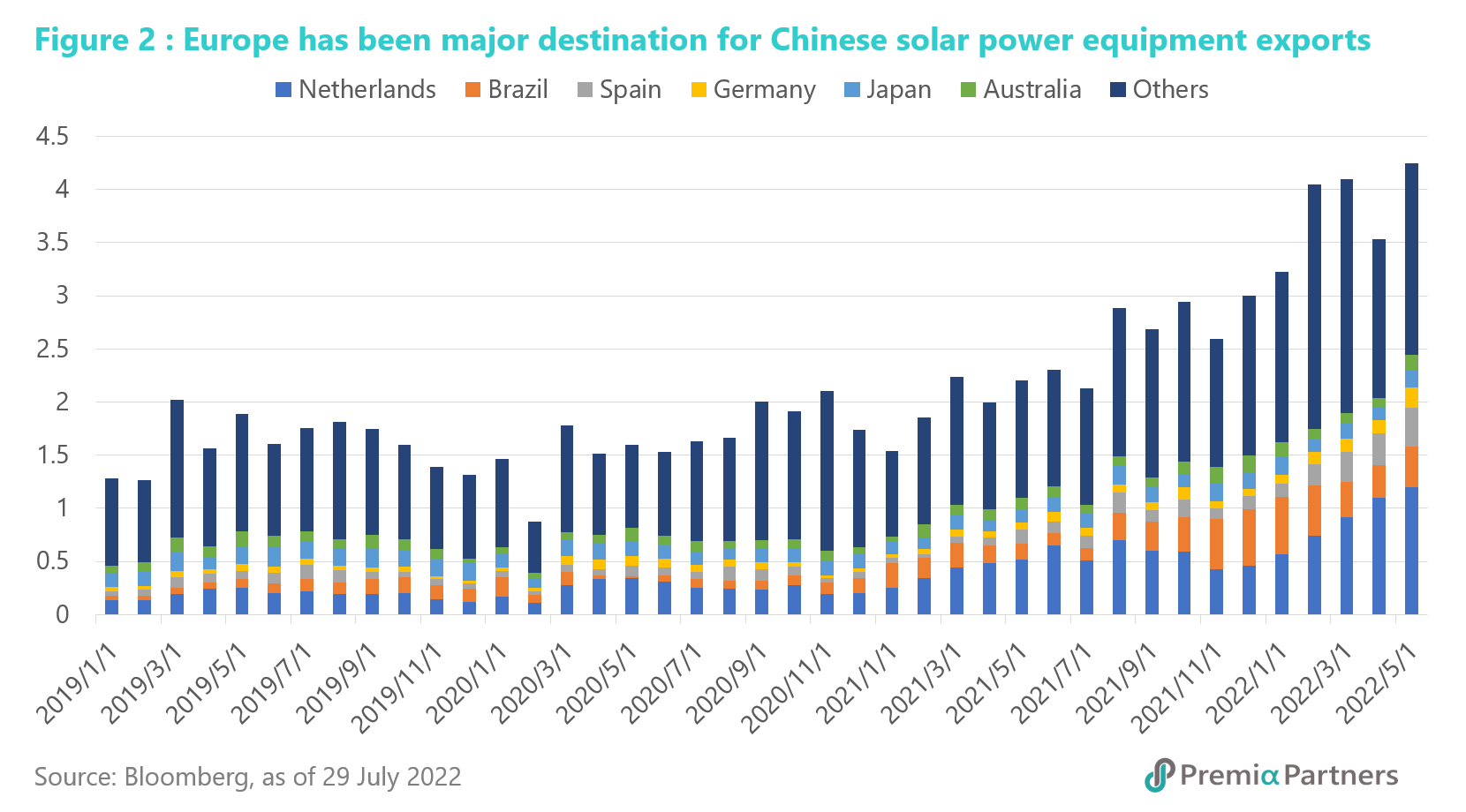

Overall, we believe investors should not overreact on any short-term price intervention, but instead focus on drivers that are conducive to sustainable industry development and leading actors that are well placed to capture the related opportunities as this game-changing megatrend for green energy continues to evolve. Solar energy is undoubtedly one of the fastest growing renewables globally. As most of the countries are aiming to reach carbon neutrality in the next few decades, the demand of PV products will remain strong. China is a clear leader dominating the supply chain across polysilicon material, solar power equipment, silicon wafer and modules, and hence the outlook of the related stocks looks promising. Currently Premia China STAR50 ETF (3151.HK) and Premia Asia Innovative Technology and Metaverse Theme ETF (3181.HK) invest in leading solar names including Tongwei, Longi Green Energy, Sungrow Power, Trina Solar, Xinjiang Daqo, and Jinko Solar that are leaders across the value chain., and would be good tools to capture solar related opportunities as China continues the journey for its 2060 net zero goals, while at the same time supports the green energy evolution globally.