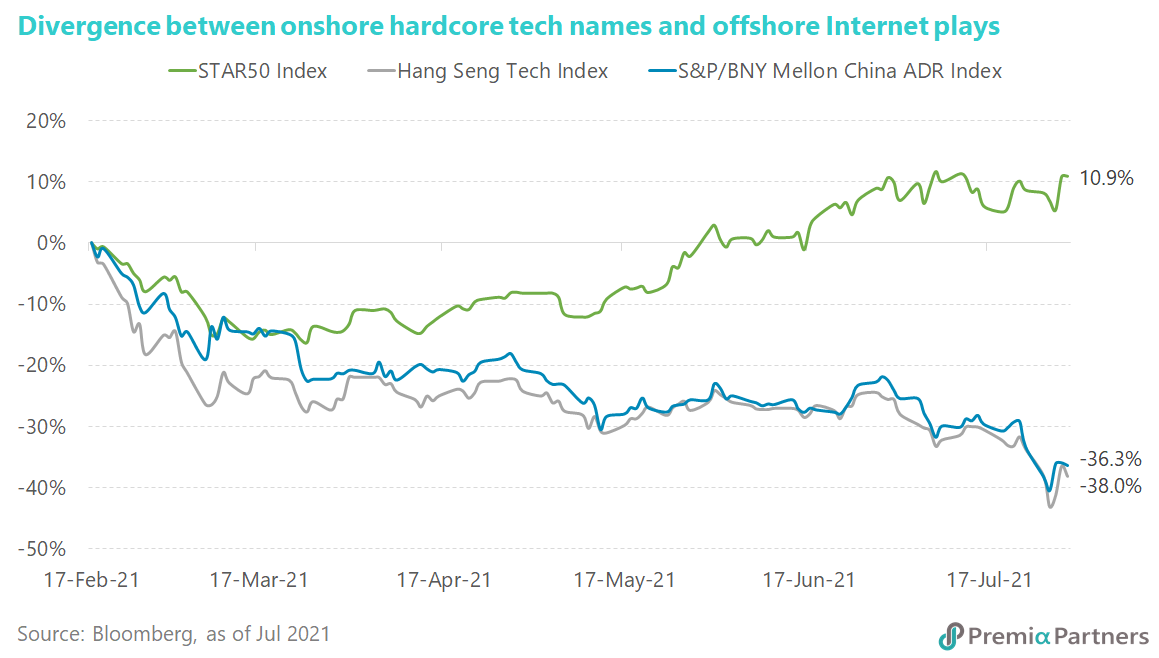

China market saw a material correction due to the regulatory crackdown in the offshore tech and education space, ranging from the investigation of Didi Global right after its US listing, ordering Tencent Music to give up exclusive music streaming rights, to remodeling the domestic tutoring business to non-profit oriented. The panic sentiment led to indiscriminative unwinding of Chinese stocks by foreign investors, pushing the HK-listed tech names and the US-listed China ADRs into a bear market technically. Although the regulatory risks remain high in near-term, investors seem getting a stronger hint about the policy direction, which aims to allocate talents and resources into more productive areas that support long-term quality economic growth and reduce external reliance in hardcore technology. That explains why the onshore tech stocks managed to outperform year-to-date and stayed resilient during the recent sell-off. Measuring from the last peak of the overall China market in mid-February to the end of July, Hang Seng Tech Index and S&P/BNY Mellon China ADR Index fell 36.3% and 38% respectively, while the STAR 50 Index went up 10.9%.

The Shanghai Stock Exchange Science and Technology Innovation Board (STAR market), launched in July 2019 in Shanghai, aims to provide a platform gathering the most promising tech companies that are building cutting-edge technologies, strategically important for the nation, driving economic and productive growth, and having high market recognition. Industry participants expect the STAR market will help innovate Chinese startups grow, a function which Nasdaq has been serving for the US and has groomed tech giants like Microsoft, Amazon and Apple in the past. Within the technology space, the STAR market simply focuses on hard core technology and key strategic pillars, different from Hong Kong and US ADR markets dominated by internet platform, e-commerce and application-based companies. For example, it includes semiconductor and artificial intelligence in new generation IT, industrial internet of things and automation in high-end manufacturing, innovative drugs and devices in biomedicine, and electrical vehicles in new energy, etc.

To facilitate the fund raising of innovative hi-tech companies, the STAR market has introduced a registration based initial public offering mechanism in the A-share market, a systematic change that accelerates the capital market reform. The STAR Market also accepts listings from unprofitable companies and from companies with unequal voting rights, both of which otherwise would be barred from going public on other Chinese exchanges. Besides, the market-oriented pricing at IPOs and the widen trading limit at intraday speeds up price discovery for stocks listed in the STAR market.

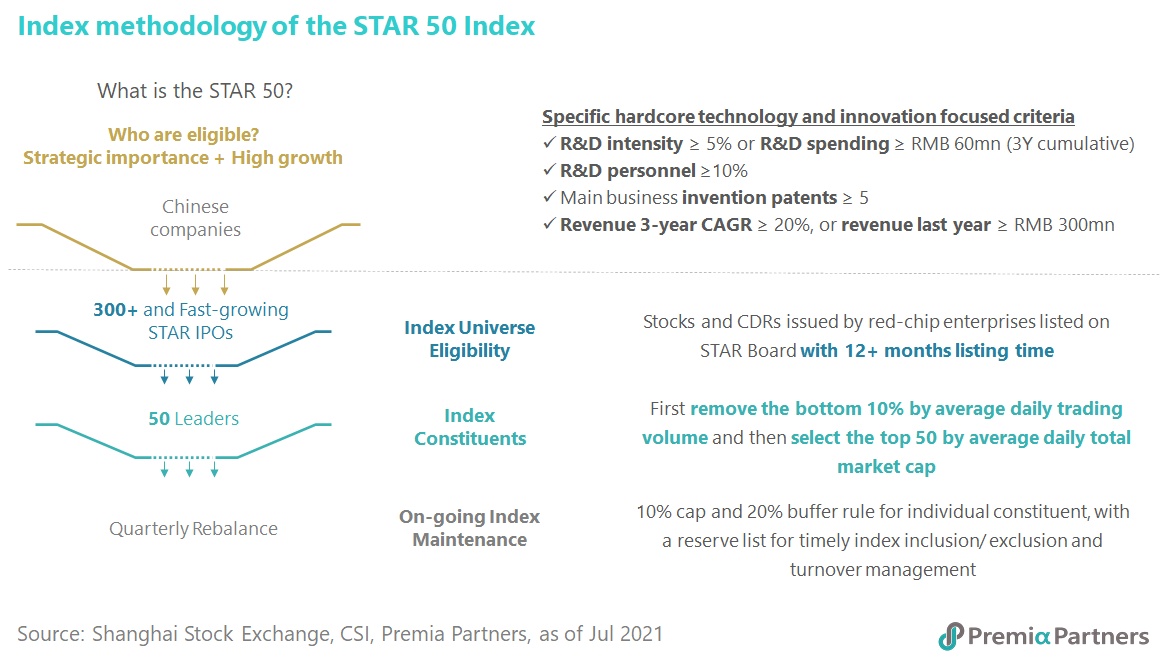

Since the STAR market’s inception two years ago, there are more than 300 companies listed successfully with a total market capitalization of USD 286 billion. There are a few technologies and innovation focused criteria for every company listed in the STAR market, like R&D intensity over 5% of sales or absolute cumulative R&D spending over RMB 60 million in the recent 3 years, R&D personnel over 10% of the workforce, number of main business invention patents over 5, the 3-year revenue CAGR over 20% or absolute revenue over RMB 300 million in the latest fiscal year. The STAR 50 Index is the flagship index of the new board, consisting of the 50 largest stocks listed in the STAR market that have passed certain liquidity requirements. Constituents will be weighted by float-adjusted market capitalization, which generally serves the purpose of reflecting market trends because it only takes into consideration the shares that are available for trade. The 10% cap on individual stock keeps the index diversified, while the quarterly rebalancing provides timely constituent inclusion and exclusion to ensure the exposure updated.

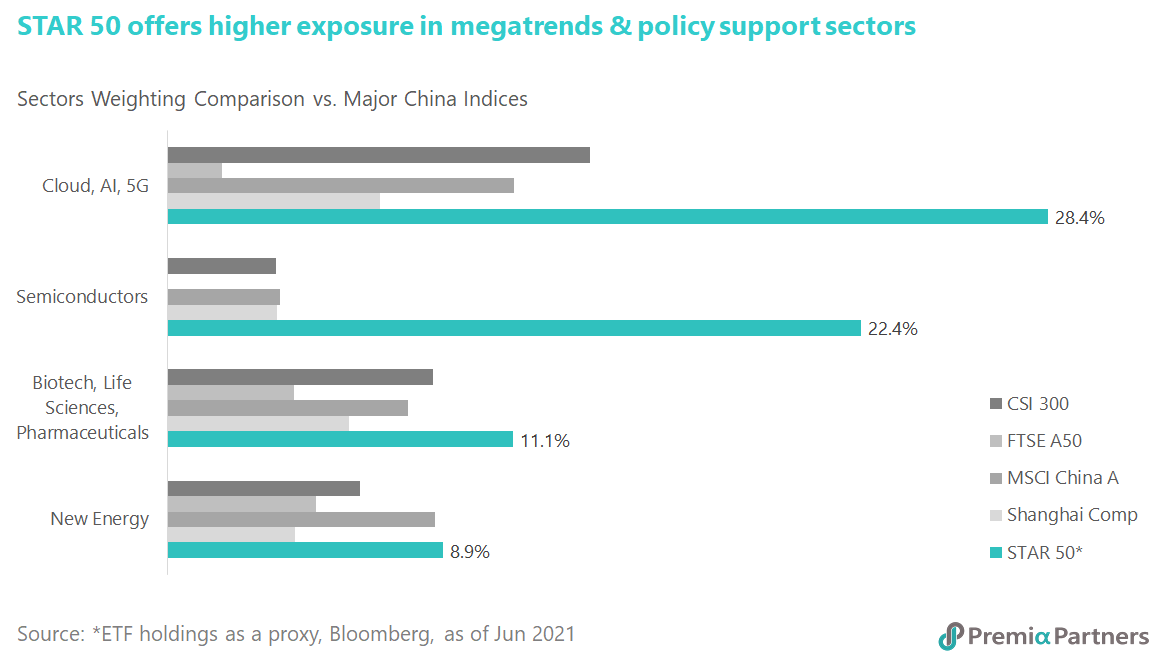

As compared with other mainstream indexes such as CSI 300, FTSE A50, MSCI China A and Shanghai Composite tracking the onshore A-share market, STAR 50 Index seems more capable of capturing the megatrends and policy support sectors. It has a weighting of 28.4% in cloud computing, artificial intelligence & 5G technology, 22.4% in semiconductors, 11.1% in biotech, life sciences, & pharmaceuticals, and 8.9% in new energy. As Chinese economy is undergoing a technological transformation, investors may expect more favorable policies and incentives to be given in these innovative sectors in order to accelerate the domestic development. Taking the semiconductors industry as an example, China is a latecomer with only a small market share of 7.6% in global chip sales. Domestic chip companies are mostly underdeveloped and notably absent in the market for high-end logic, advanced analog, and leading-edge memory products. In 2020, China imported a whopping USD 378 billion in chips, indicating a potential large market for domestic companies to grab in the future. Semiconductors were explicitly identified as a strategic technology priority in the 14th Five-Year Plan, requiring a whole-of-society effort to achieve self-reliance. The current preferential tax policies include up to a 10-year corporate tax exemption for semiconductor manufacturers, which could be valued at over USD 20 billion. Earlier this year, Ministry of Industry and Information and Information Technology released a proposal to establish a new National Integrated Circuit Standardization Technical Committee to promote R&D among the domestic players.

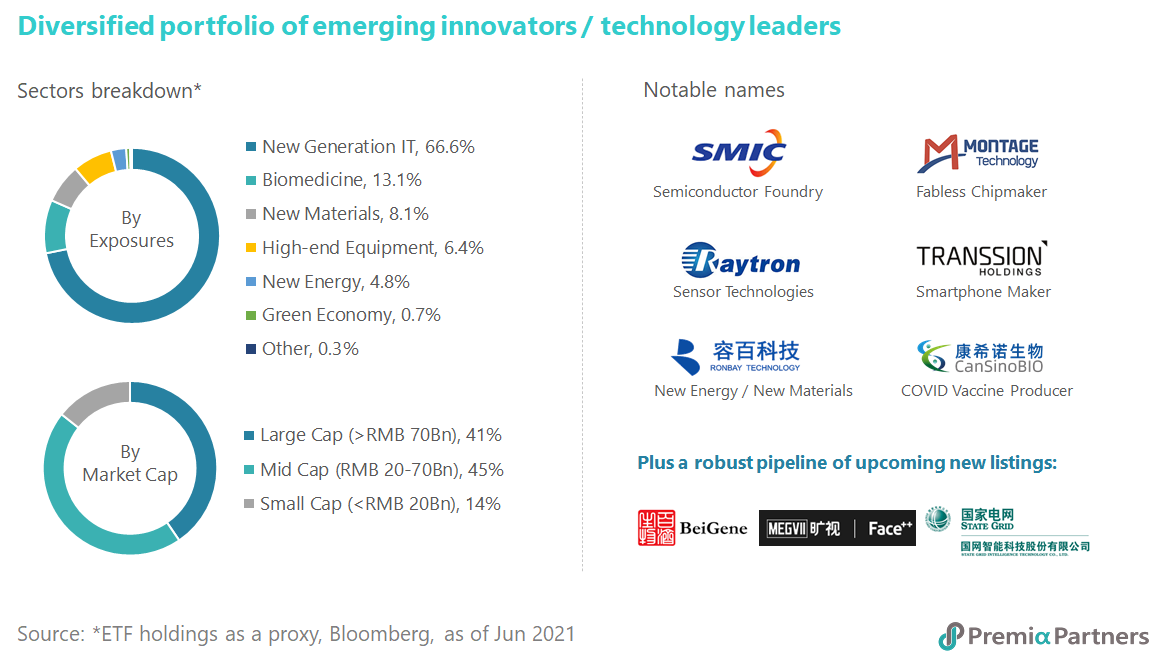

In terms of sector breakdown, new generation IT is accounted for two-third of the STAR 50 Index, while biomedicine, new materials, high-end equipment, new energy, and green economy are taking the remaining one-third. The strategy is quite balanced in terms of market cap with 41% in large-caps, 45% in mid-caps and 14% in small-caps. The key holdings include remarkable names like SMIC in semiconductor foundry, Montage Technology in fabless design, Raytron in sensor technologies, Transsion in smartphone manufacturing, Ronbay New Energy in lithium battery electrode materials, and CanSino Biologics in COVID vaccine R&D and production. Most of these names are neither the usual mega-caps that international investors are familiar with nor the well-known names that sell-side analysts cover with in-depth research. They are truly the hidden gems in the market offering exciting growth prospects. In addition, there is a robust pipeline of the upcoming IPOs potentially, including Beigene – a cancer focused Chinese biotech leader, Megvii – a facial-recognition & artificial intelligence unicorn, State Grid Intelligence Technology – the smart grid solution unit of the largest utility company worldwide, and Syngenta – a domestic leader in crop protection and seeds business of modern agriculture.

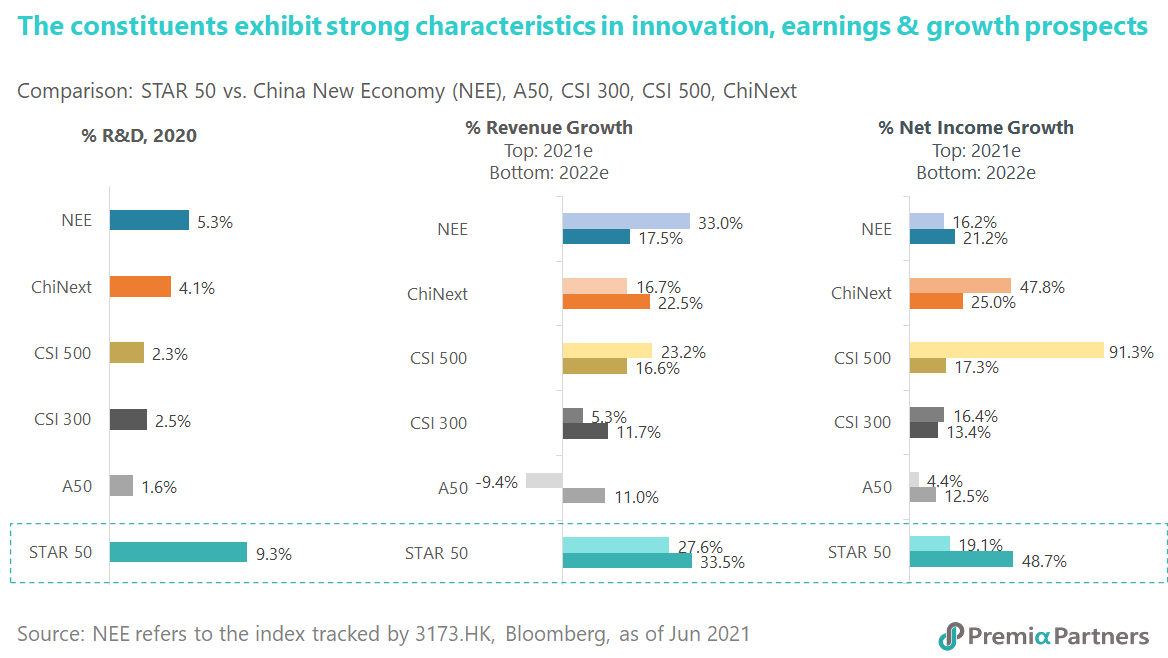

For better illustration of the strong characteristics of STAR 50 index, we measure innovation, earnings and growth prospects across different benchmarks by comparing the percentage of R&D of revenue, revenue growth rate and net income growth rate. STAR 50 Index outshines the others by ranking the first in most aspects. For example, the index constituents of STAR 50 have an average of 9.3% in R&D spending, significantly higher than 1.8% in FTSE A50, 2.5% in CSI 300, 2.3% in CSI 500, 4.1% in ChiNext and 5.3% in New Economic Engine (NEE), the underlying benchmark of Premia CSI Caixin China New Economy ETF (3173.HK). In terms of the consensus forecast of both sales and earnings, STAR 50 index also looks bright with close to 30% in top-line growth and 33% in bottom-line expansion in 2021 and 2022. Some may concern if the STAR market is overvalued, but the common price/earnings-to-growth ratio is about 1.03x, which is about the same level for FTSE A50 and CSI 300.

The timely launch of Premia China STAR50 ETF (3151.HK) helps investors gain a diversified exposure of the leading innovative and strategically important hi-tech companies focusing on the hardcore technology. Pricing at 58 basis points for the total expense ratio, the ETF should be one of the most efficient tools to capture the long-term growth opportunities in the STAR market. There are 3 trading counters available at Hong Kong Stock Exchange catering for investors’ needs in currency exposure – 3151.HK for Hong Kong dollar, 9151.HK for US dollar, and 83151.HK for renminbi.