Recently, we wrote about how investors can navigate “Mr. Market’s manic-depressive mood swings”, cautioning that those swings are likely to get shorter and more frequent.

Indeed, Mr. Market may already be getting grumpy again. It is not quite because things are going badly, but more likely be because he has gotten ahead of himself in terms of expectations.

That so-called “Goldilocks sweet spot” that Mr. Market thrives on requiring a clear path out of the pandemic; strong economic recovery; robust corporate earnings growth; modest inflation; maintenance of central bank asset purchases at current rates; and zero policy rates in the Developed Market economies. That’s a lot of stars to align perfectly, and the problem now is the bar to satisfying Developed Market investors’ expectations has been set very high.

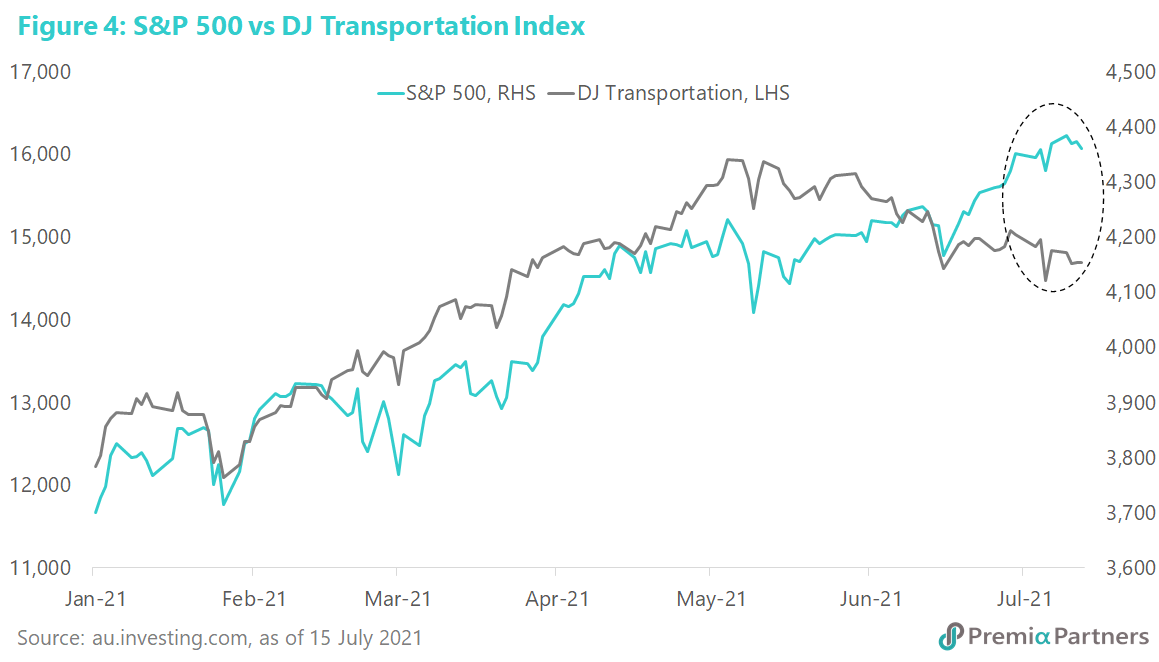

The next wave in the pandemic may have already started. We noted in the above-mentioned report that the mortality rate from the pandemic is much lower now than early last year. But the absolute number of cases is much higher. Globally, we had seen a pullback in cases over May-June. But that downward leg is done. We now appear to have started a new wave up. The United Kingdom – which reportedly was hit with the Delta variant earlier and which has a much higher percentage of the Delta variant in new cases – could be pointing us to what may be coming for the United States in coming weeks (figure 1).

The high growth with low inflation narrative is wearing thin. US inflation – both headline and core – has not taken a single backward step since the start of the year. The latest data for the US Consumer Price Index for All Urban Consumers increased 0.9% in June on a seasonally adjusted basis. Over the 12-months to June, the all-items index increased 5.4%. This is the largest increase since August 2008. The core inflation rate (excluding food and energy) also rose 0.9% in June. Over the 12-months to June, the core inflation rate rose 4.5%. This was the biggest 12-month increase since November 1991.

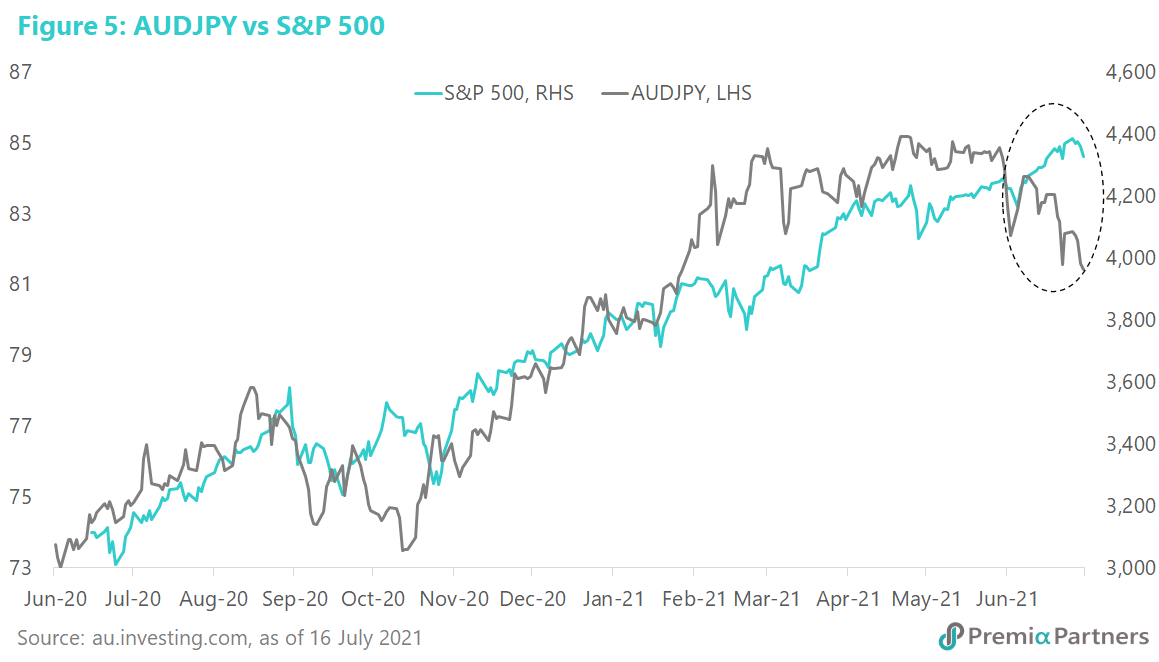

Meanwhile, the US economy may be losing its ability to surprise on the upside. The leading indicators are peaking and could be turning over in coming months, which shouldn’t surprise. The consensus forecasts are for peak GDP growth this year. Meanwhile, the US may have also hit peak stimulus. They are going to be hard pressed to further stimulate growth. It is worth reminding that US M2/GDP is at a historical high and its fiscal deficit/GDP is the largest since World War 2. Indeed, US M2 money supply growth is already rolling over (figure 2).

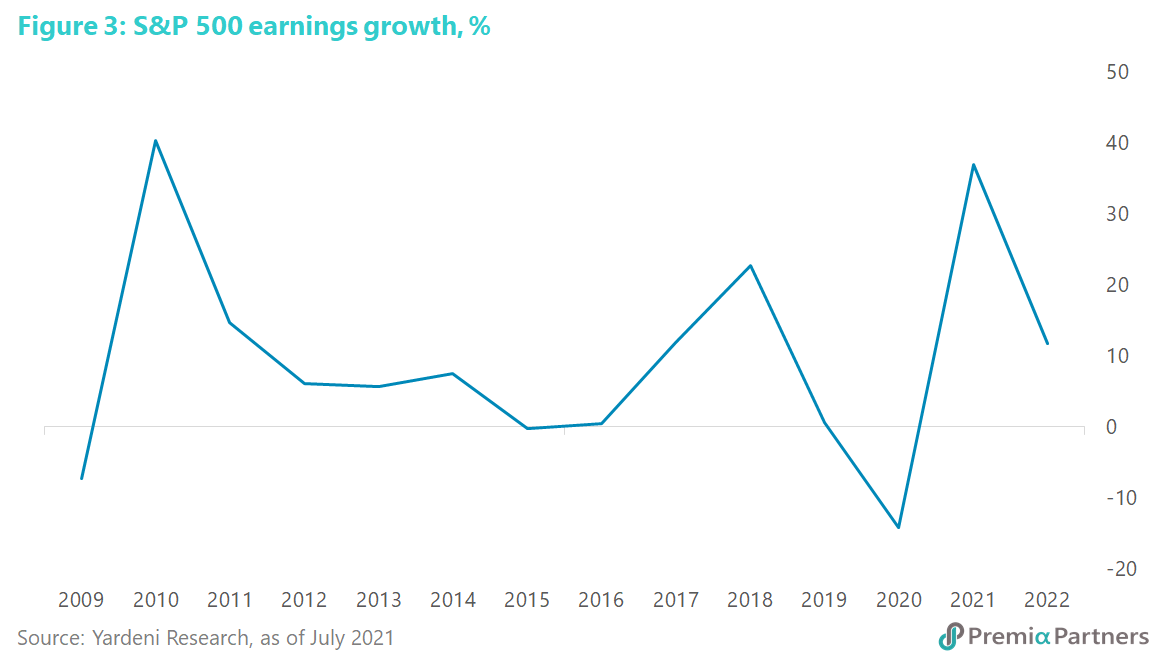

Peak economic growth also likely means peak earnings growth. Just as we have seen peak economic growth, we have likely also seen peak earnings growth. The market is expecting a 37% earnings growth for the S&P 500 for 2021 (figure 3). This is almost at the 40% growth peak post the Global Financial Crisis. And the market is looking at lower earnings growth next year. With lower earnings growth, the S&P 500 may have to accept smaller capital gains ahead. Late this year-early next year, the market will have to also start adjusting valuations for higher US rates.

A correction – not the end of the bull market. With still a sizeable gap between the 10-year US Treasury yield versus most equities indices earnings yields, there is likely to be a tendency for funds to re-enter the market on dips.

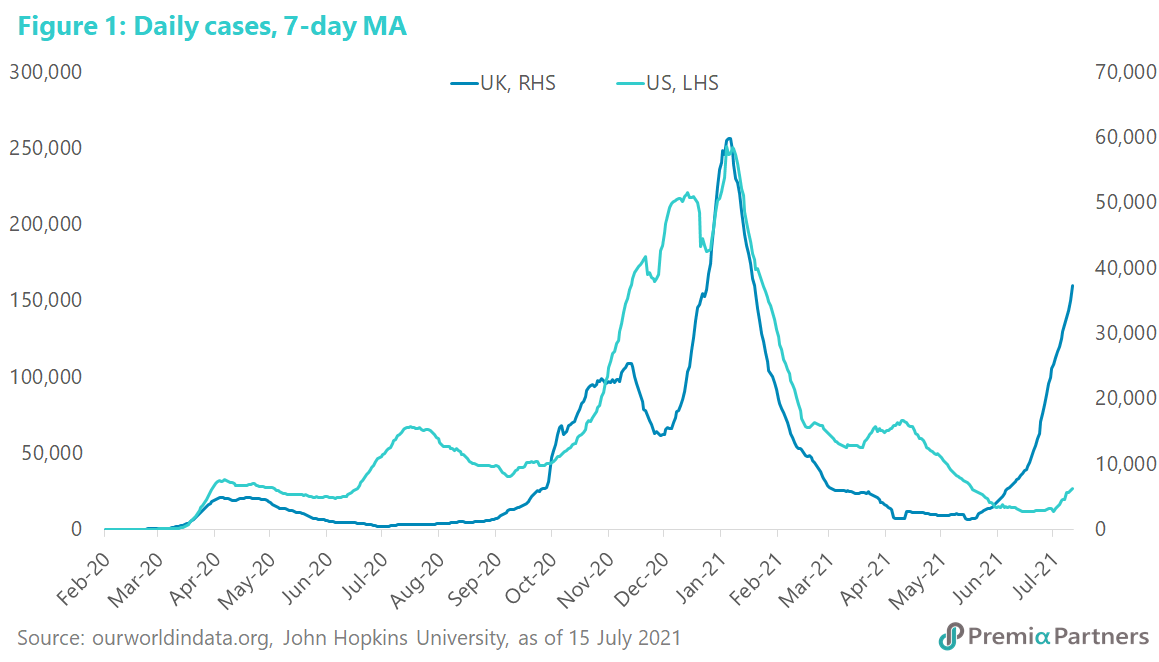

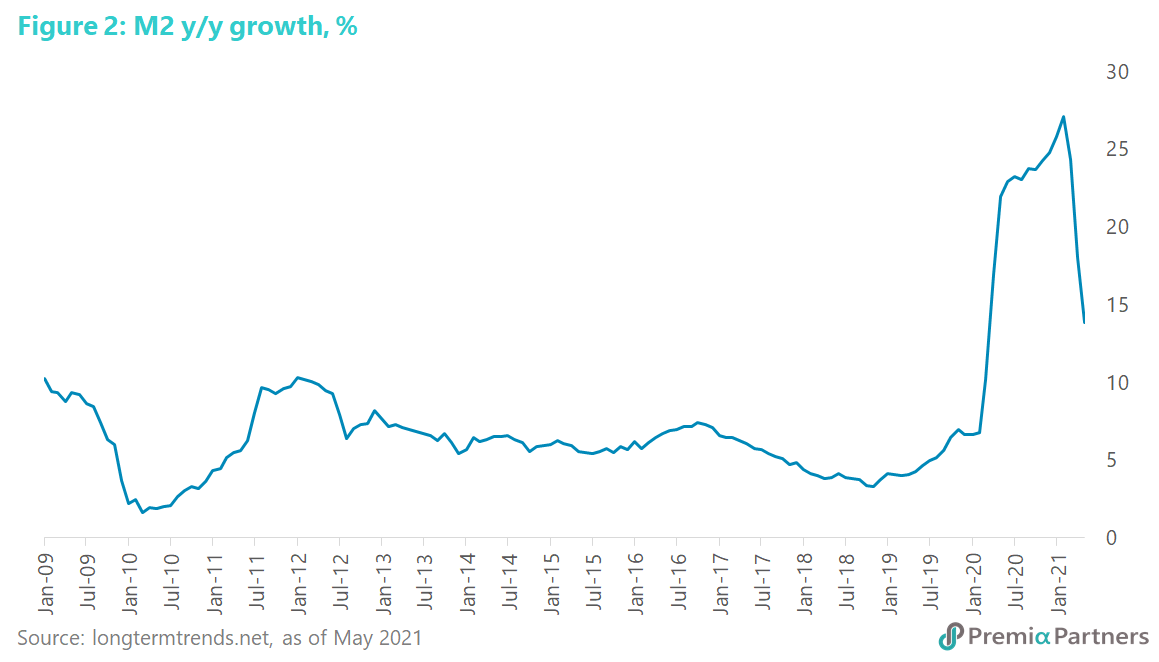

But watch these divergences. There are hints of market discontent in the divergences between the S&P 500 and the Dow Jones Transportation Index (figure 4) and the S&P 500 against that risk-on/risk-off currency pair AUDJPY (figure 5). Dow Jones Transportation and AUDJPY have not been confirming the bullishness of the S&P 500 since June.