“Where to find growth” has been the top of mind question for many in this slow growth environment. As we observe how megatrends play out, the much sought-after Yale Endowment approach of allocating more to alternatives lend much insight into modern portfolio management. Perhaps rather than a shift from conventional geography-centric or factor-based asset allocation models, it can be considered as a more holistic long term investing approach with megatrends and paradigm shifts in mind. It offers investors relevance - the choice to participate in the exciting innovations, breakthroughs and progresses from structural changes, and one that generates alpha for investors through the passage of time.

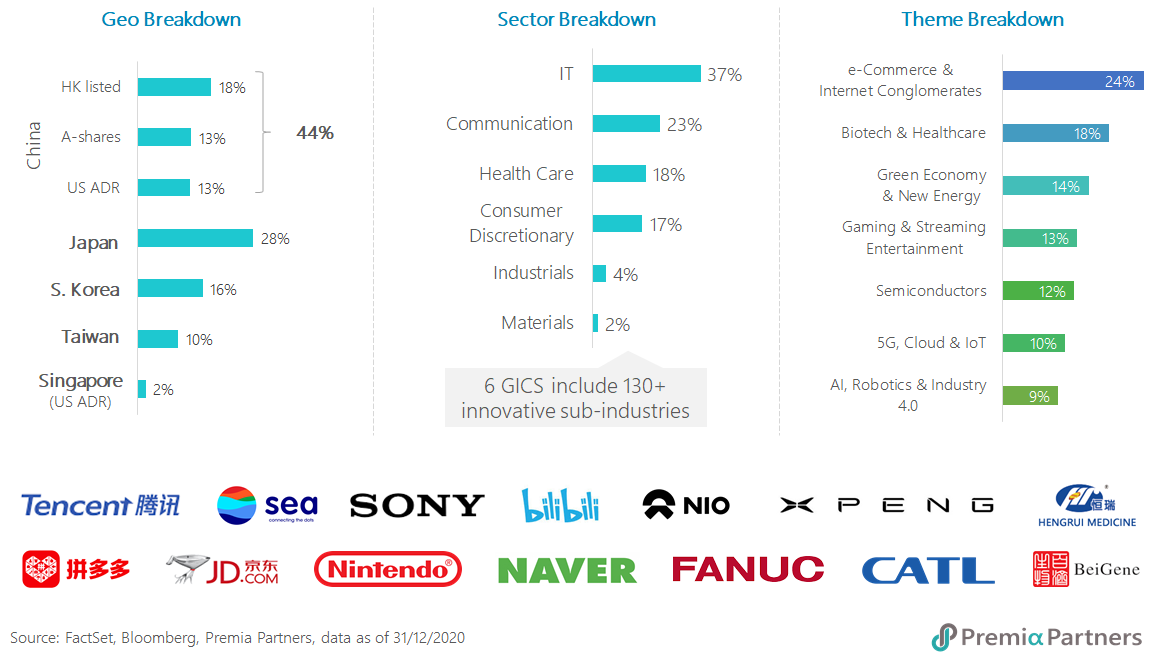

Coming back to Asia, where innovative leaders have been disrupting the productivity deadlock every day, powering sustainable growth through technology, and leveraging on the demographic tailwinds of the region – across smart EV & new energy, 5G, cloud computing, biotech, enterprise digitalization, robotic automation, and more. Yet given the Asia ETF market is still constrained by mainstream market capitalization-based approaches, investors are left with few efficient tools to position for secular growth trends in contrary to the developed markets.

As Asia increasingly becomes the growth engine of the world, fixing this void with an appropriate approach becomes more important than ever. In addition, it is vital to help investors develop use cases of how such growth themes fit into their broader portfolio strategies for better total portfolio management, especially as traditional asset allocation models typically do not consider disruptive trends. This report aims to empower readers with a playbook to position ahead for tomorrow today by addressing:

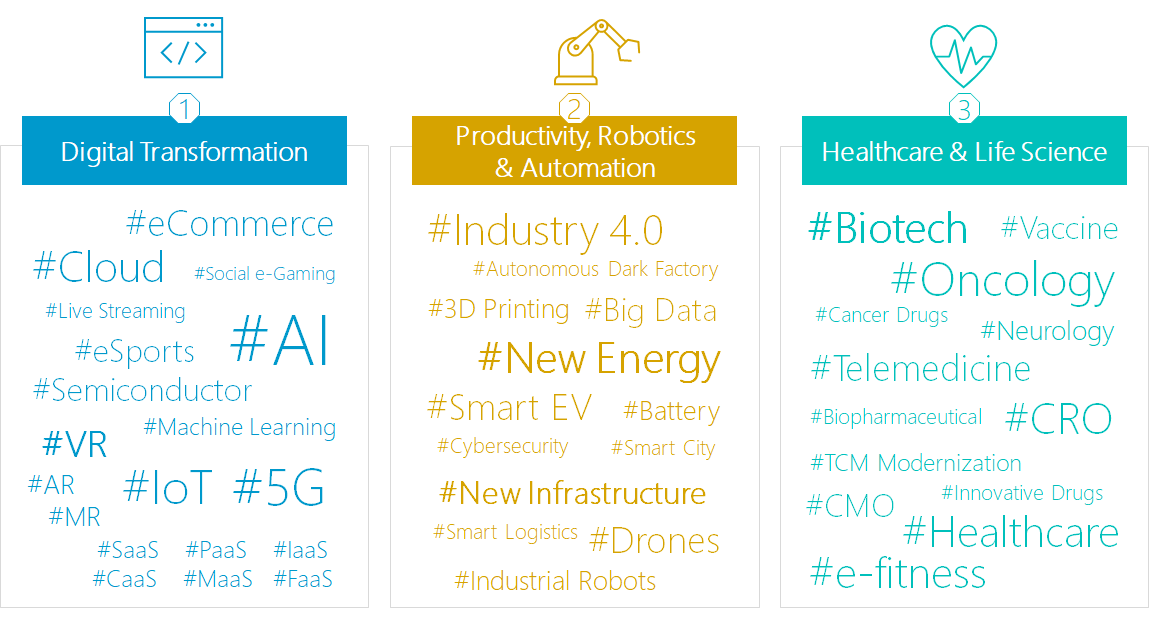

• How megatrends play out in Asia to generate enormous growth opportunities

• How to break away from the conventional GICS sector mindset and re-think “Innovative Technologies” more holistically

• How the Premia FactSet Asia Innovative Technology Index (AIT) capture growth from a broad array of existing and emerging innovative industries that disrupt their respective markets

• How AIT can add value as a critical portfolio building block for investors

The AIT index basket comprises 50 companies with significant revenue exposure spanning across over 130 innovative sectors and exhibiting strong growth prospects from the pan-Asia universe.

Throughout the full year of 2020, the Premia Asia Innovative Technology ETF (3181 HK / 9181 HK) which tracks the AIT Index generated a total return of 59.8%, and is among the best performing Asia ETFs globally.

|