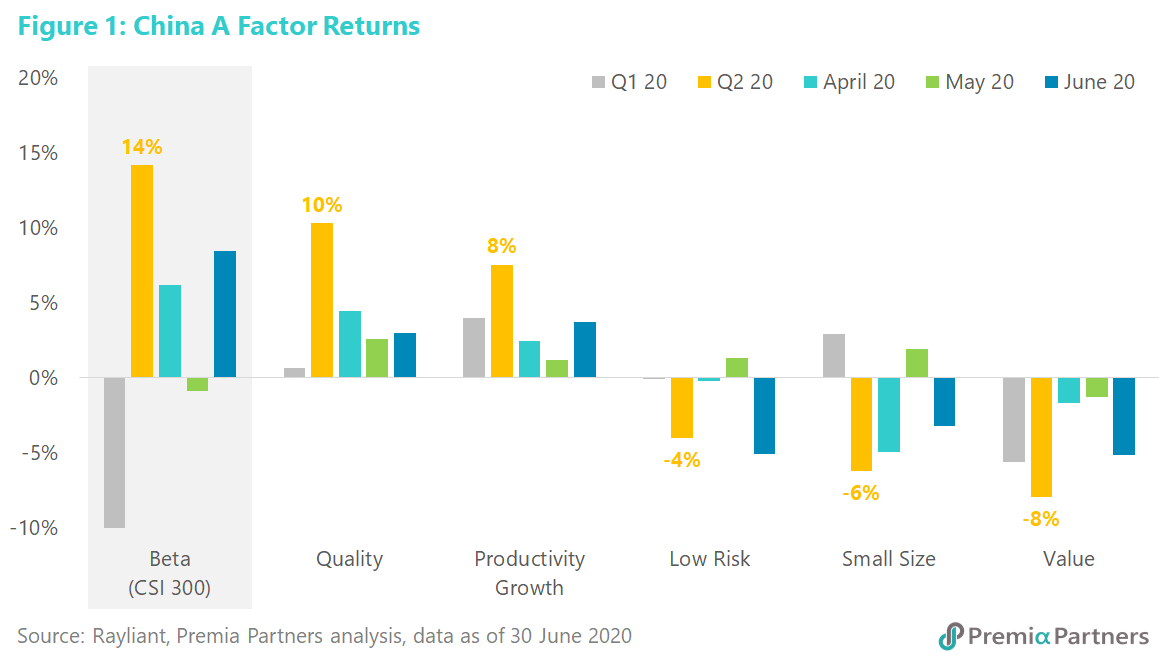

As illustrated in Figure 1, Quality and Productivity Growth factors have continued their strong momentum from Q1 while others trail. Investors looking to capture the recovery took on high-beta exposure and rotated away from stocks with lower risk, which resulted in a big drop of Low Risk factor in June. Small Size also underperformed as large-cap stocks reverted stronger in Q2 after their bigger collapse in the previous quarter. Value continued to lag with little sign of mean-reversion, and this has been a trend seen in the US and global equity markets as well.

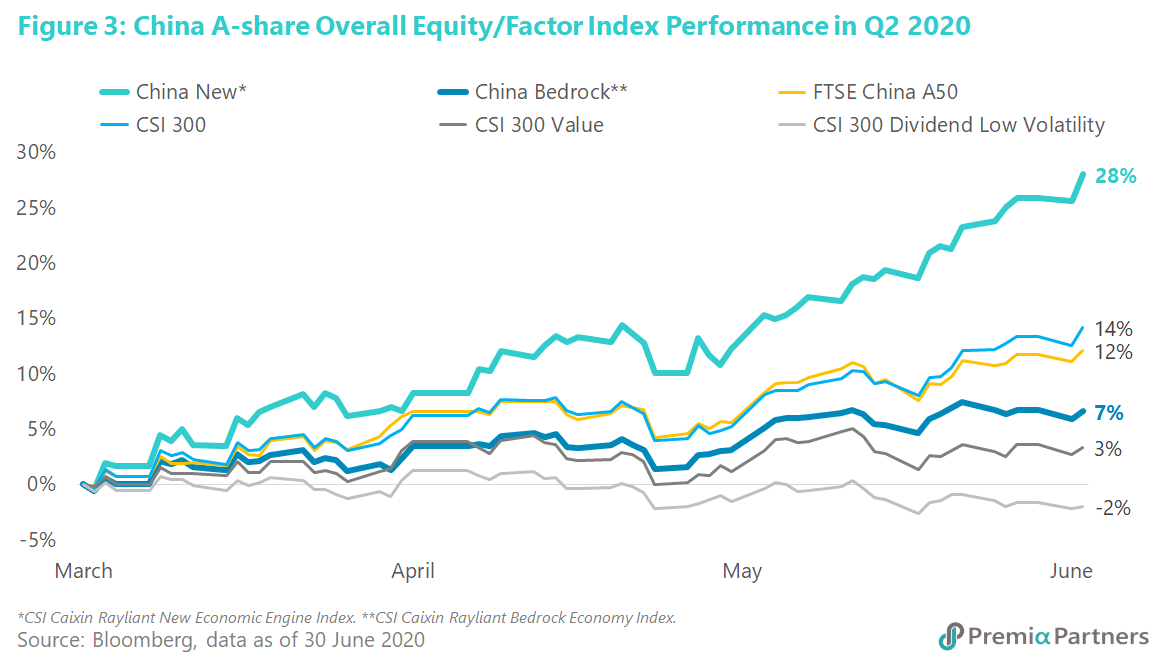

Our flagship Premia CSI Caixin China New Economy ETF, which tracks the CSI Caixin Rayliant New Economic Engine Index, outperformed the CSI 300 Index by 22% in H1 and is one of the best performing China A ETFs globally. This strategy captures the new economy leaders with style factors tilt toward Quality and Productivity Growth by design. As of 31 July, the New Economy ETF has gained US$116 million YTD inflows to reach a record high of US$269 million in AuM, from its strong performance and continuous new asset inflows.

Our other multi-factor China A shares strategy Premia CSI Caixin China Bedrock Economy ETF continues trailed market performance due to its tilt toward the Value factor. However, the in-built multi-factor design allowed the strategy to outperform peer single factor strategies such as those tracking the CSI 300 Value Index or CSI 300 Dividend Low Volatility Index.

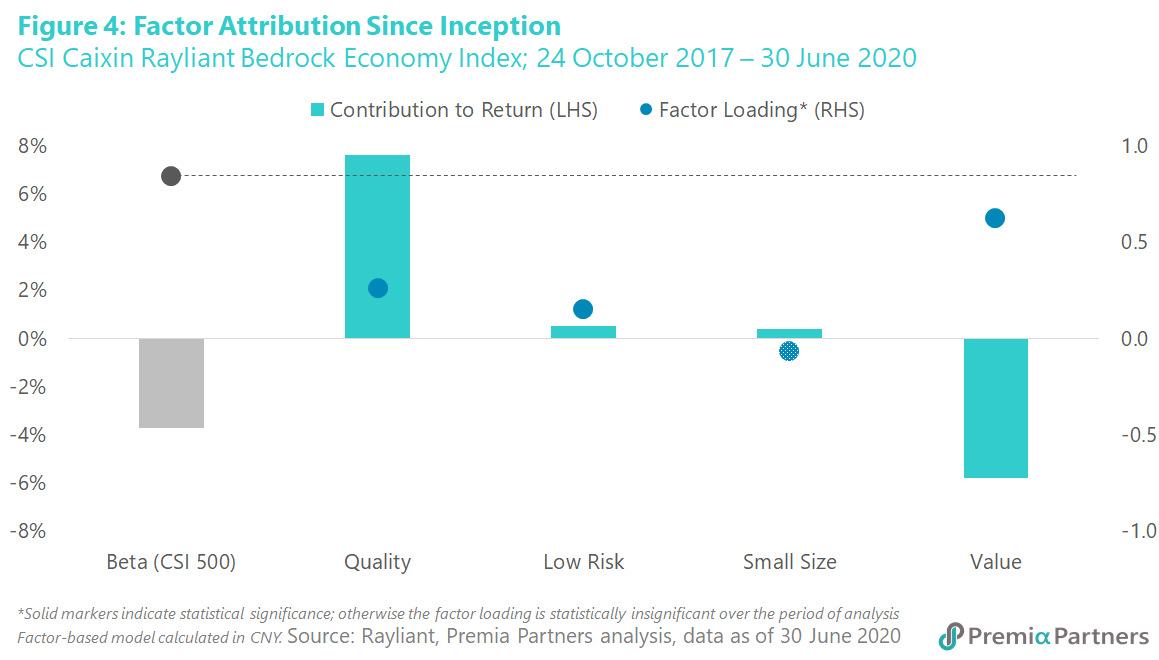

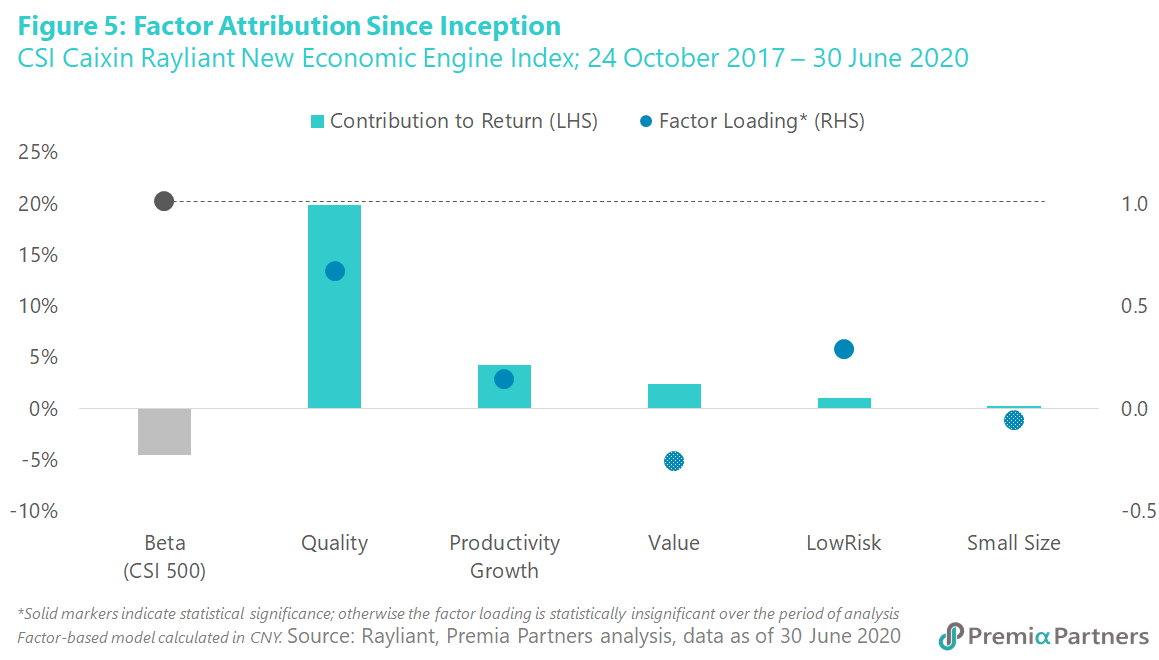

As both of multi-factor China A strategies approaching their 3-year anniversary, we also take this quarterly review opportunity to review the since inception factor attribution as illustrated in Figure 4 and Figure 5.

· The Bedrock index has a lower beta loading compared to the broad CSI 500 which echoes the overall Low Risk exposure in design. While the exposure to Value contributed most of the negative active returns, it’s offset by the multi-factor strategy’s exposure to Quality.

· For the New Economy index, the overall beta exposure is close to 1. The active factor return is mostly attributed to the positive exposure to Quality, followed by Productivity Growth as well as a nature negative exposure to Value.

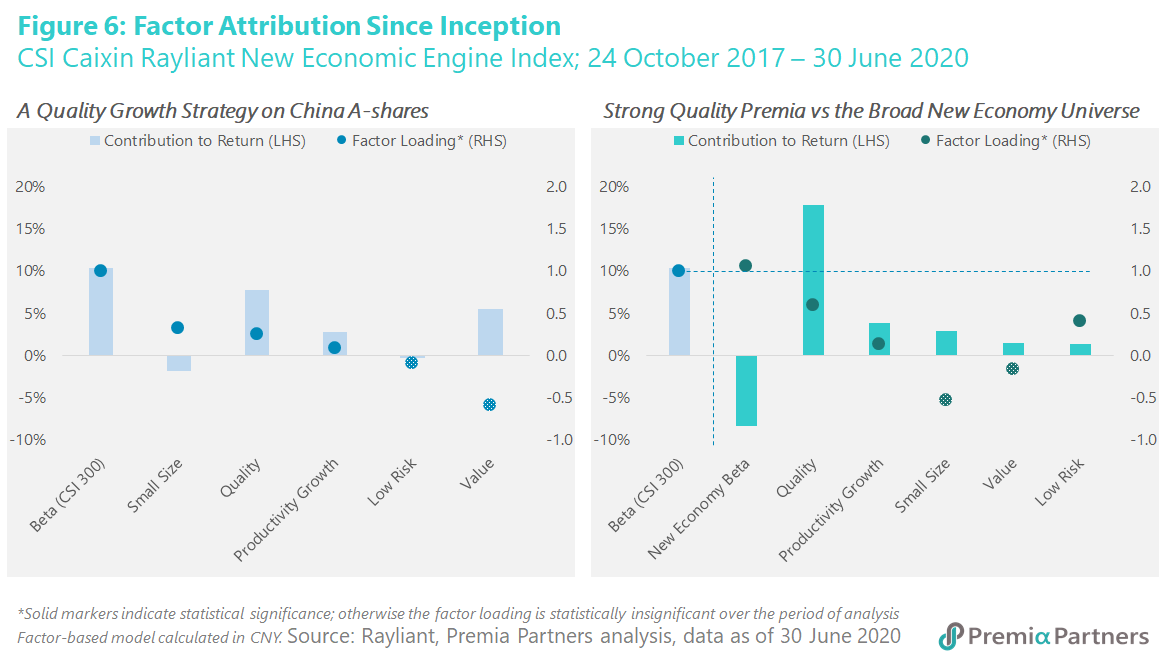

For asset allocators considering using our New Economy strategy as the core China A exposure as alternative to large cap CSI 300 or broad new economy growth strategy, we have also conducted factor analysis to illustrate the active loading and return contribution since fund inception as shown in Figure 6.

· On the left-hand side, we see the overall beta compared to CSI 300 is close to 1, and the active return comes from the quality and growth (neg value) exposures.

· On the right-hand side, the contribution from quality factor is further amplified if we were to compare the strategy versus the broad new economy industry universe. Compared to a naive industry-play of new economy beta, our factor overlays screen for the financially healthy, profitable leaders to generate the secular alpha of quality growth.

As valuations of many regional indices were at their all-time high at the end of June, there could be a short-term mean-reversion of Value in the coming months. However, the global real economy would take time to recover from the lockdown and distruption of economic activities. Hence, we are still cautious about a traditional value pureplay as the market reconfiguration to a new norm would certainly re-evaluate the multiples, favouring the growth leaders even more while also leaving some others in value trap.

Looking forward into the second half of 2020, the geopolitical uncertainties between US and China still present market risks to Chinese equities (and globally). Yet as China reconfigures to a dual circulation of switching from an investment/export-driven economy to increasingly relying on domestic consumption, high-end industrialization and supply chain upgrade, the domestic new economy sector leaders in China A would be more resilient to external shocks. On the other hand, as the market have more visibility towards US presidential election and vaccine availability, we shall expect to see the market shifting towards Emerging Markets especially China as a result of potential increase in US tax risk under new administration and a possible rate hike.

For further readings about China A shares resilient performance and solid market recovery, our co-CIO David Lai has shared in 〈Five reasons why Chinese stocks have been running hot〉 and 〈China rally - Does your exposure align with the outcome you desire?〉.