The threat of 10%-20% tariffs on all exporters to the US, outside of China which faces a 60% tariff, is a clear and present danger to world trade. Yet, ASEAN has not been singled out for harsher treatment than any other region ex-China. Indeed, it could continue to benefit from trade diversion from China. That could maintain the surge in foreign direct investments from 2017, as the global supply chain pivots away from China to avoid the threatened 60% tariffs.

US merchandise imports amount to more than US$3 trillion per year. The idea of the US producing even a majority of its imports is fantasy.

Since 2018 – and this is the impact of Trump 1.0 – the US has simply switched its imports from China to Asia Pacific ex-China. More specifically, while China’s share of US imports has fallen since 2018, ASEAN’s share of US imports has risen over the same period. Running in tandem, foreign direct investments into ASEAN have surged in that time, as companies shifted parts of their supply chain from China to ASEAN.

This time is unlikely to be different – the fundamentals of location, capabilities and competitiveness have not changed.

With inflation either declining or low, more accommodative monetary policies are likely, and will help drive growth in the region. Emerging ASEAN is done with interest rate hikes, with Vietnam an outlier which cut rates from early 2023. The others appear to have either seen peak rates or are in the early stages of a cutting cycle. That will help boost domestic demand, which generally saw mediocre growth in 2024, with most around the 4.5%-5.0% range.

Meanwhile, the greatest fiscal stimulus in China since 1994 (as measured by a budget deficit of 4% of GDP) should help offset the drag from higher US tariffs.

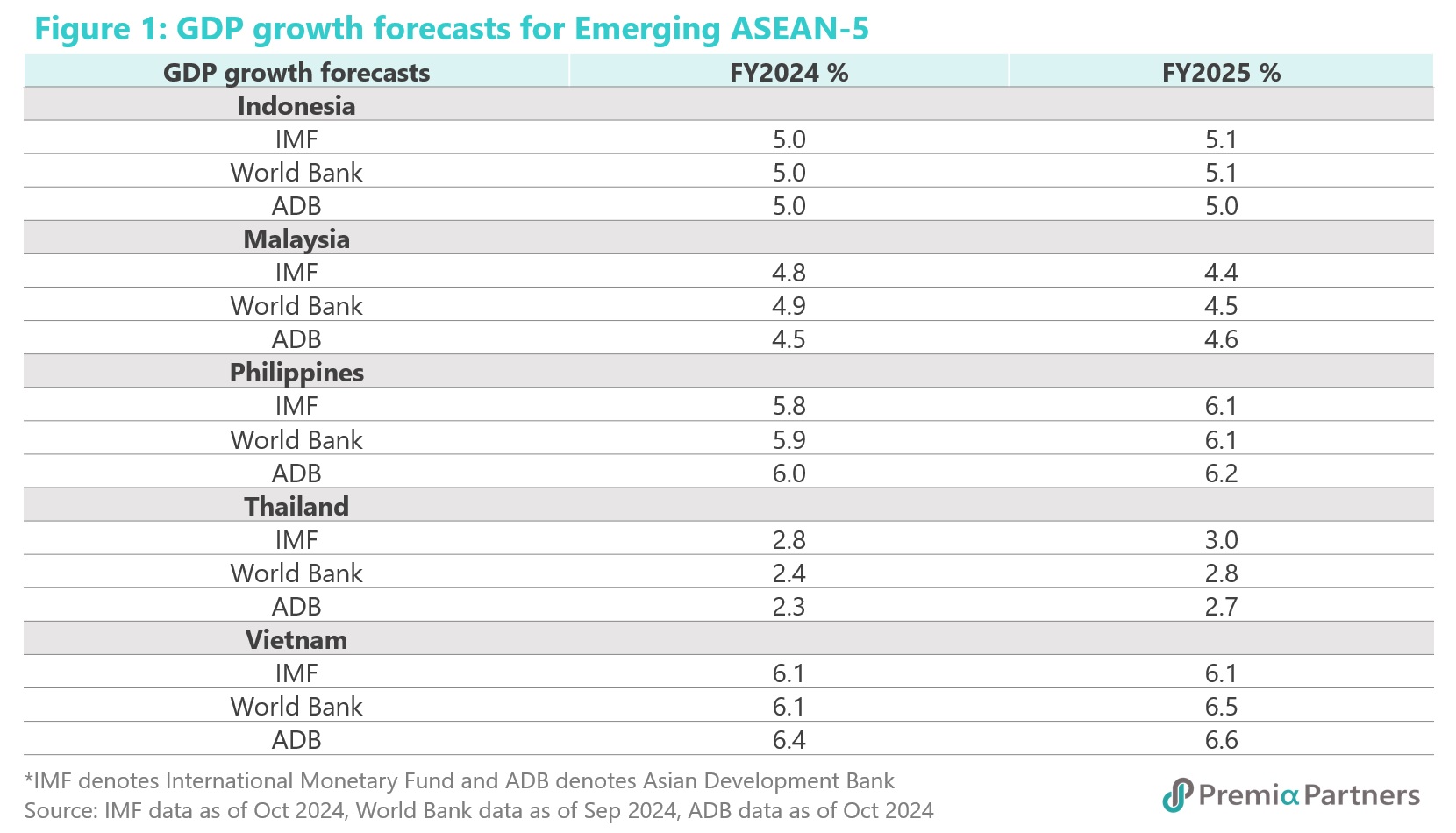

Overall GDP growth in Emerging ASEAN could be a bit stronger in 2025 compared to 2024 – stronger in Indonesia, the Philippines, Thailand and Vietnam but slightly weaker in Malaysia.

2025 – growth likely to be resilient despite trade threats. Multilateral agencies’GDP growth forecasts for Emerging ASEAN for 2025 generally suggest resilience in 2025. Almost all countries, possibly except for Malaysia, are expected to hold or advance growth rates in 2025 (figure 1).

Stronger household consumption growth is a theme that is common to most of Emerging ASEAN. Rate cuts, fiscal stimulus, lower inflation and higher wages will support domestic demand growth in most Emerging ASEAN economies in 2025.

- Indonesia – fiscal boost from election promises. In Indonesia, fiscal stimulus flowing from the early 2024 Presidential Election is a factor. Bank Indonesia cut rates in September for the first time since early 2021. The gains in Indonesia’s terms of trade in 2024 will also be helpful for domestic consumption if they hold up in 2025.

- Malaysia – helped by strong jobs market and government wage growth targets. For Malaysia, the decline in its unemployment rate from a peak of 5.3% during the pandemic to 3.2% - technically, a full employment level in Malaysia – by October 2024 has been a significant contributor to consumer confidence and spending. The Bank Negara policy rate appears to have peaked – having flatlined at 3.0% since May 2023. The commencement of a rate cutting cycle would be another boost to household spending. Longer term, the Government’s policy target of raising the wages share of national income from 32.4% cent in 2022 to 45.0% by 2035 will give household demand a big boost. Even near-term, the objective of raising the monthly median wage from RM2,424 in 2022 to RM2,700 in 2025 will be helpful, if it can be achieved.

- The Philippines – rate cuts and lower inflation. Bangko Sentral ng Pilipinas has cut rates three times since July. This will likely support consumer sentiment in 2025. This will also be helped by a halving of the inflation rate from 6.0% in 2023 to an expected rate of around 3.0% in 2025. This will ease cost of living pressures. Steady growth in overseas remittances from Filipino workers overseas – to a record high of US$37 billion in 2023 – will also help. This steady growth in (US Dollar) remittances has also been against a strong uptrend in the US Dollar against the Philippine Peso from mid-2021.

- Thailand – bigger fiscal deficit, helicopter money and rate cut. The roll-out of the “digital wallet” scheme from 4Q of 2024 – “helicopter money” directly into the hands of Thai consumers – will help support domestic demand. A bigger boost will depend on whether the Bank of Thailand follows the surprise, October rate cut with more in 2025. There had been some criticism of the “digital wallet” scheme as fiscally profligate. However, the resultant fiscal deficit of 4.3% of GDP is not out of place, considering inflation is running below 1.0% and the government debt to GDP ratio of around 66% of GDP is not unusually high by international standards.

- Vietnam – wage rises, the lagged effects of rate cuts and a decline in inflation will be supportive. A 6% rise in the minimum wage from July 2024, following a pause of two years in the growth of minimum wages, will help domestic demand in 2025. Government employees will also benefit very significantly from reforms to narrow the gap between private and public sector workers. For starters, the base salary of government workers increased by 30% from July 2024. This will likely be followed by annual increases going forward. With strong growth in foreign direct investments, private sector wages have also been rising strongly. For example, the average monthly income in 1H of 2024 rose by 7.4% over the same period in 2023. Further, the lagged effects of 150 basis cuts in rate cuts in 2023 should also help, particularly if inflation eases as expected in 2025.

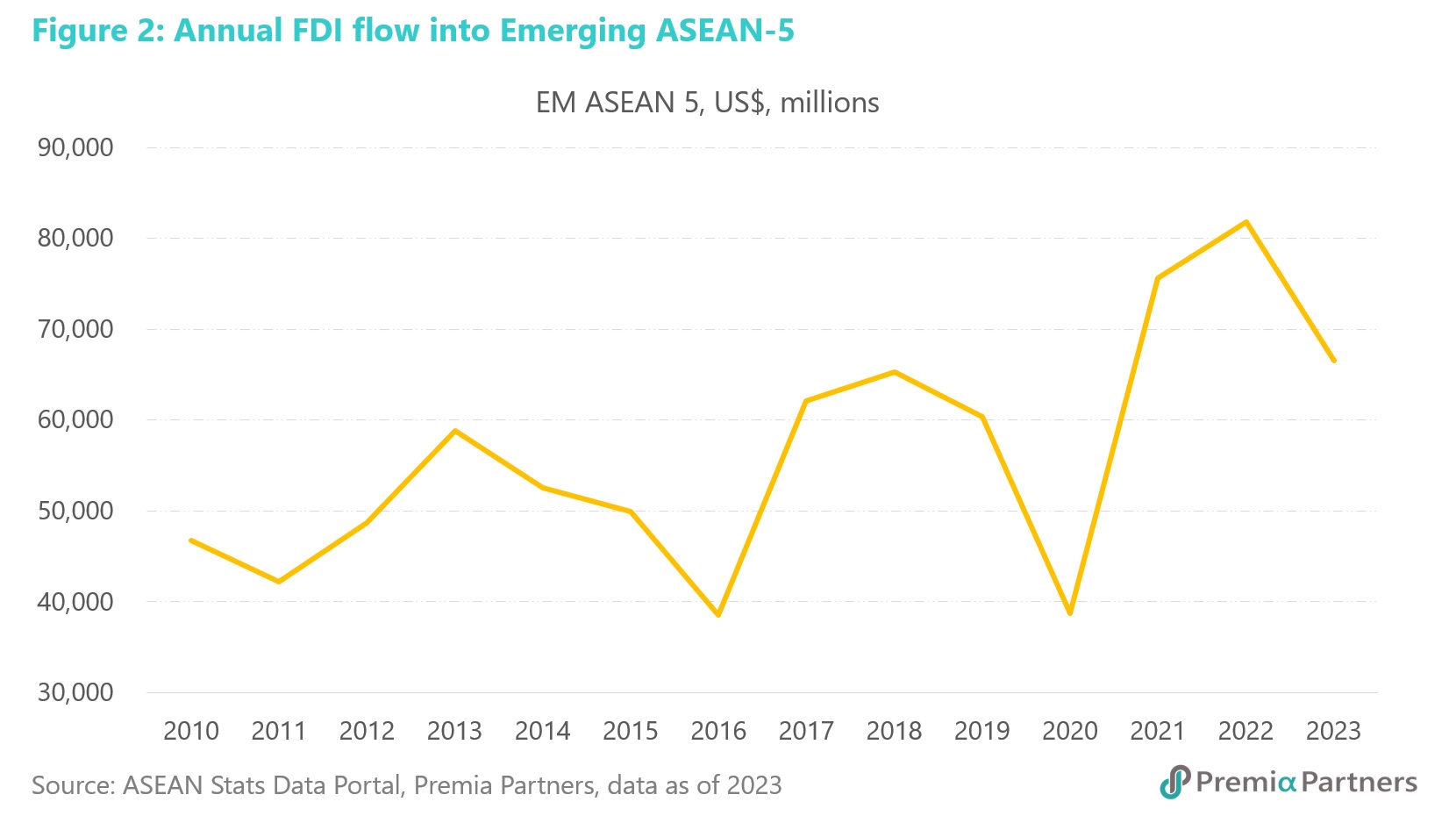

Foreign Direct Investment growth – benefiting from global supply chain adjustments to US tariffs. In the six years from 2010 to 2016, the annual flows of FDIs into the big Emerging ASEAN 5 economies (Indonesia, Malaysia, the Philippines, Thailand and Vietnam) went sideways, ending 2016 at US$38.6 billion, much lower than the US$46.7 billion in 2010. But since President Trump catalysed US economic nationalism in 2017, the annual FDI flow into EM ASEAN-5 went from US$38.6 billion in 2016 to US$66.5 billion in 2023, for a CAGR of over 8.0% (figure 2). This is the result of a pivot in global supply chains from China to avoid US tariffs. Emerging ASEAN is the logical next destination given its overall competitiveness. We expect this will continue in Trump 2.0 as under Trump 1.0.

Much has been written about how that might change under Trump 2.0, if the US goes after beneficiaries of the trade diversion from China, such as Mexico and Emerging ASEAN.

But how far can the US take this game of “whack-a-mole”? Import substitution for over US$3 trillion of imports is a fantasy. In theory, it will require trillions of dollars of investments and a much larger workforce. In practice, it is well neigh impossible.

ASEAN has been gaining shares of total imports by both the US and China. The IMF recently reported that since 2018, ASEAN has increased its market share of both Chinese and US goods imports, with both China and the US absorbing a higher share of the region’s value added. The IMF also reported that for some ASEAN economies, exports of products targeted by Chinese or US tariffs grew faster than exports of untargeted products. This is trade diversion at work.

“Moreover, the ASEAN economies increased exports in targeted goods to third countries, suggesting that they exploited not only trade diversion opportunities but also realized economies of scale,” the IMF said.

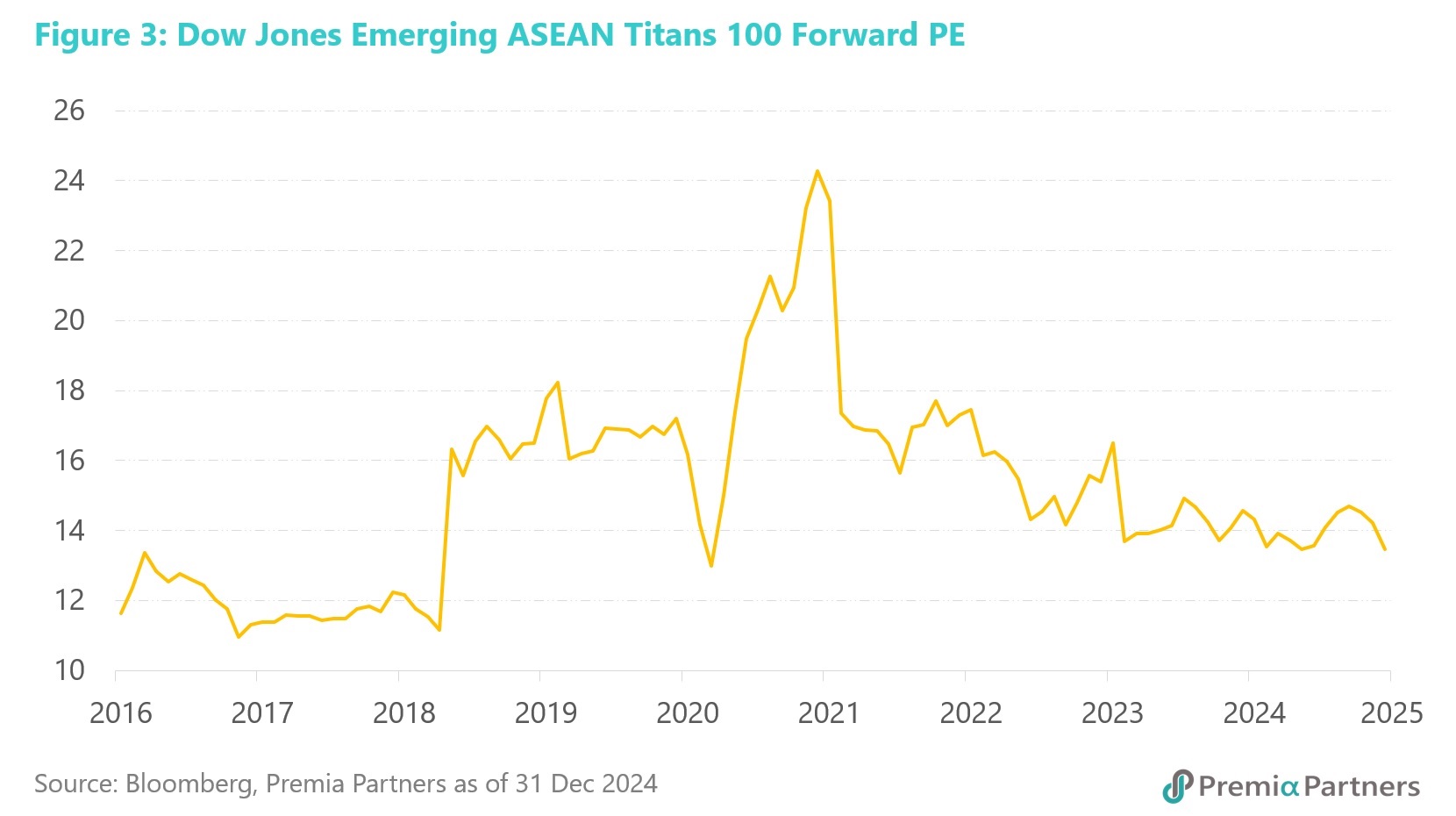

EM ASEAN stock valuation is almost at the pandemic low. The market is valuing Emerging ASEAN stocks as if they are facing a situation as bad as COVID-19. The Dow Jones Emerging ASEAN Titans 100 Index is now valued at a forward PE ratio of 13.5x, approaching the COVID-19 pandemic low of 13.0x in early 2020.

The first year of the pandemic was an economic catastrophe for the ASEAN region, with GDP contractions of -2.1% in Indonesia, -5.5% in Malaysia, -6.1% for Thailand and -9.5% for the Philippines. By comparison, for 2025, we are looking at growth rates of over +6.0% for Vietnam and the Philippines, around +5.0% for Indonesia, around 4.5% for Malaysia, with the weakest Thailand still registering around +2.7% to +3.0% growth.

Translated into earnings, the Dow Jones Emerging ASEAN Titans 100 Index is expected to turn in one-year forward growth of 10% on Bloomberg analyst estimates. Against a one-year forward PE ratio of around 12x, that offers a moderate PEG ratio of 1.2x.

Will this be a rerun of late 2016, when Emerging ASEAN valuations hit a low in anticipation of Trump 1.0, rebounding in subsequent years? Reconstructing the Dow Jones Emerging ASEAN Titans 100 Index forward PE ratio (using its portfolio constituents) back to before the index started in mid-2018, we see valuation reaching a low of around 11x late in 2016, around the time Donald Trump won the Presidential Election. The ratio recovered in subsequent years (figure 3).

JP Morgan recently made a similar point using the MSCI ASEAN Index CAPE (cyclically adjusted PE) ratio, which was already more than 1-standard deviation below its 2011-2024 mean. On the CAPE, the MSCI ASEAN is not quite as low as during the worst point of the pandemic, but well under its 2016 low.

There is fear that the US could get harsher (than thus far stated) on beneficiaries of trade diversion, such as Mexico and Emerging ASEAN. The well-worn cliché is “anything is possible with Trump”. We cannot add anything more to that. But we note that Emerging ASEAN is geographically and geopolitically crucial to the US in its “strategic competition” with China. How hard can the US push ASEAN economically without risking geopolitical blowback?

Focus: Vietnam – firing on all engines. Vietnam has been the strongest GDP growth performer in ASEAN in 2024. The IMF and the World Bank expect 6.1% growth in 2024 and the ADB is looking at 6.4%.

It has been firing on all engines – with good growth in private consumption, investment, and exports.

Private consumption has been picking up from 2023, to register 7% growth in the 3Q of 2024, with full year growth likely around 5%. Decisive interest rate cuts of 150 basis points from March 2023 to June 2023 would have helped lift domestic consumption in 2024.

Meanwhile, foreign direct investments for the period January to November of 2024 grew by 7.1% y/y. Exports come up strongly from negative in early 2023 to y/y growth of 15.4% in the first nine months of 2024.

For 2025, Vietnam is again expected to be the fastest growing economy in ASEAN: The IMF expects continued 6.1% growth, the World Bank’s forecast is 6.5%, and the ADB is looking at 6.6%.

For 2025, policy makers appear to be building domestic buffers against external volatility, via channels such as wage rises; infrastructure spending; and recovery in the real estate sector.

As outlined earlier, the rise in the minimum wage and the huge increase in the base salaries of government employees in 2024 will set the stage for increased consumer confidence and spending in 2025.

Adding to the domestic momentum are infrastructure projects such as the continued building of Ho Chi Minh City’s Long Thanh International Airport and an acceleration of the Hanoi Ring Road No. 4 project.

Market specialists expect that legislative reforms (which offer more transparency and better investor protection), strong economic growth, high occupancy rates, and a working through of the residential property glut, will help turn the real estate market cycle in 2025, which should in turn support consumer confidence.

Vietnamese corporate earnings growth is far and away the strongest in ASEAN – indeed world-beating at 35% for one-year ahead earnings. Against a one-year forward PE ratio of 9x, that is growth at a really reasonable price.