Investors are now at a crossroad to decide whether China tech is still investible. On one hand, the Internet platforms, used to be the market leaders, may no longer be the high-growth candidates in future as shown by the recent sluggish financial results. On the other hand, technological advancement remains one of the government’s key agendas that should help support the sector. In this article, we would like to share how to identify the “right” tech exposure to capture the opportunities in China market.

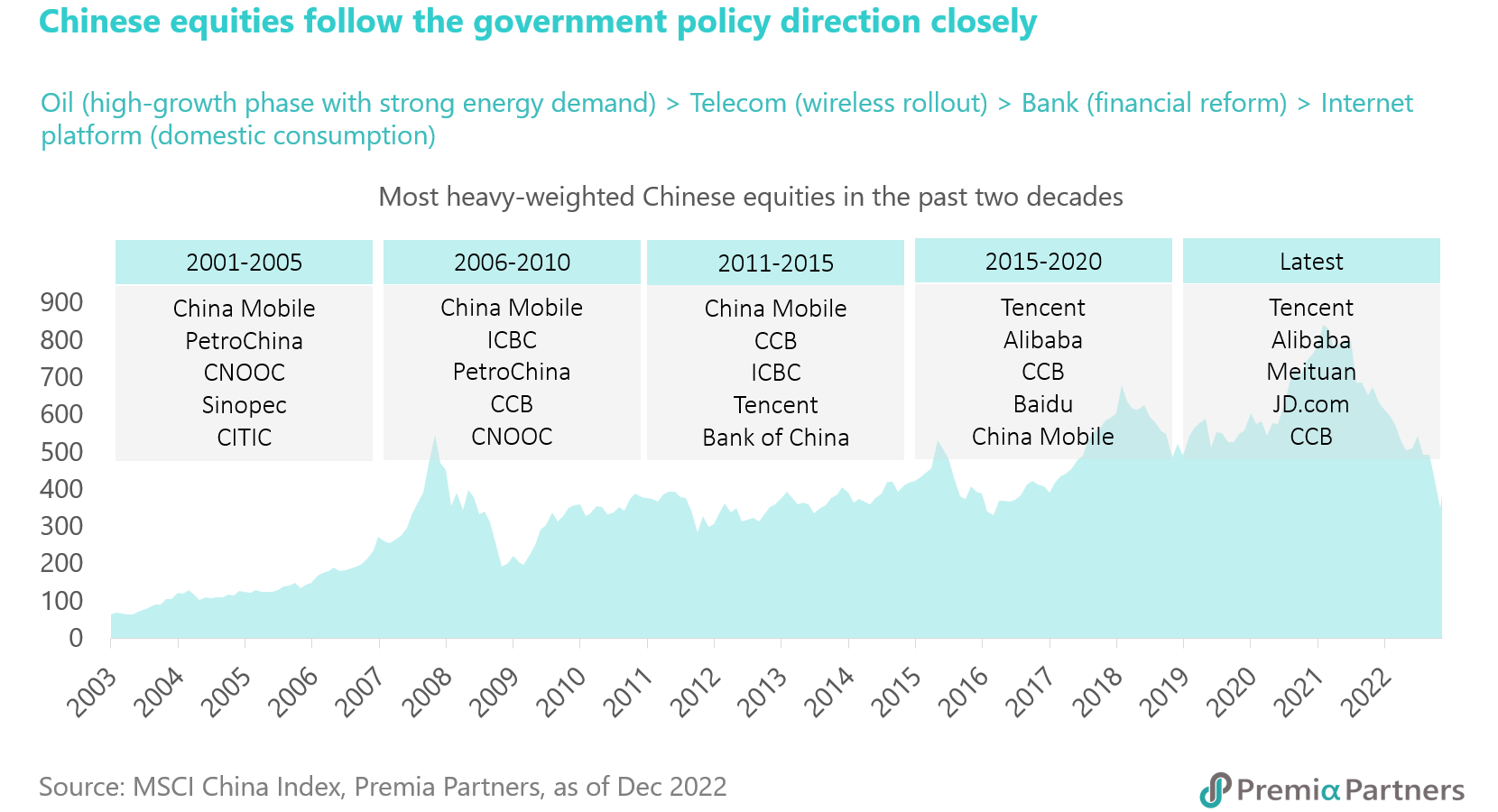

If we agree China may offer outperformance in 2023, the next step is to figure out the right positioning to capture the alphas. Chinese government policy is usually a good indicator that guides investors to explore the growth areas of the economy and the corresponding capital market movement.

- When energy needs surged once China joined the World Trade Organization and turned into a global manufacturing center, the domestic oil producers such as PetroChina, CNOOC and Sinopec became the market favorites.

- During the time in rolling out the wireless network nationwide, China Mobile sat on the throne as the largest listed company for years as it kept acquiring new customers and charging higher monthly bills until the industry matured.

- Chinese banks, including ICBC, Bank of China and China Construction Bank, had their own heydays when financial reform was undergoing whilst the underlying economy was expanding at a pace of over 10% annually.

- Internet platforms like Tencent, Alibaba, Meituan and JD.com dominated the market by riding on the digital uptrend and the promotion of domestic consumption in the last decade.

As China is looking for sustainable and quality growth, continuous technological development is essential for achieving this goal. Logically, tech sector should be well supported by the government, but the crackdown on Internet platforms has lured investors doubting if China tech is investible.

We see the scrutiny is simply telling the market loud and clear that these tech players are not necessarily the ones to lead or add value to the required technological breakthroughs going forward.

- In fact, the country probably does not want to encourage youngsters playing games for longer time and spending more in upgrading their avatars, consumers doing excessive impulse purchase without considering the damage to the environment, or people making unfit financial decision by installing new apps on their mobile devices.

- E-commerce, gaming, live streaming, delivery and other similar operators do bring convenience to the users by applying technology on their platforms, but they are not developing the strategic hardcore technology needed.

Instead, China will seek advancement in semiconductors, advanced manufacturing, artificial intelligence, life science and biotech, green economy, new materials and renewable energy in order to increase its competitiveness in the international stage. And China has been increasing its effort in research and development (R&D) on technology.

- Basic research accounted for 6.5 % of China’s overall R&D expenditure in the first year of the 14th Five-Year-Plan, on track to achieve its goal of 8% by 2025.

- The total spending was up by 24% YoY to RMB 182 billion on basic research in 2021, a much faster pace as compared to the 9.8% in the previous year.

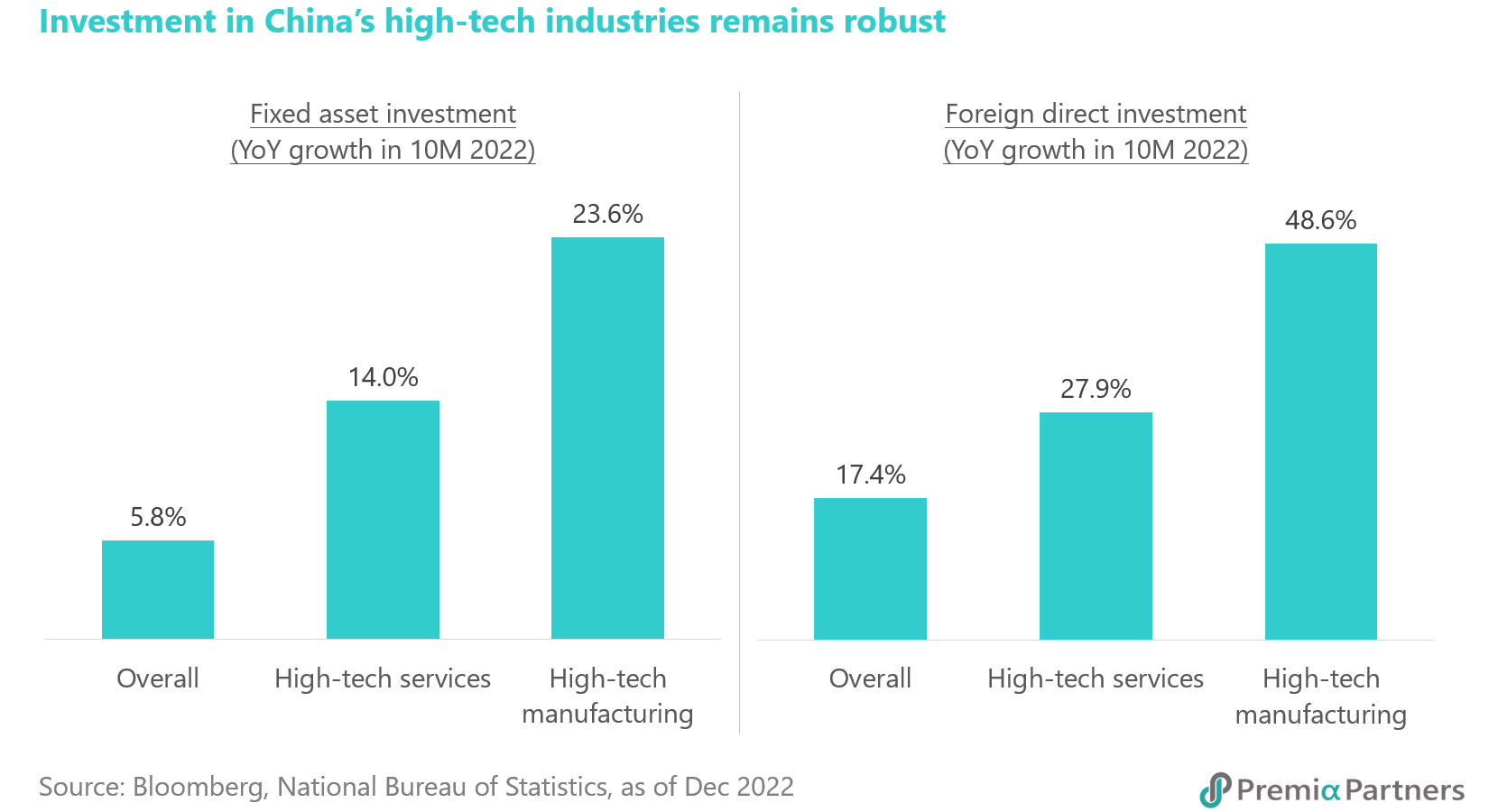

- In the first 10 months of 2022, investment in high-tech industries grew by 20.5% YoY, with high-tech manufacturing and high-tech services expanding 23.6% and 14.0% respectively.

- The growth in investment in high-tech industries for the period was 14.7% points higher than the nationwide fixed-asset investments, indicating a benign trend in the technology industry and improving quality of economic development.

- Overseas investors also jumped on the bandwagon of China’s flourishing high-tech industries since foreign direct investment in high-tech manufacturing and the high-tech service sector rose 48.6% and 27.9% respectively.

Since the launch of STAR Market in July 2019, it has brought together ~490 listed companies and becomes the first choice for enterprises with "key and core technology" to go public.

- In the first three quarters of 2022, the companies on STAR Market realized operating revenue of RMB 782 billion (+33% YoY), net profit of RMB 89 billion (+25% YoY) and R&D spending of RMB 61 billion (+33%), showing a stable growth momentum and dedication in innovation despite the strong macro headwinds.

- Especially, the new energy industry represented by photovoltaic (PV) and power battery has a stellar performance. 13 PV companies saw their operating revenue and net profit surging by 106% and 183% YoY respectively, and 16 battery names saw their operating revenue and net profit going up by 93% and 93% YoY respectively.

- The semiconductor and biomedical industries also see a promising advancement, with the number of listed companies reaching 79 and 107 respectively, and the growth rate of operating revenue exceeding 20%.

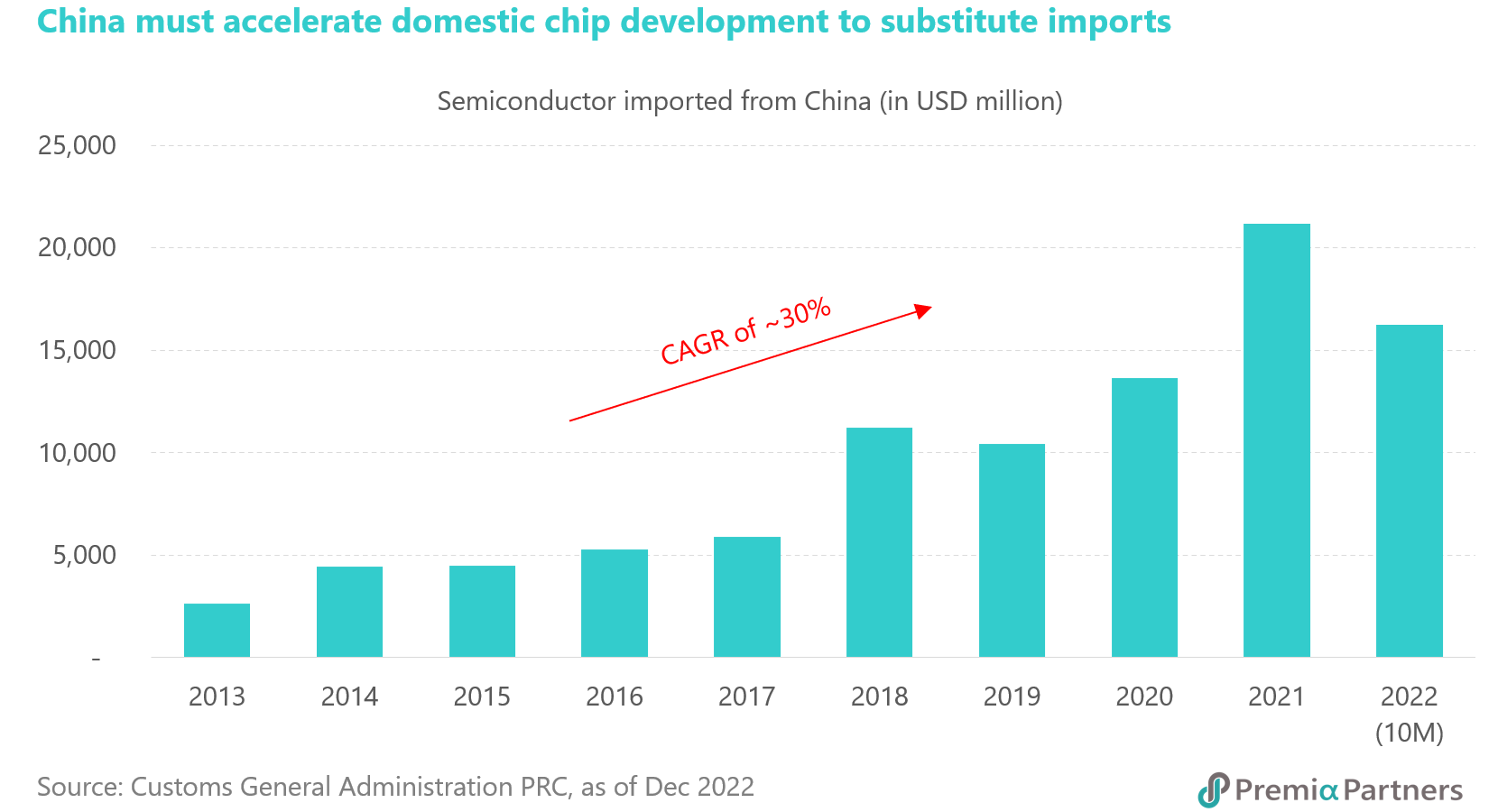

- Meanwhile in response to US’s CHIPS Act (Creating Helpful Incentives to Produce Semiconductors and Science Act of 2022), China is also working on a RMB 1 trillion support package for its semiconductor industry. This would be one of its biggest fiscal incentive package over five years, to bolster semiconductor production and research activities at home, and step up support for Chinese chip firms to build, expand or modernise domestic facilities for fabrication, assembly, packaging, and research and development.

Investors should understand that the road for China in technological self-reliance or net-zero emissions would be full of obstacles and opportunities at the same time. The escalated conflicts between China and the US over technology transfer such as the recent exports ban of advanced chips would certainly create difficulties for the semiconductor industry in China, but it does not mean the outlook is dismayed. Huawei is blacklisted by Washington from acquiring US technology for smartphones, leading to a delay of its product pipeline. It is in the redesign process and will be ready to relaunch 5G phones as soon as next year.

Besides, not all companies are following the outright ban. TSMC and SK Hynix have secured a one-year waiver to continue supplying chip-making equipment to China. Most corporates, including the US ones, have their own agenda to serve shareholders and conduct business, while China is a substantial market which no one would like to drop it without any alternatives.

Ultimately, China has stronger incentives to develop its own advanced technology. Investors should expect the government policy will be turning even more favorable to the domestic hardcore technology companies that will put in extra efforts in R&D and accelerate the development cycles.

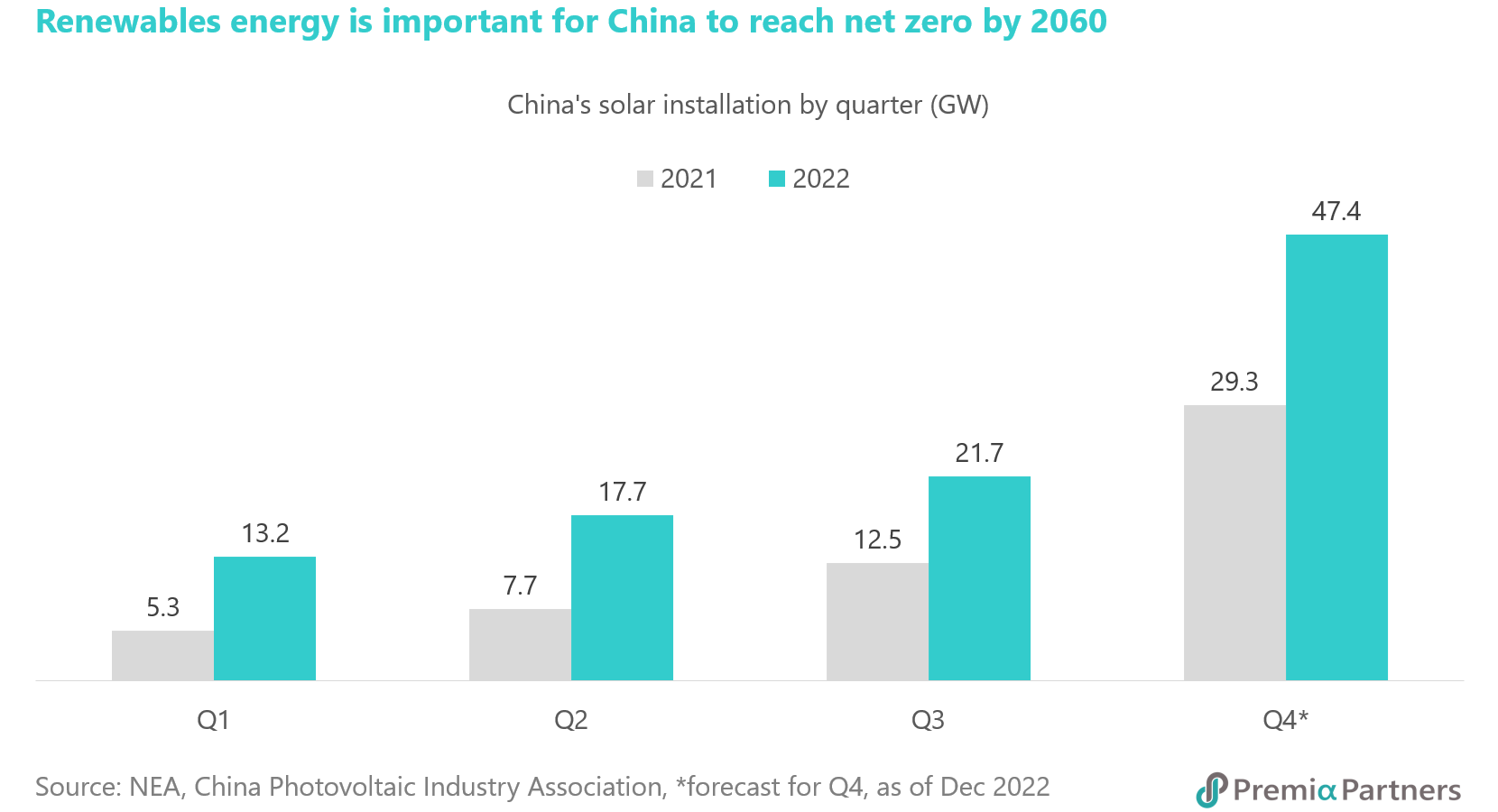

The encouraging progress in green technology aligns the country’s transition to carbon neutrality, targeting to reach a peak in its CO2 emissions by 2030 and net-zero before 2060. LONGi Green Energy, one of the leading Chinese solar companies, has just set a new world record for silicon solar cells, achieving a conversion efficiency of 26.81% on full-size silicon wafers through mass production. The previous record was set by Japanese firm Kaneka Corp six years ago. The first time to see a Chinese solar company breaking a world record is a milestone for China’s PV industry, illustrating its scientific and technological strength.

China has actively promoted the development of the domestic PV sector, ranging from upstream polysilicon, midstream wafers, cells and panels to downstream module and inverters. When the ongoing expansion plans of the Chinese solar industry are completed, its market share in all segments of the PV value chain is projected to increase to 90-95% from current 80%.

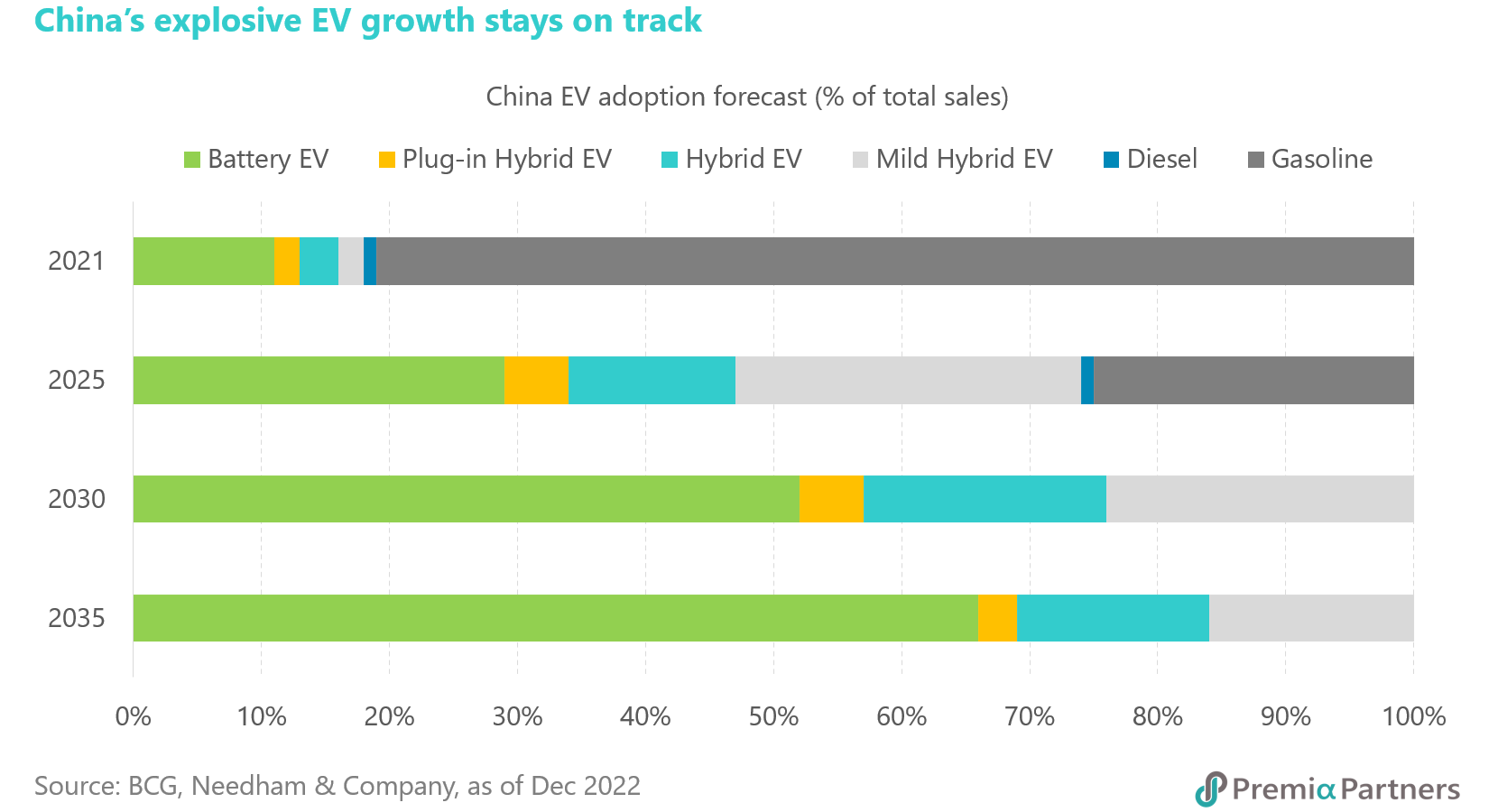

The National Development and Reform Commission reiterated lately that it is studying various policy measures to promote consumption to help support the economy. It pinpointed the new energy vehicles (NEVs) as one of the major focuses.

- The sales volume of NEVs doubled to 6.06 million units in the first eleven months, accounting for 24.9% of all vehicle sales. In November, sales of battery EVs were up by 67.4% to 615,000, and plug-in hybrid sales grew by 92.6% YoY to 171,000.

- The country’s public charging stations increased 65% YoY to 1.6 million, setting the foundation for wider EV adoption.

- Bloomberg reported that the EV chargers in Guangdong province alone have already surpassed the total number of charging facilities in the US.

- The rising NEVs industry also boosted the export competitiveness of made-in-China cars, which were mainly selling to developing nations in Africa and Middle East a few years back.

- Now Europe is the biggest market for Chinese auto exports.

In summary, China tech should be a core building block for every investor’s portfolio, but it is necessary to update for the right tech exposure and be policy aligned – as the 14th Five Year Plans have clearly written, technology would be the critical growth engine to take China to the next stage as the modern high-tech society. For investors who would like to capture the “right” exposure in the hardcore tech in China, the following two offerings at Premia may be of help:

Premia China STAR50 ETF (3151.HK) – 50 largest companies on STAR Market for sectors of national strategic importance, with focus on hardcore technology (semiconductor), healthcare, biotech and medical equipment (including those with COVID related vaccines/ cure/ devices), new energy, new materials and green technology (solar, wind), and IT (SaaS, smart systems) and industrial (advanced manufacturing, smart infrastructure)

Premia CSI Caixin China New Economy ETF (3173.HK) – Diversified, quality growth tilted strategy focusing on policy supported new economy sectors including healthcare/ biotech and medical equipment (including those with COVID related vaccines/ cure/ devices), industrials (advanced manufacturing, EV battery, new energy and green technology), IT (semiconductor, SaaS, IoT, industrial automation), materials and consumer discretionary.