Review of 2025: Asia ended the year on a high note, US wary of vulnerabilities

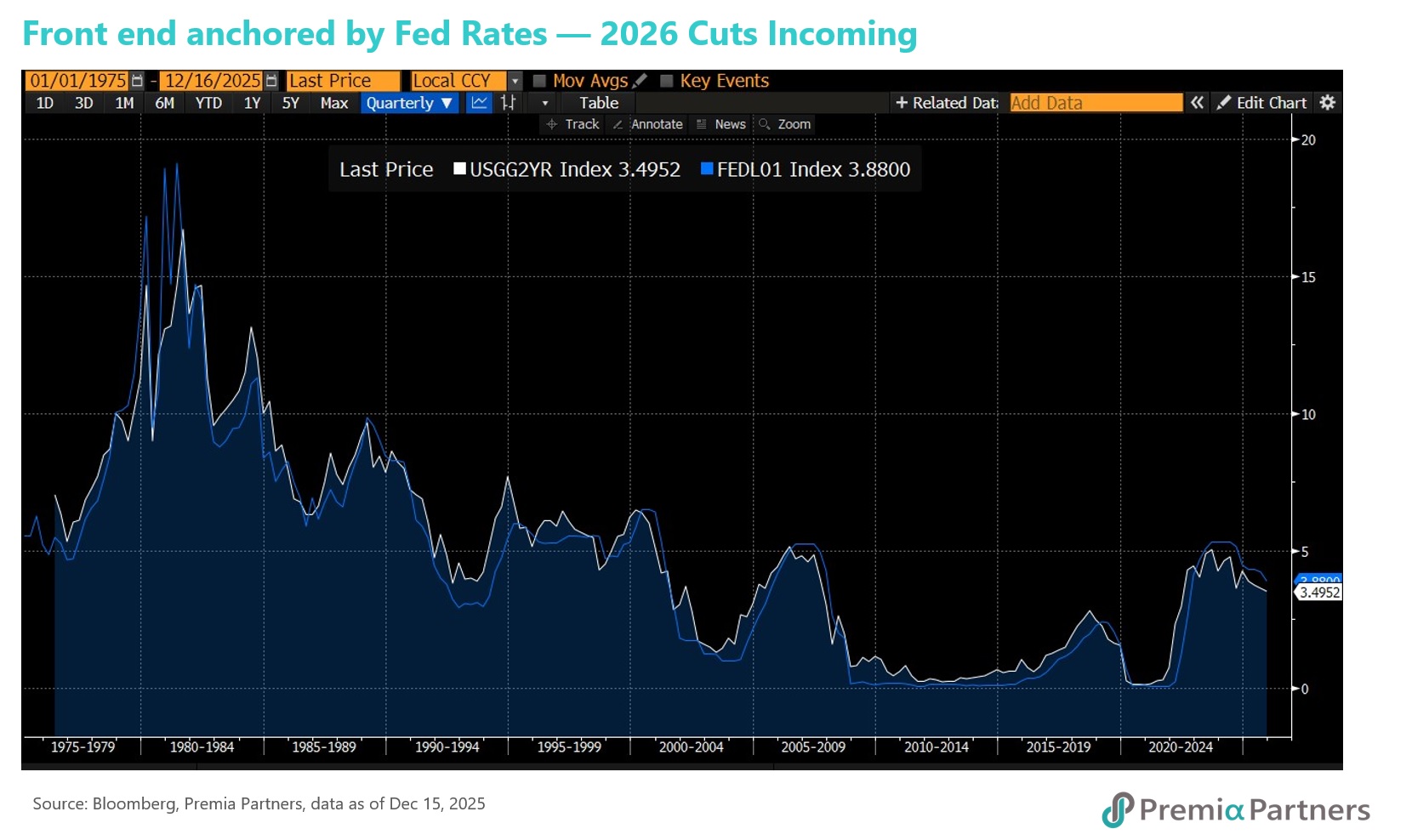

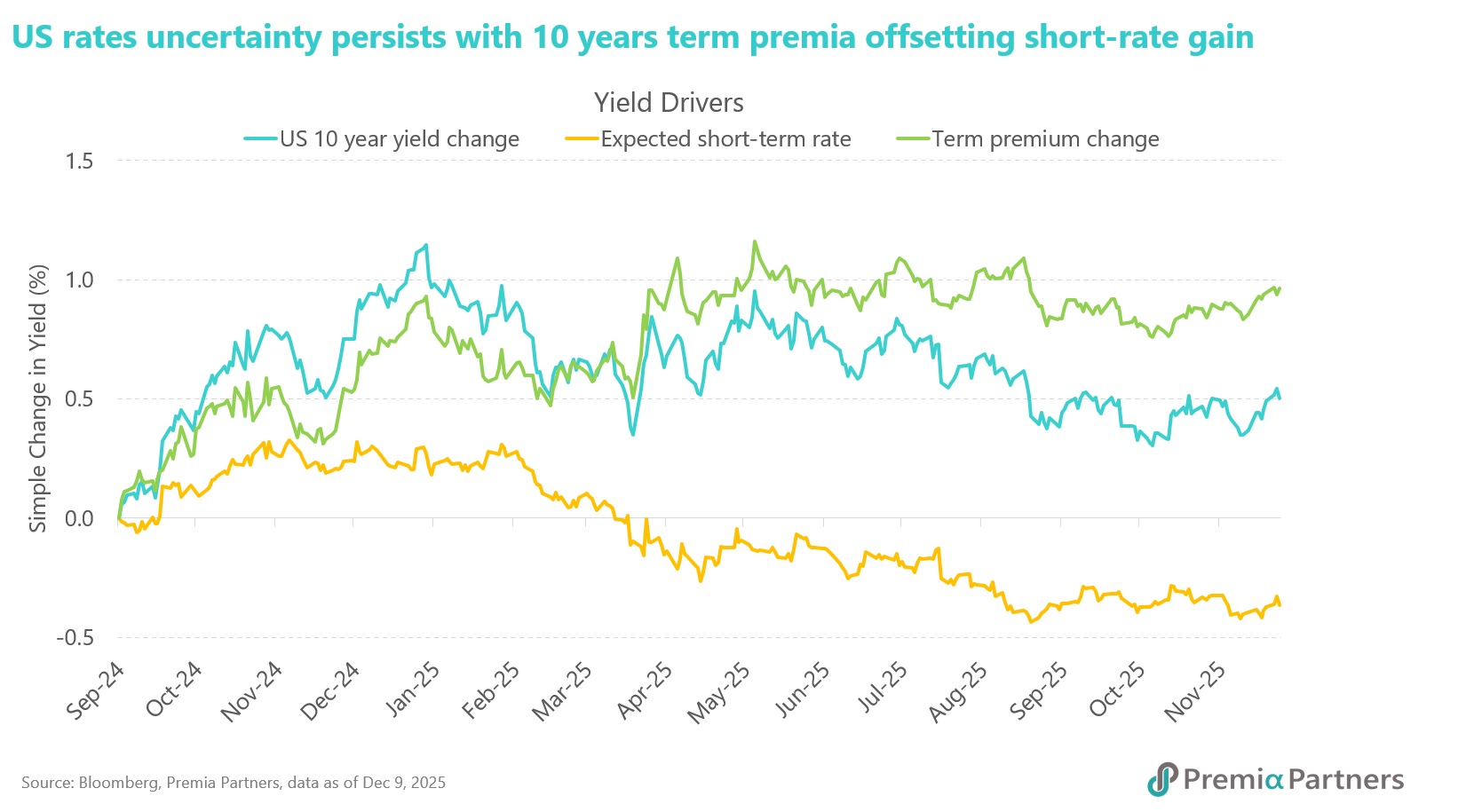

The Fed shifted from hiking to easing as it appeared to tolerate 3% inflation as the new target and prioritized labour market conditions. The 10-year Treasury yield remained above 4% amid concerns over deteriorating US fiscal health and elevated inflation. Meanwhile, markets grew increasingly alert to vulnerabilities in US private credit, with rapid growth in AI-related investments and high margin debt cited as potential pressure points.

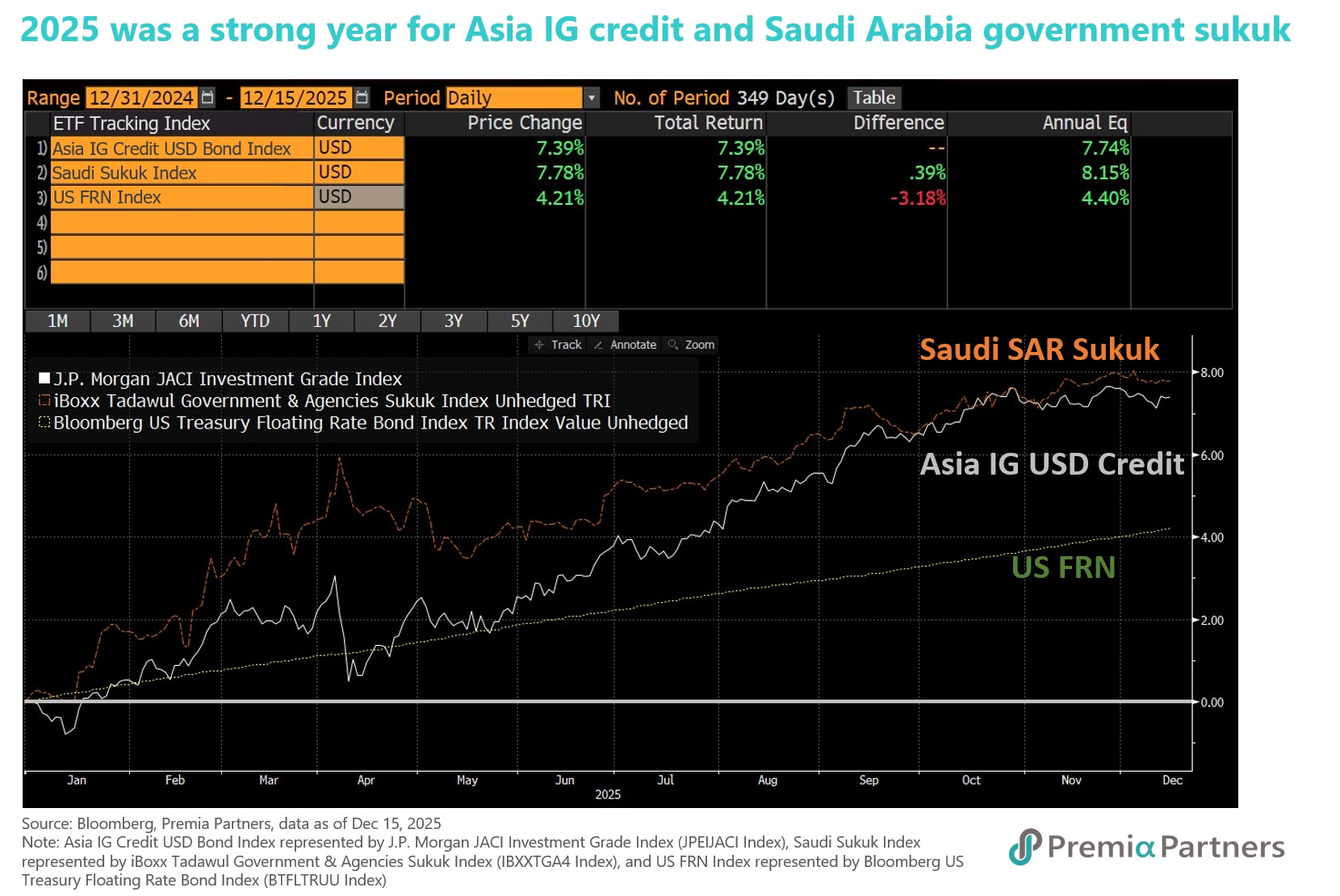

Asia’s USD credit market is closing out the year on a high note, with tight spreads and strong returns driven by solid fundamentals and technicals. The strength was best showcased by China government USD bonds priced at 2bps spread over corresponding US Treasury.

Macro growth across Asia remained resilient despite tariff shocks and global headwinds, with 2025 Asia GDP growth expected to close near the high‑4% area – still the fastest among major regions. This supports both corporate earnings and sovereign balance sheets. The credit cycle has clearly turned positive: the Asia investment grade universe has seen more upgrades than downgrades since 2H24, and “fallen‑angels” have shrunk to a small share of the universe. For more details on the improvement of EM debt please see ‘EM’ification of DM Debt: The case for diversification amidst risk convergence’.

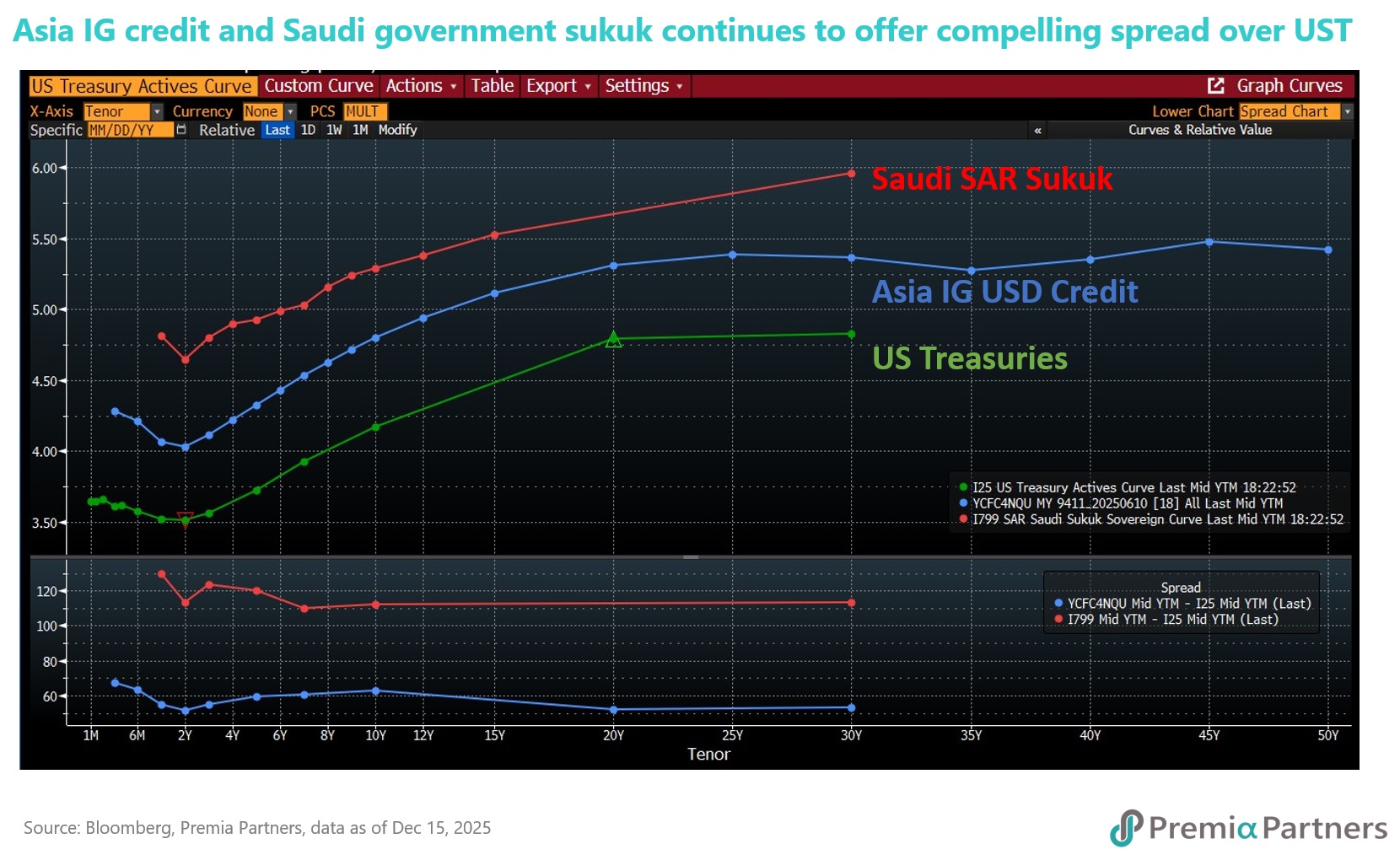

Meanwhile Saudi government Sukuk delivered modest gains, and with the Fed initiating Treasury buybacks and cutting rates in December, SAR‑denominated Sukuk remain an attractive yield alternative, offering around 100 bps over USTs for SAR sovereigns and 50–90 bps for USD sovereigns.

Saudi Arabia’s pragmatism in executing Vision 2030 has reinforced investor confidence: fiscal discipline is back in focus, and Sukuk yields still offer a meaningful premium to Treasuries. The government reassessed major “gigaprojects” like Neom and Trojena, redirecting focus to priority sectors such as industry, logistics, minerals, AI and religious tourism. Global investors are also warming up to the reprioritization, as the opportunity sets resonate more with their interests and investment horizon. In fact, the Kingdom is increasingly seen as a land of real economic opportunities, where people would come to deploy capital and make money, and not just as a source of capital as in the past.

Moody’s also recently updated its credit opinion of Saudi Arabia, maintaining the sovereign rating at ‘Aa3’ and upgrading projected GDP growth to 4.5% for 2026 (4.1% in 2025), highlighting the Kingdom’s strong credit profile as the Kingdom’s public debt to GDP remained low among global peers at 31.9% while contribution from non-oil sectors continues to grow to more than half of it’s GDP as of Sep 2025.

Market Outlook 2026

The dovish shift in policy expectations has arrived at an awkward moment for U.S. assets. The “Trump imperative” is pushing for the next Fed chair to ease aggressively, even as credit spreads remain tight and valuations across U.S. risk assets are elevated. Markets have taken notice: term premiums on long-duration Treasuries are rising, keeping the 10-year yield above 4%, while gold prices remain firm amid mounting concerns over fiscal and monetary discipline. Furthermore, combining rate cuts with Treasury buybacks – will likely revive inflation risks in latter half of 2026, leaving the Fed and Treasury with a very narrow margin of error. In such an environment, any policy misstep or negative surprise could have an outsized impact on U.S. markets, reinforcing the case for careful portfolio construction and diversified risk exposures.

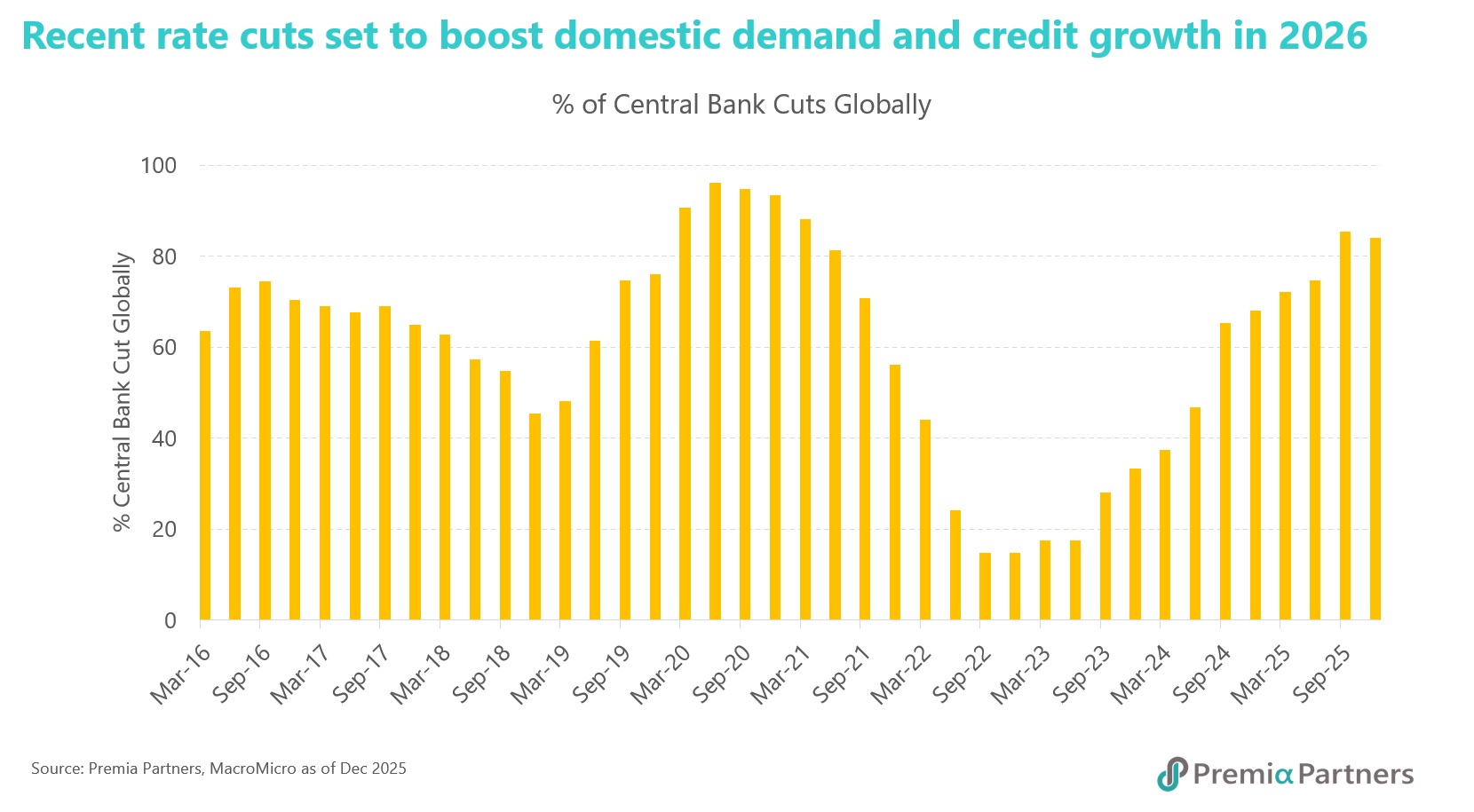

The US-centric risks, however, create opportunities elsewhere. Lower US interest rates and a softer Dollar are acting as classic liquidity tailwinds globally, particularly for Asia ex-Japan and Saudi Arabia. Central banks across the region – from USD-pegged jurisdictions like Saudi Arabia and Hong Kong SAR to China, Indonesia, Thailand, India and the Philippines - are expected to implement rate cuts in 2026. This monetary easing cycle supports domestic demand and credit growth while maintaining currency stability, a critical balance that was harder to achieve during the Fed's tightening stance in early 2025. Further, the lagged impact of rate cuts implemented in late 2025 should increasingly filter into more meaningful household spending and loan growth as 2026 progresses especially for the more populous markets.

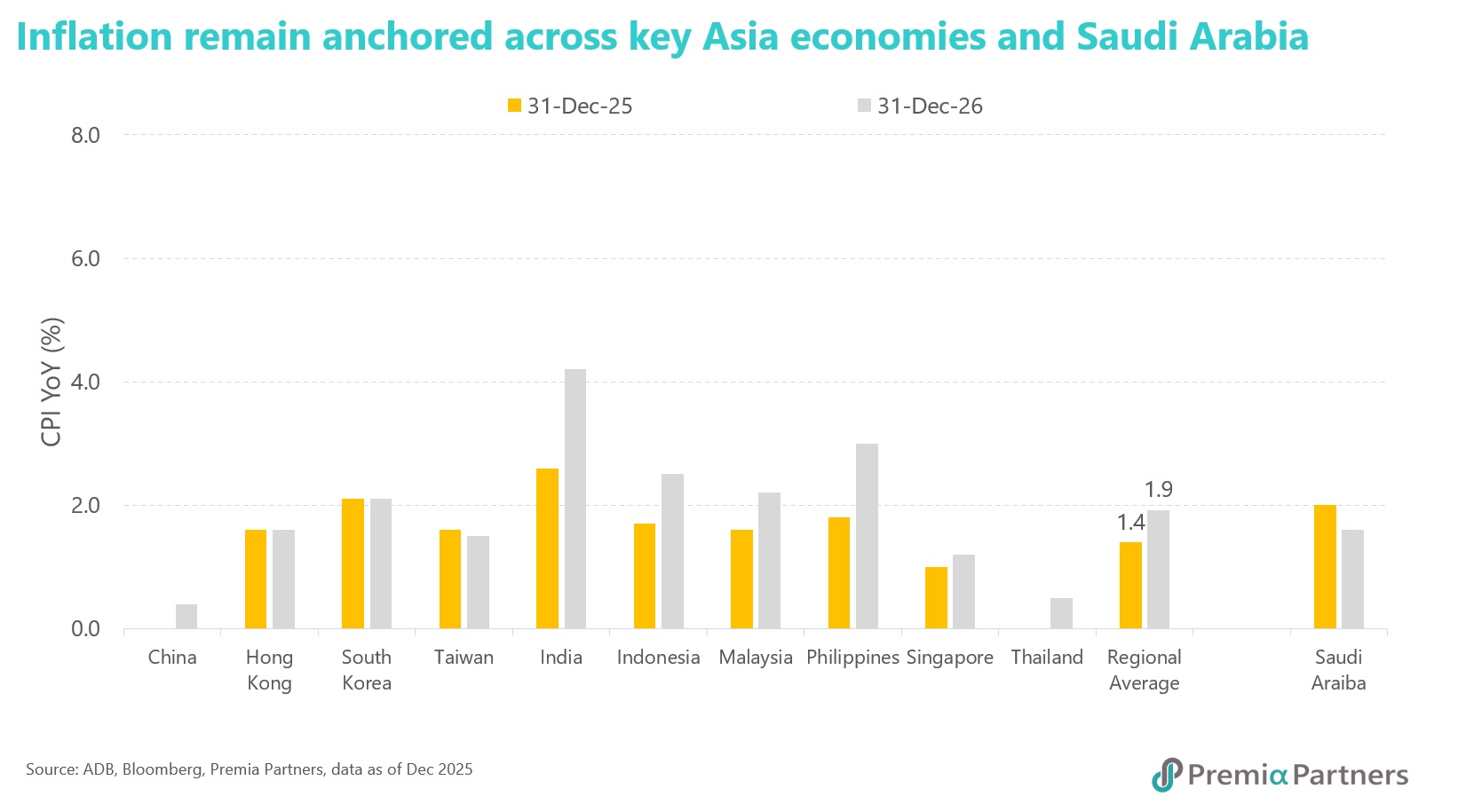

Inflation across Asia and Saudi Arabia is expected to remain well-anchored throughout 2026. Structural factors including weak consumer demand and moderating food inflation in most economies are keeping price pressures anchored, even as headline inflation rises modestly from cyclical lows. The Fed’s rate cuts have opened space for Asian central banks to ease monetary policy without risking destabilizing capital outflows, providing crucial support for domestic credit expansion and economic activity.

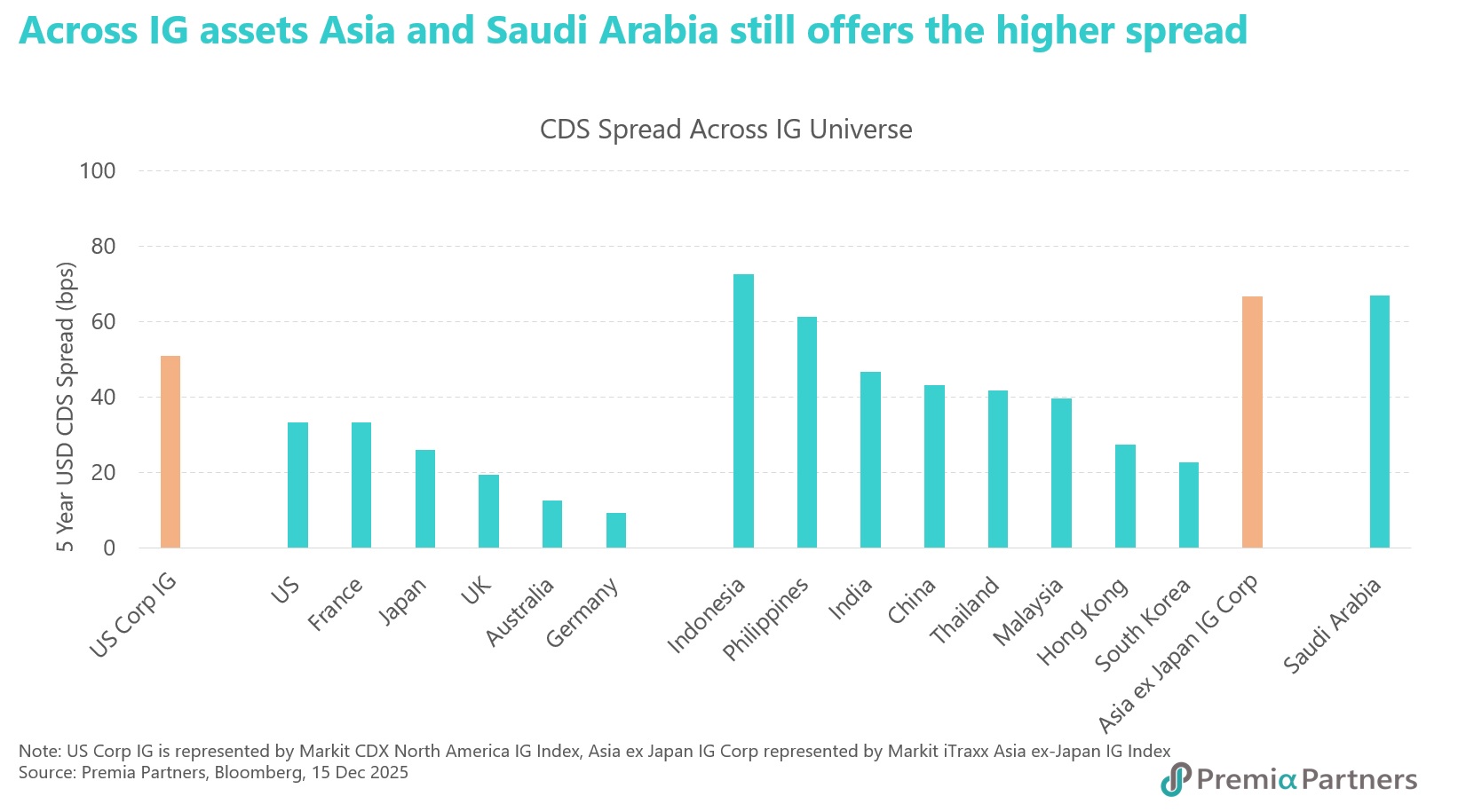

Extracting yield from geographic diversification, or going down the credit curve for riskier cohorts? As the Fed cuts rates, investors are hunting for yield beyond developed markets, where credit spreads have compressed to decade lows. Developed market sovereigns trade below 40bps, U.S. Investment Grade spreads hover around 50bps – less than 10bps above their tightest levels in a decade - and high-yield spreads sit only 45bps off cycle lows. With equity valuations elevated and the S&P 500's forward P/E well above its long-term average, traditional return sources offer limited upside.

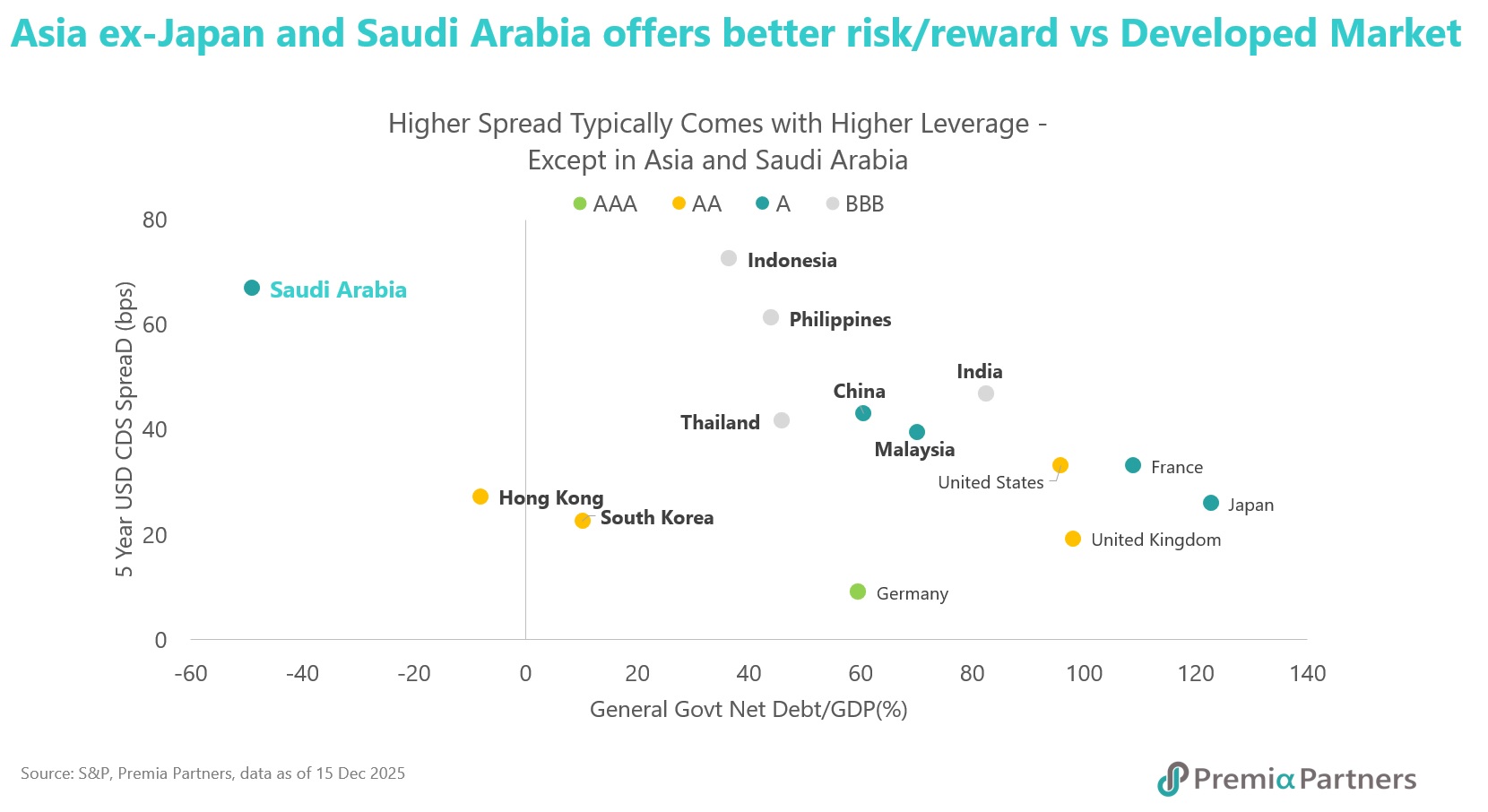

Go for the under-allocated sweet spots in search for incremental yield: Asia Investment Grade USD credit and Saudi government Sukuk, where spreads remain attractive with comparable or better credit quality. Both markets offer attractive carry-and-roll potential into 2026, supported by robust fundamentals. While Asia Investment Grade spreads have tightened, they continue to trade wider than U.S. and European equivalents—a gap that reflects opportunity rather than elevated risk.

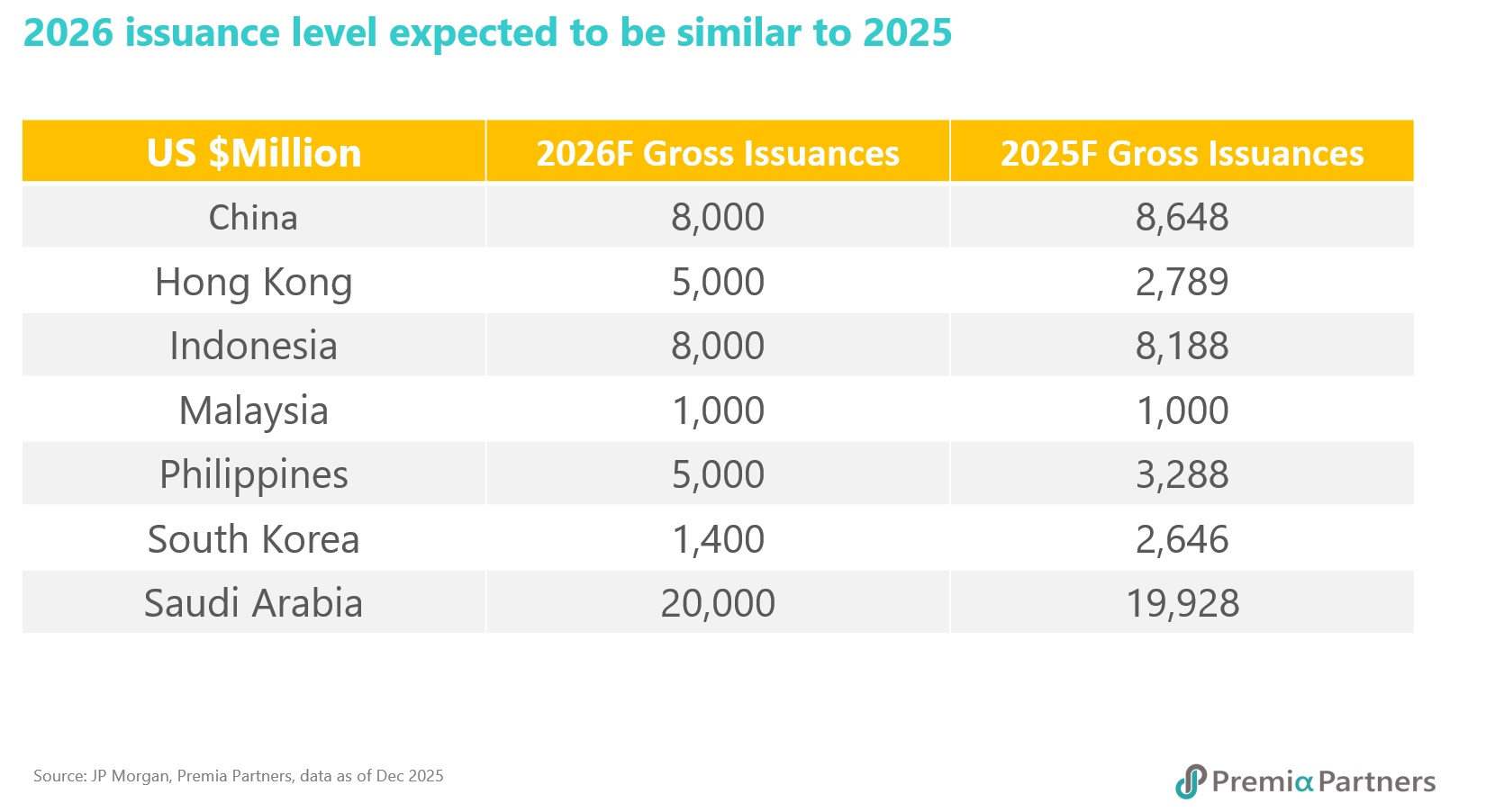

New issuances are expected to remain steady in 2026, with no large sovereign one-offs anticipated in Asia and Saudi Arabia. Analysts in general noted that issuances should be stable in Dollar terms, as elevated gross financing needs are increasingly met via local markets rather than offshore hard-currency taps. It is expected 2026 gross EM Asia issuances to see just a small increase. On the corporate side, China - which accounts for around 30% of the Asia USD Investment Grade credit universe - is being reshaped by tighter approval rules and quotas on SOE foreign debt. Offshore issuances have already pivoted towards refinancing, while more funding needs have migrated onshore into RMB and panda bond markets.

Saudi Arabia dominated GCC issuances in 2025 and, given the budget gap, is likely to maintain similar issuance levels in 2026. At the same time, progressive and pending index inclusion steps for Saudi SAR-denominated Sukuk are likely to channel structural inflows from passive and benchmark-aware investors, compressing spreads and broadening the buyer base.

On balance, given Asia and Saudi Arabia offer better risk-adjusted yields - robust performance should extend into 2026. While developed markets in the US and Europe may appear liquid and familiar, they come with a hidden cost: significantly higher sovereign leverage ratios. Asian sovereigns maintain net leverage lower than 80%, vs close to 100% or more in the US and Europe excluding Germany. Saudi Arabia showcases similar favourable fundamentals, offering a CDS spread of around 70bps while benefitting from improving credit ratings and fiscal resilience. The combination of higher spreads and lower leverage creates a compelling value proposition: investors capture meaningful incremental yield without proportionate increases in credit risk, making these markets particularly attractive when developed market credits trade at historically tight spreads.

How to position for 2026

Given the outlook for 2026 - a steepening US curve, the risk of policy missteps, rich valuations of risk assets, and compressed yields across IG and HY - the search for income needs to go beyond Developed Markets. The trend toward diversifying away from the US is likely to continue, with Asia ex-Japan and Saudi Arabia offering compelling alternatives. These regions provide investors with high‑quality duration but with better carry, stronger fundamentals, and lower sensitivity to the US fiscal story. In addition, these markets are expected to see constrained issuance and improving investor demand.

Core Duration Strategies

At Premia Partners, we offer investors easy one-click access to these high-quality, higher-yielding investment grade opportunities:

- Premia J.P. Morgan Asia Credit Investment Grade USD Bond ETF (3411 / 9411 HK) - A diversified basket of USD-denominated bonds issued by high-quality Asian issuers such as AIA, Alibaba, Tencent, Temasek, SK Hynix, Standard Chartered, and Adani Port. The ETF offers high-quality duration of roughly 4.8 years and a yield of 4.5%, with 85% of exposures under 10 years in duration.

- Premia BOCHK Saudi Arabia Government Sukuk ETF (3478 / 9478 HK) – Asia’s first ETF providing direct access to investment-grade Sukuk issued by the Saudi Arabia government and its agencies with an A credit rating. The ETF offers a duration of about 5.6 years and a yield of 5.0%.

Cash Management Alternative

For investors looking to keep their powder dry, ready for deployment, the Premia US Treasury Floating Rate ETF (3077 / 9077 / 9078 HK) offers a maximum duration of around one week and a yield of 3.7%. This makes it an ideal choice for investors seeking to de-risk while preserving both yield and liquidity.