MSCI China A-shares inclusion is happening this week, but there are still a lot of global investors who hesitate to add China A to their portfolios. Over the last 12 months we’ve heard multiple reasons cited for this aversion to A-shares. In this post, we debunk the 10 most popular myths and highlight why the rational investor not only can, but should, allocate to A-shares, perhaps even ahead of MSCI’s multi-year inclusion plan.

The 10 myths behind A-shares avoidance:

1. China exposure is already covered via Chinese equities in HK & the US (offshore)

2. All quality companies are listed offshore

3. A-shares are trading at a premium to offshore Chinese equities

4. A-shares have poor corporate governance

5. A-shares are mainly SOEs whose interests do not align with shareholders

6. A-shares add volatility only, without producing any long-term performance

7. Renminbi is too volatile and always depreciates

8. Rational investors should steer clear due to A-shares’ massive retail participation

9. A-shares investment requires quotas and other complex processes

10. There isn’t enough research coverage.

1. China exposure is already covered via Chinese equities in HK & the US

First, the A-shares market has 3x the number of stocks available offshore. The daily turnover is 5x greater than both H-shares (HK) and ADRs (US) combined. In other words, the onshore market is the primary market, no matter what the global community may think. Some sub-sectors are even unique to the A-shares market only, namely aerospace and defense, Chinese distillers, entertainment & publishing, cable & satellite, precious metals, and many others. They are listed only onshore and include companies that many investors should be reviewing as part of their allocation to China in the 21st century. Conclusion: Myth

Source: Bloomberg as of May 21, 2018

2. All quality companies are listed offshore

First and foremost, this doesn’t hold up to scrutiny. China A-shares score similarly to many other global markets on metrics such as profit margin, ROA, ROE and current ratio. In fact, on all but ROA, China A-shares have a bigger quality exposure than MSCI World. In addition, many industry leaders are only listed in either Shanghai or Shenzhen, not offshore: Jiangsu Hengrui (pharmaceuticals), Midea (home appliances), Kweichow Moutai (beverages), China International Travel Services (leisure), and Shenzhen Inovance (automation), etc. If investors keep excluding A-shares from their radar screens, then they exclude many of the most recognized domestic consumer brands. Beyond the existing onshore listings, the launch of China Depositary Receipts (CDRs) in the coming months will encourage some offshore listed national champions to return home. In addition, the China Securities Regulatory Commission (CSRC) is speeding up IPOs of qualified unicorn companies in biotechnology, cloud computing, artificial intelligence, and high-end manufacturing. By then, the domestic markets will look even more complete and attractive. Conclusion: Myth

Source: Bloomberg as of May 21, 2018

3. A-shares are trading at a premium to offshore Chinese equities

A-shares are trading at a premium? Yes, but only if looking at dual-listed A/H shares (the companies that are listed both onshore and offshore). The overall premium of dual-listed A-shares is ~20% over their dual-listed H-shares counterparts. But that is only part of the story.

When looking at the overall market, the story is quite different. CSI 300, the main benchmark for China A, is trading at ~13.0x of forward PER versus MSCI China, the main benchmark for offshore Chinese equities, which is trading at ~13.4x. A-shares have a lower Price to Book and a higher Dividend Yield as well. Basically, both onshore and offshore China plays are trading at similar valuations. But that’s assuming mainstream benchmarks. At Premia, we follow the CSI Caixin Rayliant Bedrock Economy Index for our traditional economy ETF, 2803 HK (product page). A-shares investment looks even more attractive from a valuation point of view, when utilizing our approach. Conclusion: Partial Myth

Here’s another way to look at the dispersion. Mid/small-caps are currently trading in the ~10th-20th percentile in valuations relative to their own history. In contrast, mega/large-caps are trading in the 50th-60th percentile vs the last 10 years. Over a shorter horizon, mega-caps in particular look rich in the 75th-85th percentile vs the last 3-5 years.

Source: Bloomberg as of May 21, 2018; China A: CSI300; Offshore China: MSCI China; Bedrock China A: CSI Caixin Rayliant Bedrock Economy

4. A-shares have poor corporate governance

Corporate governance issues are not new or unique to China. They exist in every emerging market and developed market. Think about the recent global scandals such as Facebook’s leak of personal data, Samsung’s bribery issues resulting in the heir going to jail, the collapse of Lehman Brothers and AIG during the financial crisis, etc. The Chinese government and regulators have been stepping up efforts to ensure that a fit and proper corporate governance is in place for listed companies. A cumulative voting mechanism to protect minorities’ interests, a minimum proportion of independent directors and International Financial Reporting Standards have all been gradually introduced in the past. Even now, one could argue that corporate governance in China is no worse than in other EM markets, and is in fact getting better as the government has made tackling the issue a priority. Increasing foreign ownership can only help push the market in the right direction. Conclusion: Partial Myth

5. A-shares are mainly SOEs whose interests do not align with shareholders

A-shares are mainly SOEs whose interests do not align with shareholders

Among 3,608 listed companies in Shanghai and Shenzhen, there are only ~1,000 central or local SOEs, accounting for less than one-third of the total number of A-shares. Investors have plenty of choice when putting their money in non-SOE companies. That said, it is also overly simplistic to say that all SOEs are in bad shape, mismanaged or over-geared without proper due diligence. Corporate governance goes hand in hand with SOE reform, a priority for the government going forward. Some SOEs like Gree and Shanghai Auto already deliver good operating results and manage to outperform the broader market. Effective screening tools for selecting the right stocks is important, regardless of their SOE or non-SOE status. For more info on our approach, click here. Conclusion: Myth

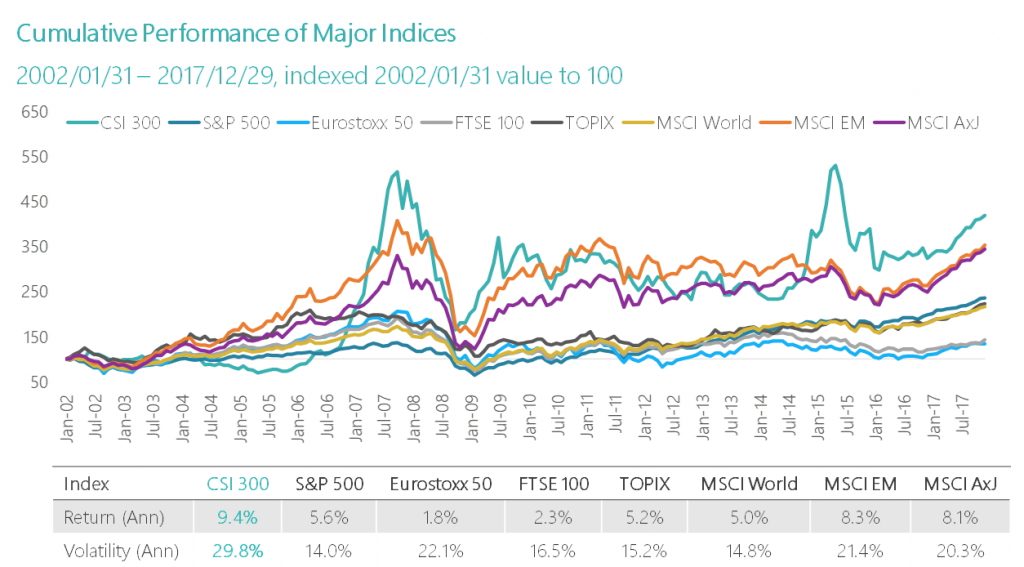

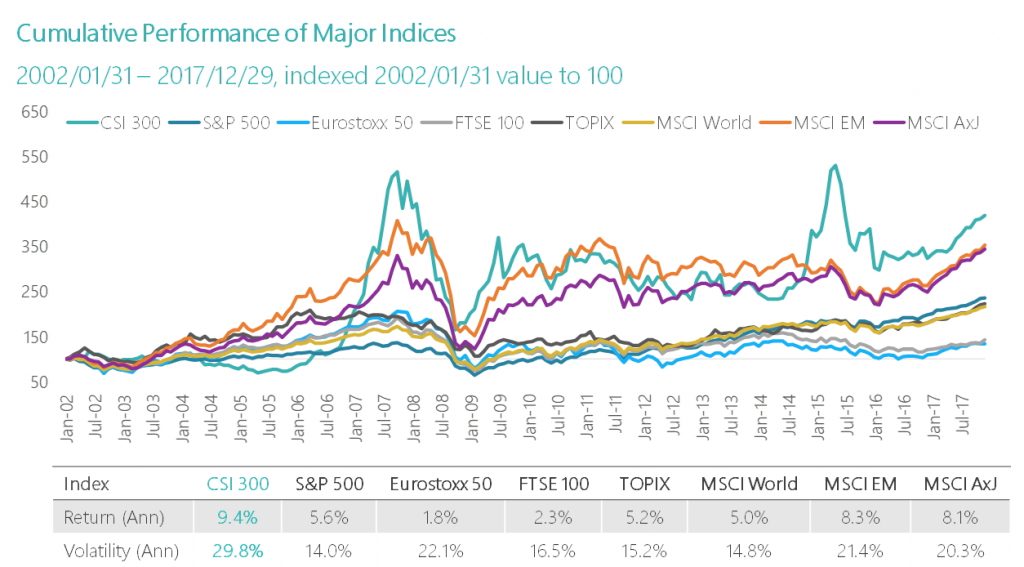

6. A-shares add volatility only, without producing any long-term performance

Given the nature of emerging markets, China A-shares do have higher volatility compared to most developed markets such as the US, Europe and Japan. However, A-shares have also outperformed those markets over the last ~15 years. So while the volatility is higher, so too is long-term return, in line with modern portfolio theory. More recently, volatility has decreased and we expect it to trend down as the market becomes more institutionally driven. Besides, looking at volatility only without considering correlations is a largely irrelevant asset allocation exercise. Adding A-shares into one’s portfolio helps increase diversification due to the low correlation of A-shares with other markets. Conclusion: Myth

Source: Bloomberg, Premia Partners, as of December 31, 2017

7. Renminbi is too volatile and always depreciates

Following the internationalization of the renminbi, the IMF voted to designate the renminbi as one of several main world currencies, thus including it in the basket of special drawing rights. An ongoing renminbi devaluation for the sake of increased exports is a misleading accusation. China is in the middle of transforming its economy from being export-oriented to domestically focused. Currency depreciation does not make long-term sense in that context. This is one of the reasons why the basket of currencies maintained by the State Administration of Foreign Exchange has been expanded to all their trading partners, rather than just USD. But all these points pale in comparison to an even simpler way of proving this concern false – the data. The renminbi appreciated by more than 7.4% in USD term in the past 12 months. Conclusion: Myth

Source: Bloomberg as of May 21, 2018

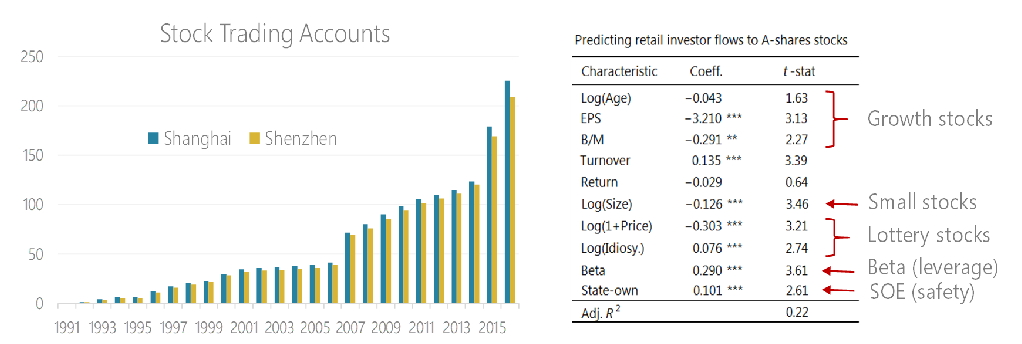

8. Rational investors should steer clear due to A-shares’ massive retail participation

90% of daily turnover comes from individual investors in China A whilst less than 10% in the US. This is true. Similar to individual investor behavior in developed markets, retail flows in China lean toward stocks that are small, growth biased, lottery in nature and high beta, etc. These elements lead to higher volatility and unpredictability. That said, retail investors in China offer opportunities for professional investors to outperform, just like in developed markets. Inefficiency and behavioral errors create opportunity for capturing alpha, both through capable active management and through well-researched smart beta strategies. Conclusion: Partial Myth

Source: Rayliant Global Advisors, Premia Partners as of May 31, 2017

9. A-shares investment requires quotas and other complex processes

Foreign investors used to invest in China A through either Qualified Foreign Institutional Investors (QFII) or Renminbi QFII. Each institution had to apply for its own quota to trade physical A-shares. But as Chinese regulators decided to open their capital markets to global investors, the Stock Connect program was introduced in November 2014. It is a more flexible scheme that does not require individual investor quotas. No applications or complex processes are required – a total of 1,485 A-shares listed in either Shanghai or Shenzhen is available for trading through Stock Connect on the Hong Kong Stock Exchange. Conclusion: Myth

10. There isn’t enough research coverage

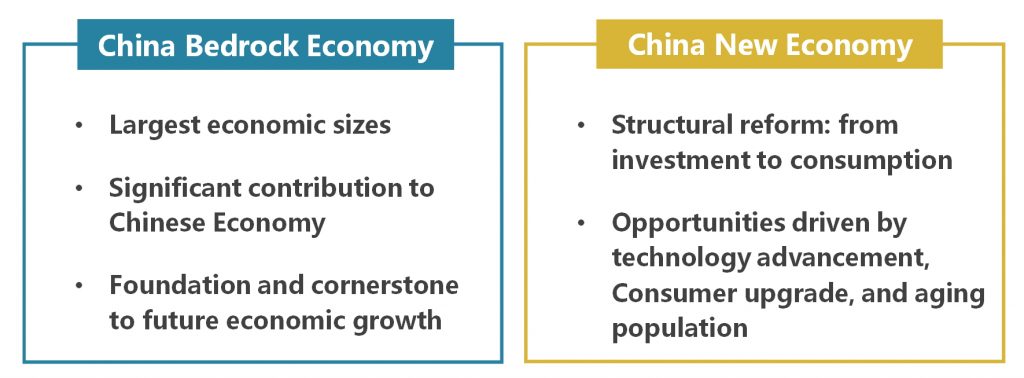

There are 3,608 A-shares listed in either Shanghai or Shenzhen with most of the names not recognizable by many foreign investors. Given the above concerns, it’s understandable that global investors wouldn’t be satisfied with a passive approach and prefer active management instead. But with so many stocks, it’s easy to get lost without investing material resources in research. This is where Premia can step in and help. 7 months ago we built two solutions to tap into different segments in China whilst capturing excess return. The Bedrock Economy strategy (2803 HK) focuses on stocks that are the backbone of the Chinese economy whilst the New Economy strategy (3173 HK) taps into the future growth story of China including consumption upgrades, technological advancement and aging population. Both strategies not only focus on those two different aspects of China A-shares, but then screen each universe to identify stocks that offer long-term excess return. Bedrock focuses on value, quality, low size and low volatility companies while New Economy prioritizes asset-light, quality and R&D focused firms

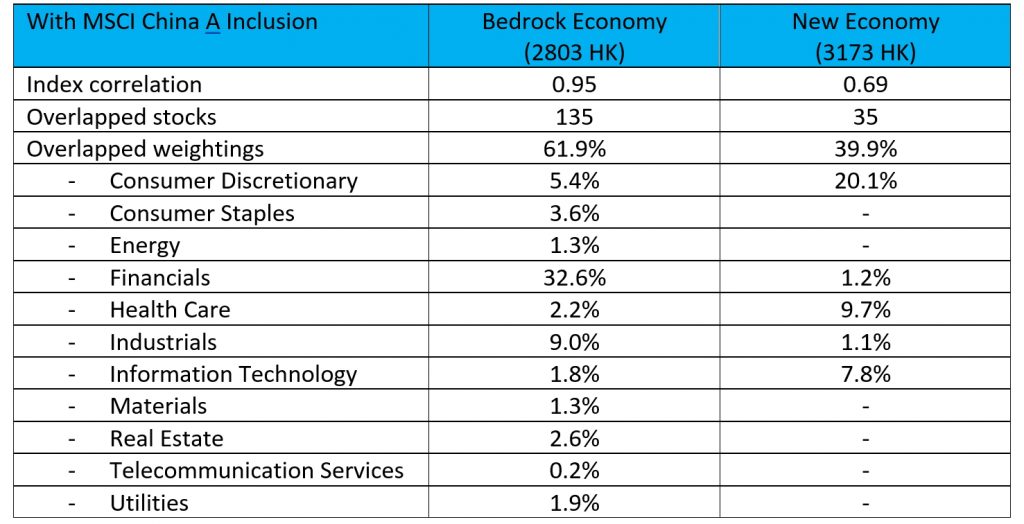

Comparing the latest disclosure of the 234 index constituents for MSCI China A Inclusion, the following is an analysis of index correlation, stock and sector overlap with the underlying indexes of Bedrock Economy and New Economy. Bedrock Economy (2803 HK) has a much higher correlation and more stock overlap with MSCI China A Inclusion. If you’re aiming for excess return vs MSCI China A Inclusion but don’t want to deviate significantly from that benchmark, the 2803 HK would be the right choice. On the other hand, New Economy (3173 HK) offer a drastically different exposure, focusing more on Information Technology, Consumer Discretionary and Healthcare sectors. If you’re aiming to steer clear from large-cap SOEs and to prioritize China’s future rather than today’s economy, than 3173 HK may be the exposure for you. Conclusion: Partial Myth

Source: Bloomberg as of May 21, 2018

Out of 10 common reasons for not investing in A-shares, we score 6 as complete myths, not based on current facts about A-shares. The other 4 are partial myths, where choices of data drive the outcome or where the facts are true, but the implication isn’t. In our view, gone are the days when A-shares as a market can be ignored. Investors need to allocate to A-shares in their portfolios, or risk decreasing their diversification and leaving opportunities for alpha on the table.

Regards,

David