The topic of “trade war” seems to be dominating the market headlines lately with global equities weakening on poor sentiment. Should everyone simply sell their holdings and take a long vacation? It’s certainly important to be cautious and to consider downside risks. It might not be the worst decision for those who can take profit from the strong rally late last year and early this year, especially if there is no benchmark to worry about. However, adopting such a pessimistic approach and setting “risk avoidance at all cost” as a primary investment focus may result in many great opportunities missed. Indeed, even in today’s negative climate, we find some interesting movement in China A-shares that may help investors generate positive returns while overall markets are flat or down.

On 22 Mar 2018, Trump signed an executive memorandum that would impose tariffs on up to USD 60 billion in Chinese imports. Global markets reacted with fear of a potential slowdown in the global economy with major indexes dropping the next day. The A-Shares market was no exception. Intriguingly, mega-to-large caps and mid-to-small caps reacted differently since then. Mega-to-large caps (FTSE A50 and CSI 300) fell immediately and continued down afterward whilst mid-to-small caps (CSI 500 and ChiNext) rebounded and even managed to record a positive return. It’s important to understand the difference in the universe of stocks before making decisions on the what and how of an A-shares allocation.

Changes since trade war: mega-cap -5.5%; large-cap -3.3%; mid-to-small cap +0.3%; ChiNext +4.6%

Source: Bloomberg as of 2 April 2018

Undoubtedly, most of these outperforming stocks come from segments that have less influence from overseas sales, such as semiconductor, IT services and health care. All 3 segments recorded a positive return during the down market. They are not only considered as defensive during the current trade war but also viewed as beneficiaries from the increasing tension in the bilateral trade between the US and China.

Sector performance since trade war: Semiconductor +8.3%; IT Services +7.9%; Health Care +1.6%

Source: Bloomberg as of 2 April 2018

The first outperforming segment that comes into our sight is Semiconductor. After the outbreak of the trade war, China may encourage the use of domestically developed semiconductor products rather than those imported from the US. One such product is the Graphics Processing Unit (GPU). Currently the world’s largest and leading GPU manufactures are mostly US companies, such as Nvidia and AMD. GPU not only plays an important role in gaming but also in the area of Artificial Intelligence (AI) and Cloud Computing. Since China advocates AI and Cloud Computing as future growth drivers, the demand for GPUs will remain high regardless of a trade war. At the company level, Changsha Jingjia Microelectronics (300474 CH), a domestic leading GPU manufacturer with strong research and development capabilities, may benefit from the switch. Zhejiang Jingsheng (300316 CH), a high-tech enterprise in semiconductor silicon material, PV silicon material and related equipment, would also gain from the potential change.

Following the same logic, the IT Services segment had a great rally as well. One of the key sectors targeted for tariffs by the Trump administration is technology. It is highly likely that future sanctions may involve punishing Beijing over technology transfer policies. Separately, the State Council issued new guidelines last week that technology exports and Intellectual Property (IP) transfers that are part of acquisitions made by foreign firms involving patents, integrated circuit design and computer software copyright will be subject to national security checks. Going forward, domestic software companies such as Beijing VRV Software (300352 CH) and Xiamen Meiya Pico Info (300188 CH), focusing on information security software, may continue to take advantage of the government’s support to homegrown players.

On the healthcare front, the National People’s Congress just passed a proposal to establish a National Health Commission, combining the functions of some former agencies. The main aim is to cut bureaucracy and implement a Healthy China strategy. China will move from a disease treatment approach to a preventative model. It is highly likely that the new agency will lead efforts in improving the medical services and insurance systems, while applying AI and Big Data technologies to promote precision medical treatment. Winning Health Technology (300253 CH) focuses on digitalizing medical information and applying AI and Big Data analysis in hospital and public health, while Autobio Diagnostics (603658 CH) specializes in R&D and production of clinical diagnostic products covering immunoassay, microbiology and biochemistry. Since most of their current and potential customers are domestic and would not be affected much by the trade war, it is not surprising that they managed to outperform after markets digested the initial news flow.

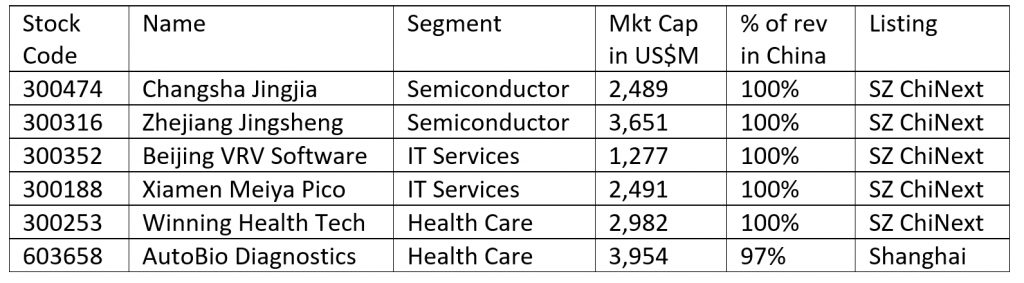

Stocks from semiconductor, IT services and health care recorded decent gain in a down market

Source: Bloomberg as of 2 April 2018

It’s not hard to notice a few similarities among these highlighted companies: (1) all of them are mid-to-small caps, (2) they have negligible overseas revenue, (3) most of them are listed in ChiNext, (4) they all belong to China’s new economy sectors. Because of the latter, they qualify for the Premia CSI Caixin New Economy ETF (3173 HK) which outperformed the broader market materially during this period.

Source: Bloomberg as of 2 April 2018

We expect the development of a trade war to carry on in the next few months, causing ups and downs in global stock markets. It is hard to tell what path the negotiations and public rhetoric will take. From a macro point of view, we do see a silver lining in that China will further prioritize the development of domestic demand and will speed up innovation across many aspects of its economy. Aligning with its Made in China 2025 strategy and the national interest to become a tech superpower, it is time for Chinese companies to invest more in research and development. As investors, we see this as an opportunity to invest alongside government priorities and initiatives. As Warren Buffett once said “Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.” We recommend embracing the change and using depressed overall market values to reallocate to your desired 3-5yr horizon positions, riding along the up-and-rising Chinese companies.

Regards,

David, Alex