Macro Developments and Factor Performance

Nearing the end of the third quarter, many patient investors in Chinese stocks who, like us, remained optimistic about long-term prospects for China’s continued economic transformation, had come to look at the entire market—not just the blue chip companies at the heart of the nation’s ‘old economy’, but also high-growth firms making up its new economy—as the quintessential contrarian ‘deep value play’. In closing out last quarter’s commentary, in fact, we readily admitted that although the timing of a rebound was “anyone’s guess”, we saw stocks as pricing in so much negativity that we imagined a revaluation would be “strongly felt” whenever a catalyst did arise. Those who held faithful to that thesis despite such uncertainty were greeted, in the final week of September, with a resounding validation of our claim, as surprise announcements on the part of China’s central bank and Politburo in the waning days of Q3 forcefully reignited investors’ hope that better times might lie ahead.

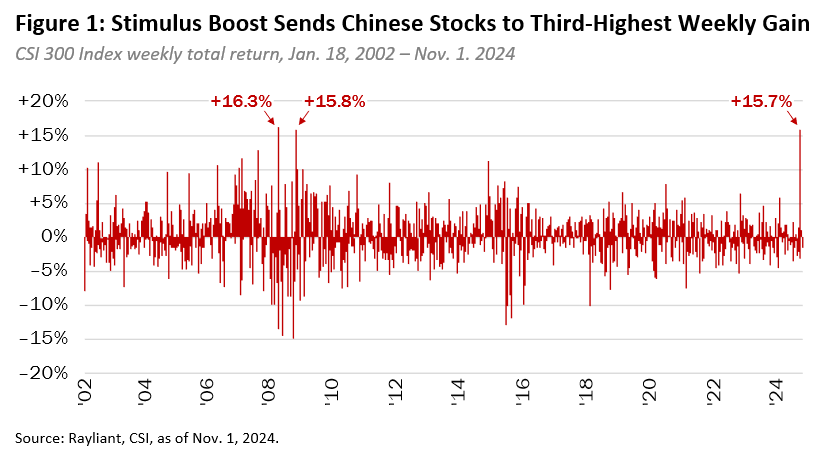

It all started when the People’s Bank of China shocked the market on September 24th, releasing a massive stimulus package that included not only a hefty dose of the usual policy rate cuts and reserve ratio requirement reductions, but also entirely unexpected provisions, offering liquidity to institutional equity investors and establishing a fund for stabilizing the world’s second-largest stock market. That was followed up two days later by a meeting of China’s Politburo, which delivered strongly worded statements in support of China’s economy and financial markets, including taking “stronger counter-cyclical actions” in pulling policymakers’ fiscal and monetary levers and an explicit commitment to “halt the declines” in China’s struggling property sector. That was enough to send mainland-listed shares in the CSI 300 Index to their biggest weekly gain since the Global Financial Crisis, over fifteen years ago (see Figure 1, below).

In hindsight, the timing of Beijing’s double-barreled policy announcements as Q3 came to a close appears unlikely to have been a coincidence. For one thing, China’s central bank acted after September’s long-awaited FOMC meeting: one at which US central bankers kicked off their monetary easing cycle with a supersized 50-bps rate cut. That obviously gives the PBoC a bit more room to loosen policy itself (though by how much they want to see the yuan strengthen is another matter entirely). We suspect an even stronger influence on the sequencing of announcements was the October 1st start of China’s seven-day Golden Week festivities—a great time for inducing FOMO on the part of retail speculators staring down an extended market holiday, and the perfect moment for a boost to consumer sentiment, crucially important in supporting a sustained economic recovery.

From an economic perspective, this was also bordering on the latest policymakers could intervene and still salvage the official GDP growth target of “around 5%” for 2024. In the months leading up to September’s fateful announcements, economists’ consensus forecast had dipped to a lackluster 4.8%, though we expect the combination of front-loaded monetary stimulus and added fiscal support promised at the end of Q3 will be just enough when all is said and done, to exceed the median analyst’s estimate and hit Beijing’s 5% bogey (see Figure 2 below).

As we discussed last quarter, it is not that 5% is an impressive target; it is well below the clip at which China’s economy was expanding before the pandemic. Yet, the fact that policymakers were willing to act with such urgency to avoid a potentially embarrassing miss does, in our view, offer an answer to one of the most disconcerting questions on the minds of China investors whose faith had been shaken by quarters of disappointing results: Is Beijing willing to endure endless pain in the short run as it pursues what we agree is an attractive path for long-term “high-quality” growth? Coordinated announcements by the PBoC and Politburo seem like a clear ‘no’ to us. There is a limit to the disruption authorities will tolerate, and we have reached it. Officials do seem to want to bridge the gap between today’s economic state of play and the more sustainable sources of growth they have planned for the future, and this is the clearest indication we have seen of policymakers’ intent to establish a floor underneath China’s economy and stock market.

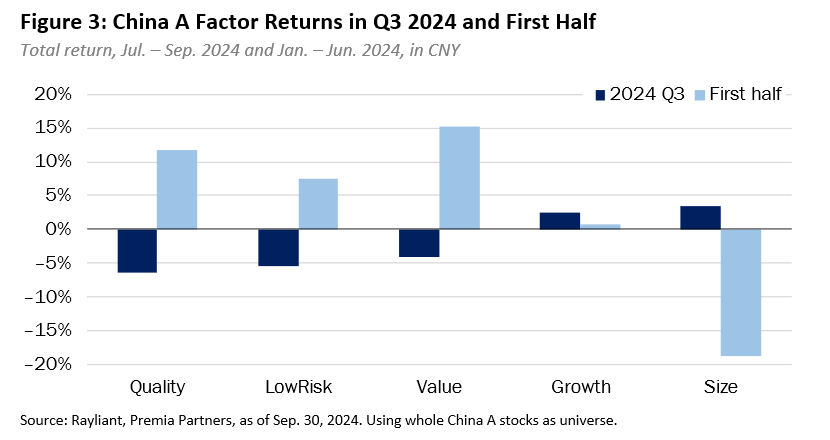

So, how have different investment styles performed in the face of such an abrupt shift? As often happens at inflection points, factor exposures were a mixed bag, with many factors that had been performing well over the first half of the year suddenly flipping signs as Q3 brought a sharp reversal in sentiment (see Figure 3, below). Small stocks, which got a bit of a lift at the beginning of July, as China’s National Team started putting money to work in small-cap ETFs, also disproportionately benefitted in the wake of late-September policy announcements, as investors raced to place bets on companies more levered to hopes of a turning macro tide. High-quality growth stocks were the other clear benefactor of shifting sentiment during Q3, though a more general tilt toward quality characteristics underperformed for the quarter: in part, a function of investors reallocating to more distressed plays in a bid to more strongly capture reversal in ‘junk’ stocks. Poor results for the Low Risk and Value factors in recent months were the least surprising, as tilts toward more defensive names generally lag when markets rocket higher—though that trend thankfully was not enough to completely undo the first two quarters’ gains for stocks deemed a safe haven amidst first-half market declines.

Index Performance and Outlook

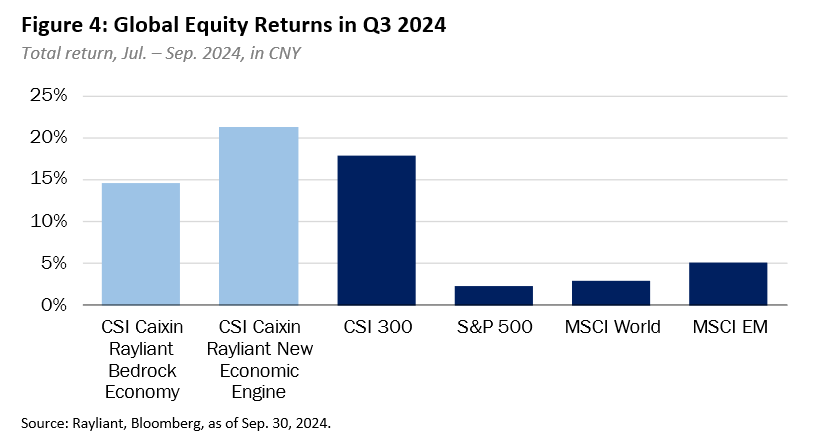

It is remarkable and a testament to how stark the shift in sentiment was that Chinese equities managed to so strongly outperform stocks around the rest of the world in a quarter marked by solid equity returns pretty much across the globe (see Figure 4, below). For the three months ending September 30th, the CSI 300 Index returned 17.9% (CNY), far exceeding the return on emerging markets more generally, with the MSCI EM Index adding 5.1% (CNY) for the quarter. In addition to China’s stellar performance, EM stocks likewise benefitted from the Fed’s jumbo rate cut and macro data indicating a soft landing for the US economy: factors which gave somewhat less of a boost to shares in the S&P 500 Index, ahead by 2.3% (CNY) for the quarter. We should note that in dollar terms, US stocks’ 5.9% (USD) return in Q3 looks significantly more impressive—and not least because S&P 500 stocks were already up over 15% (USD) YTD going into the third quarter. Broader developed markets slightly outperformed shares in the US, posting a return of 2.8% (CNY) over the last three months.

The CSI Caixin Rayliant China A indices did what one would expect in light of their respective style tilts and the factor performance described above, with the CSI Caixin Rayliant New Economic Engine Index (tracked by Premia’s 3173 HK/9173 HK ETFs) returning 21.3% for quarter, strongly outperforming the broader market, while the CSI Caixin Rayliant Bedrock Economy Index (tracked by Premia’s 2803 HK/9803 HK ETFs) lagged, despite posting a very respectable 14.6% return in Q3. Size and Growth exposures clearly helped the New Economy strategy’s relative performance during the quarter, while the Bedrock strategy’s Quality, Low Risk and Value tilts were a definitive drag over the last three months. At the sector level, strong selection among Industrials and IT stocks were by far the greatest contributors to New Economy strategy performance, with a large underweight to Financials being the greatest detractor. By contrast, an overweight to Financials was a significant help to the Bedrock strategy, though weakness in stock selection due to out-of-favor factor tilts described above ultimately dominated Bedrock attribution for the quarter.

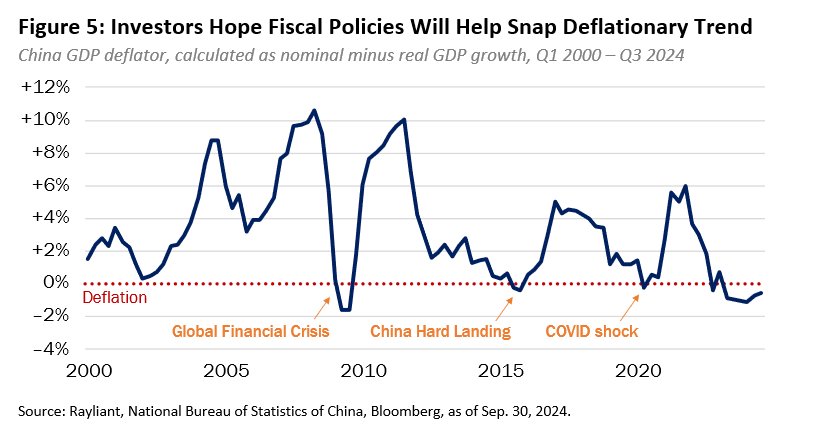

Looking ahead, we note that in the month or so since onshore markets resumed trading after Golden Week, Chinese stocks have given back a decent chunk of their late-September gains, with investors waiting—rather impatiently, it must be said—for follow-through on Beijing’s pre-holiday proclamations. Immediately following the PBoC’s announcement of policy loosening, prior to the Politburo making its own surprise statement on stimulus just days later, we opined that while a burst of monetary support certainly is not bad news, it also will not be the full recipe for solving China’s economic challenges. Those reading our commentary in recent quarters will know that this is a message we have been delivering for some time: As long as sentiment among businesses and consumers is so poor, injecting more liquidity will not lead to a sustained recovery. Nowhere is that more apparent than in data on deflation in China (see Figure 5, below), a trend of weakness that must have contributed to the urgency in policymakers’ promises to do more on the fiscal side in an effort to rekindle demand and kickstart a virtuous cycle in the nation’s domestic economy.

That domestic component to China’s economic rebound is especially important in the wake of a US election, the outcome of which was never likely to be particularly good for America’s trade with China, no matter which candidate won the day. As we have noted before, while a US policy of China “containment” could actually benefit strategic sectors of China’s economy longer-term—semiconductors and green energy technology, for example—the bigger picture is not just growth in exports of China’s high value manufacturing sector, but also continued expansion of domestic consumption, which motivated many investors’ bets on China before the pandemic sent policymakers in a different direction. Prospects for growth of the latter type will, in our view, depend heavily on fiscal stimulus Beijing telegraphed at the end of September and details of which have gradually trickled out over the course of the ensuing weeks. We remain confident it is not a matter of ‘if’, but ‘when’, and that despite clawing back significant ground as investors recalibrated expectations around a China recovery, long-depressed China stocks have much more room to rally from here. If we are right, things look even brighter for investors intelligently allocated to China’s growth elements from new economy and STAR50, as well as bedrock, blue-chip stocks for portfolio completion we believe are in the strongest position to gain from China’s return to growth.

*****************************************************************************************************

Dr. Phillip Wool is the Global Head of Research of Rayliant Global Advisors. Phillip conducts research in support of Rayliant’s products, with a focus on quantitative approaches to asset allocation and return predictability within asset classes, as well as the design of equity strategies tailored to emerging markets, including Chinese A shares. Prior to joining Rayliant, Phillip was an assistant professor of Finance at the State University of New York in Buffalo, where he pursued research on quantitative trading strategies and investor behaviour, and taught investment management. Before that, he worked as a research analyst covering alternative investments for Hammond Associates, an institutional fund consultant. Phillip received a BA in economics and a BSBA in finance and accounting from Washington University in St. Louis, and earned his Ph.D. in finance from UCLA, where his research focused on the portfolio holdings and trading activity of mutual fund managers and activist investors. Premia CSI Caixin China New Economy ETF and Premia CSI Caixin China Bedrock Economy ETF track the CSI Caixin Rayliant New Economic Engine Index and CSI Caixin Rayliant Bedrock Economy Index respectively.