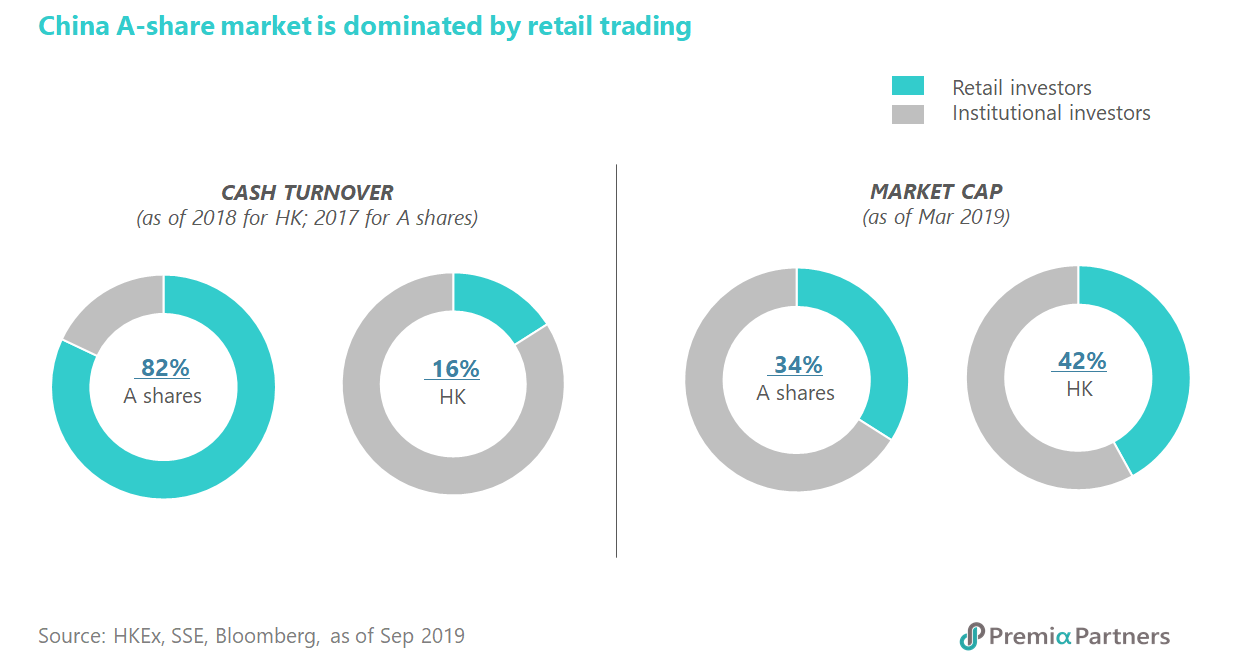

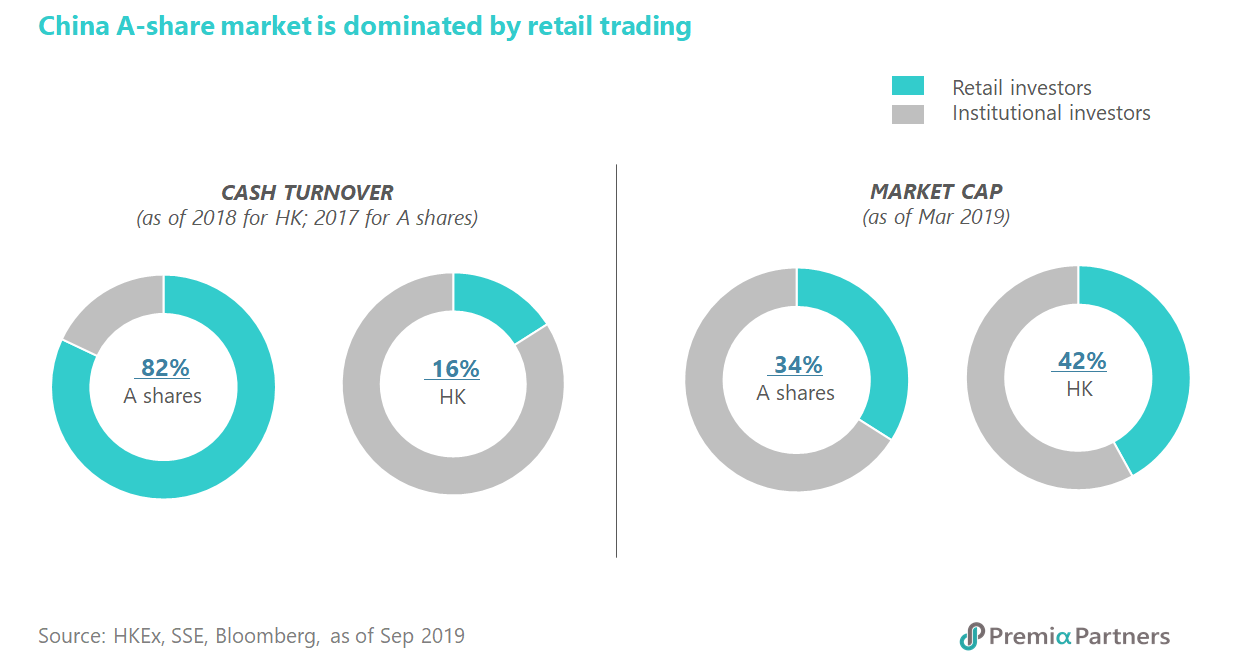

The combination of market participants looks quite unique in China A-share with close to 82% of daily trading turnover contributed by individual investors, while retail trading only accounts for 16% in Hong Kong, where China H-share is listing. Institutional investors are still the minority in China A-share although their involvement will continue to pick up as domestic pensions, insurers, asset managers, and family offices are growing. Besides, foreign investors are able to gain access to the onshore Chinese equities listed in Shanghai and Shenzhen easier through Connect Program, which trading can be executed via Hong Kong stock exchange. That's said, given the current mix of investors in China A-share now, professional investors may generate alpha performance from the potential mispricing on the back of less sophisticated trading activities.

The combination of market participants looks quite unique in China A-share with close to 82% of daily trading turnover contributed by individual investors, while retail trading only accounts for 16% in Hong Kong, where China H-share is listing. Institutional investors are still the minority in China A-share although their involvement will continue to pick up as domestic pensions, insurers, asset managers, and family offices are growing. Besides, foreign investors are able to gain access to the onshore Chinese equities listed in Shanghai and Shenzhen easier through Connect Program, which trading can be executed via Hong Kong stock exchange. That's said, given the current mix of investors in China A-share now, professional investors may generate alpha performance from the potential mispricing on the back of less sophisticated trading activities.