Q1 has been an eventful start for the year 2022 where the world has experienced economic turbulence, regional conflict and continued COVID impact. The United States is facing record high inflation tackled with aggressive monetary policy on interest rate hike and balance sheet reduction. We have also seen regional conflicts causing supply chain disruption in certain fields such as oil and gas.

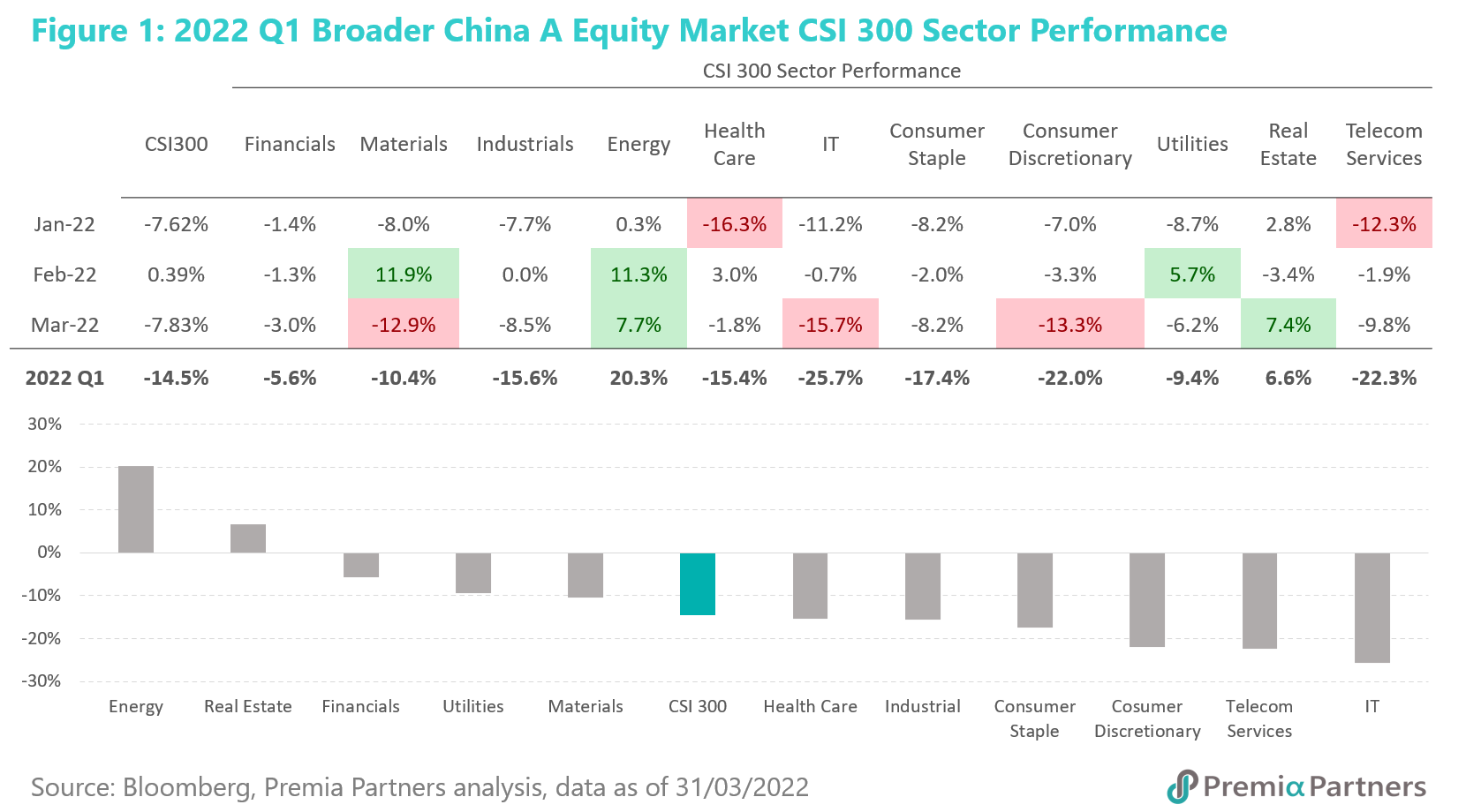

In China, although in a much better inflation environment, COVID outbreak since late Q1 in Shanghai and some other cities had caused some disruption to China A share market. Overall, broader index CSI 300 underperformed -14.5% in Q1 (Figure 1).

Energy and Real Estate were the only positive sectors in CSI 300. Energy was uplifted from regional conflict between Russia and Ukraine that caused oil and gas supply disruption. While volatility stayed elevated for Real Estate, it experienced some reprieves in late March as roll out of various policy measures and improved mortgage loan approval rate supported modest rebounds in the housing market. On the other hand, IT/Communication Services and Consumer Discretionary were the dragger in Q1. Among IT sector, Semiconductor were the better performer than IT Software and Hardware due to on-going global chip shortage and it is a China policy supported sector. Meanwhile, Consumer Discretionary underperformance was related to COVID outbreaks and lockdowns in some cities sent downward sentiment and expectation.

Factor Performance

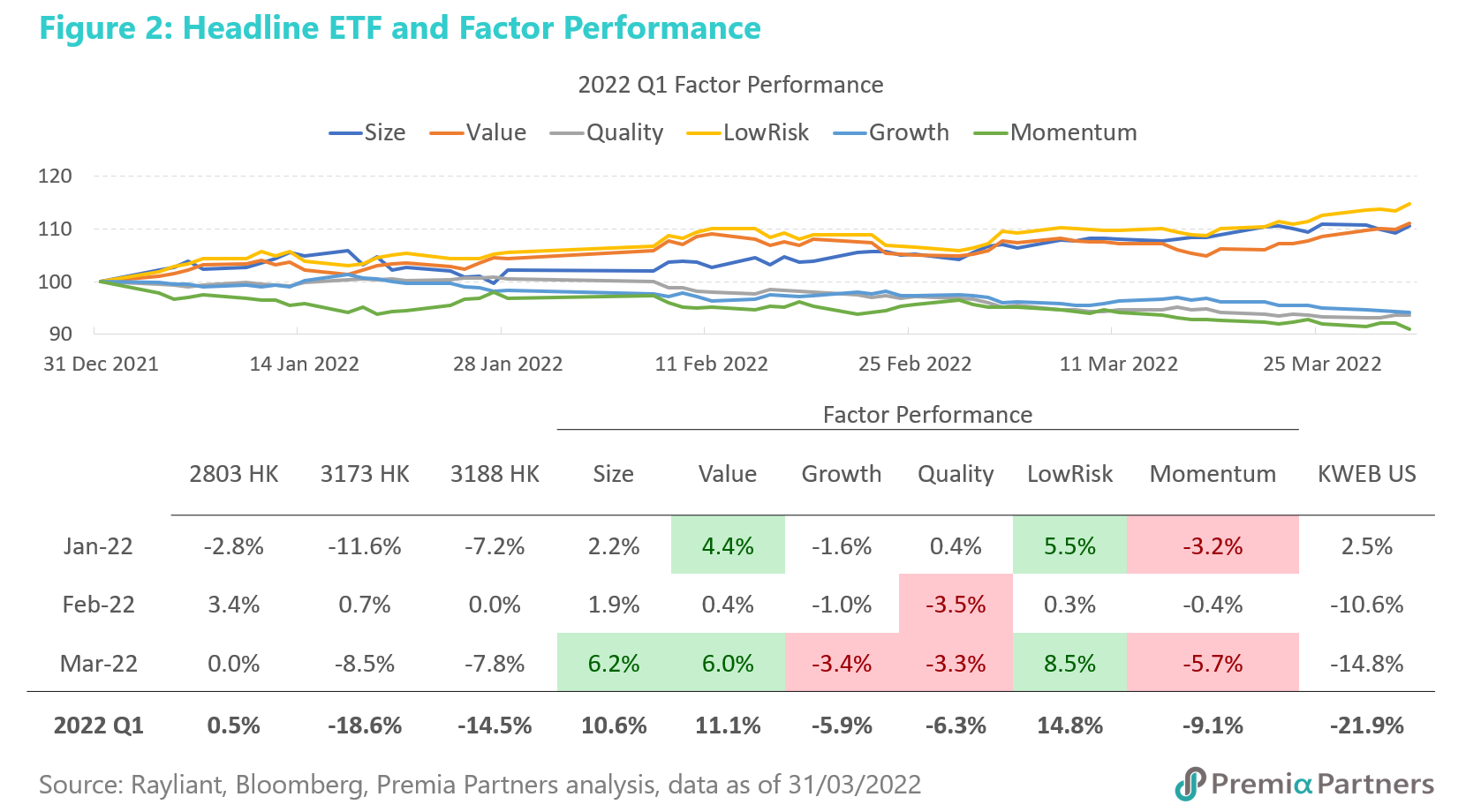

We have seen a clear divergence in factor performance in Q1 (Figure 2). Low Risk, Value and Small Size factor outperformed while Quality, Growth and Momentum underperformed. The factor behavior was consistent with what we had seen in sectors. The risk-off sentiment caused by global and China economic environment and regional conflict had led investors shift their focus to Value and Low Risk stocks. This was in particular evident in January and March. In January, the increasing possibility of much more aggressive rate hike trajectory given the record high US inflation, coincided with the delay of more tangible policy easing measures in China have shaken investment confidence across risk-on assets including China. Getting to March, the conflict between Russia and Ukraine turned out to be an extended Black Swan event for global investors, which had caused turbulence in global commodity prices and further fueling risk off sentiment for Chinese equities.

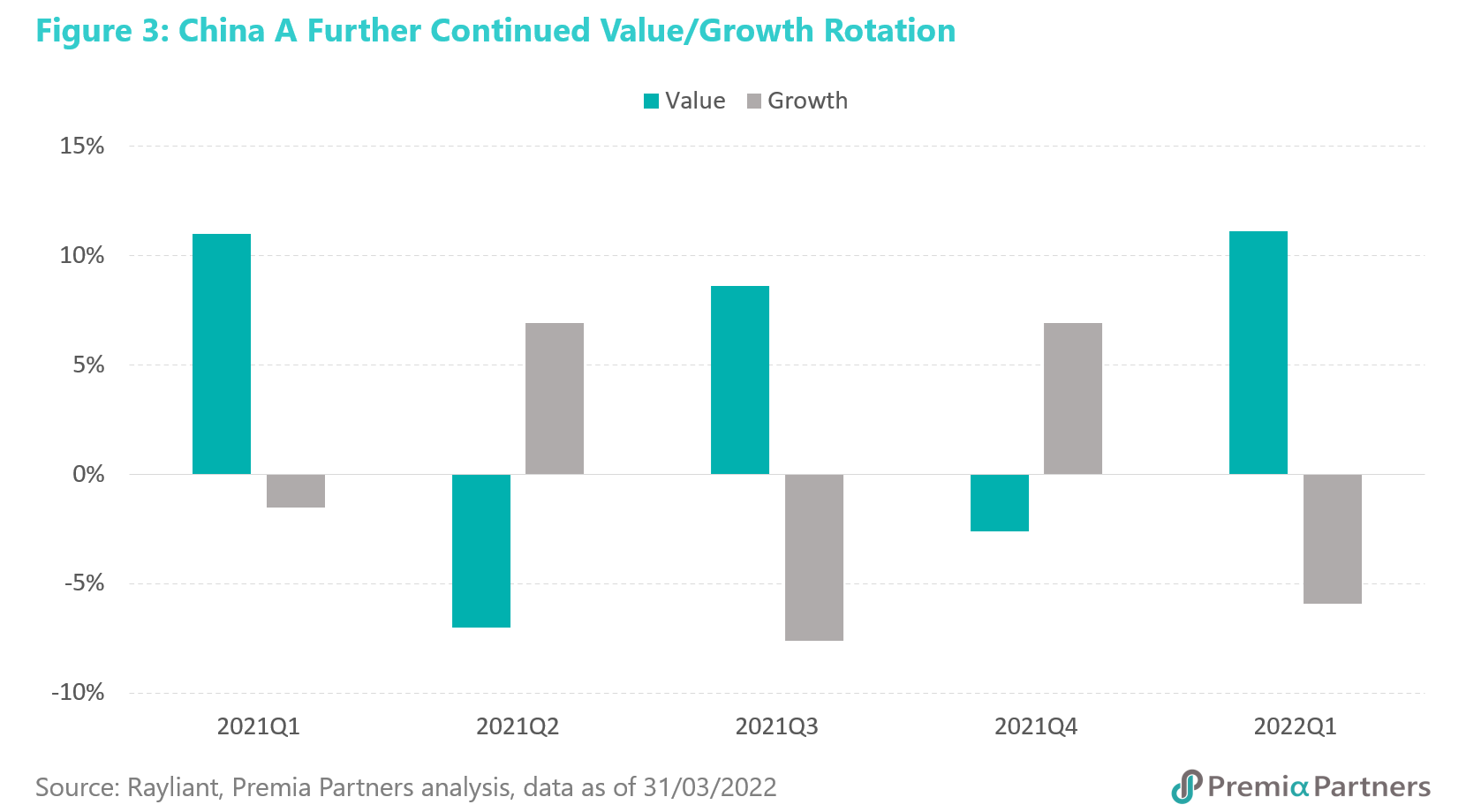

During the period, Value/Growth rotation also continued from quarter to quarter. Value returned in Q1 2022 (Figure 3) after 2021 fourth quarter Growth expectation from monetary easing measures, investors are yet to see the easing to be materialized and global economic environment and regional conflict further send Value stocks to north.

During the period, Value/Growth rotation also continued from quarter to quarter. Value returned in Q1 2022 (Figure 3) after 2021 fourth quarter Growth expectation from monetary easing measures, investors are yet to see the easing to be materialized and global economic environment and regional conflict further send Value stocks to north.

Premia Partners New Economy ETF and Bedrock Economy ETF

Our Premia CSI Caixin China Bedrock Economy ETF (2803 HK) in Q1 significantly outperformed the Broader China A market (0.5% vs -14.5%) while our Premia CSI Caixin China New Economy ETF (3173 HK) was comparable (-18.6% vs -14.5%). Both ETFs continued to outperform offshore listed China Tech ETF (KWEB -21.9%) which suffered from the double whammy of global investors shunning US growth/ tech stocks and lacklustre appetite for Chinese ADRs facing delisting risks in the US and regulatory crackdown domestically in China.

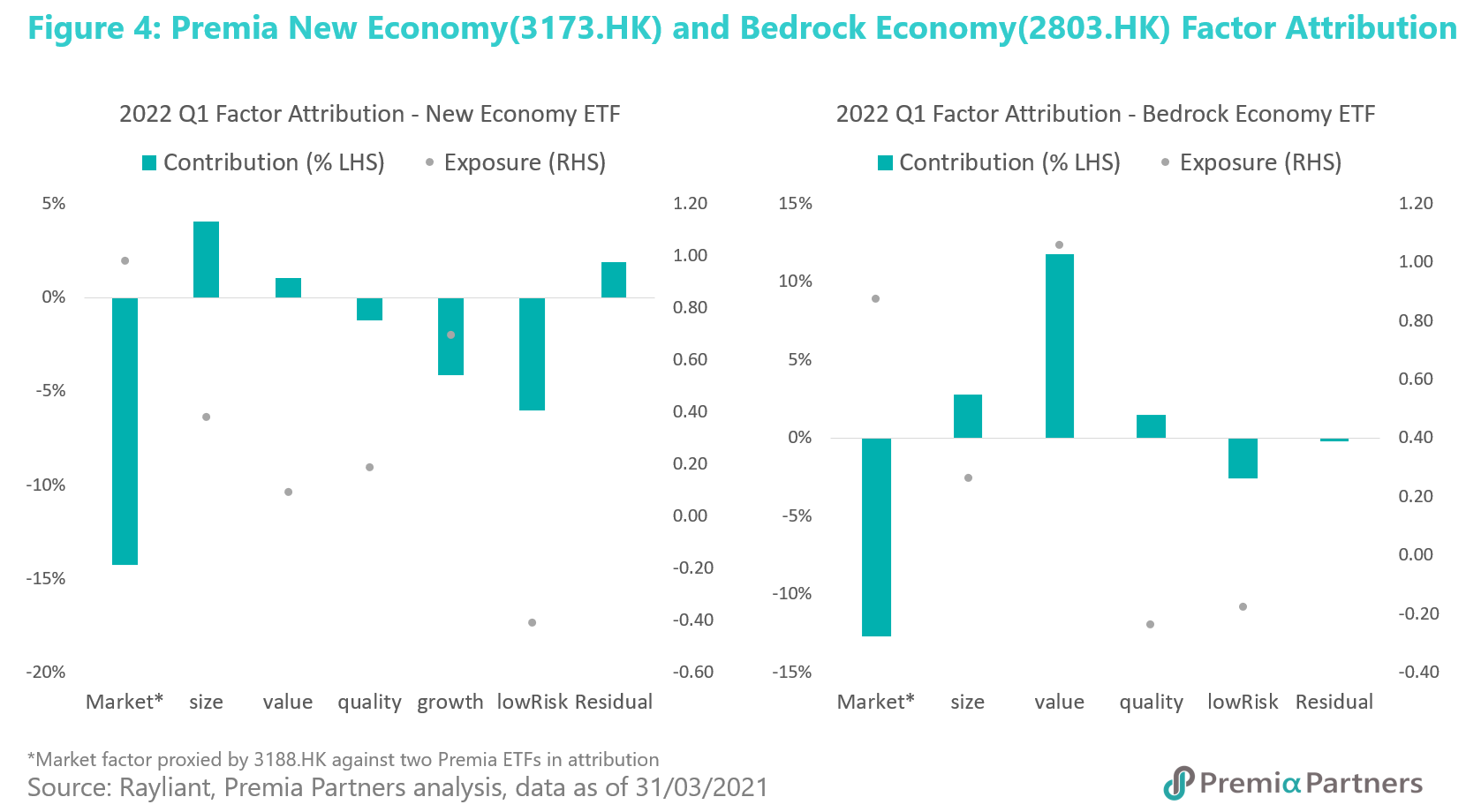

Figure 4 shows the much outperformance from Bedrock Economy ETF in Q1 was from having Value Tilt against the broader market offset by having market exposure (beta) which detracted from the overall performance. The gain in Small Size exposure and underweight in Quality was offset by underweight in Low Risk. We would like to note that the seeming underweight in Quality and Low Risk factor was relative to the CSI 300 universe. Our Bedrock ETF apply the Quality and Low Risk score from the broader CSI All Shares universe with Economic-Size screen, resulting a tilt towards small size and non-State owned enterprises vis a vis the large cap Energy and Materials universe within CSI300 in particular..

On the other hand, while our Premia CSI Caixin China New Economy ETF (3173 HK) underperformed, it was in line with the broader market correction as market exposure (beta) which contributed -14% out of -18% total performance. The gain in the Small Size exposure was offset by underweight in Low Risk and positive tilt in Growth Factor.

Valuation

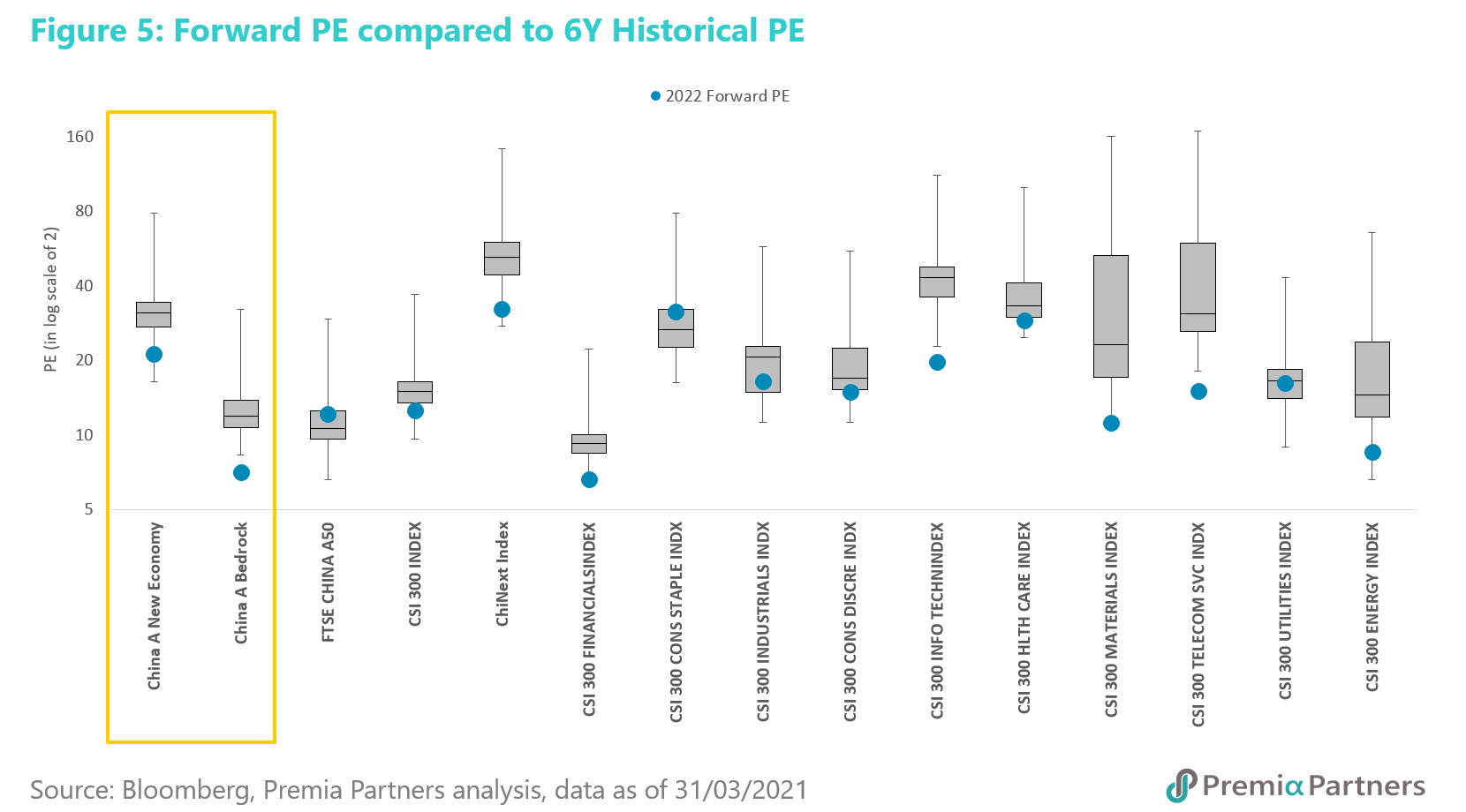

Finally, we would like to bring to discussion on Forward Valuation (Forward PE) comparison against historical valuation range for our two China A ETFs and broader market sectors. Whether it is for the purpose of asset allocation or specific investment opportunities such as policy supported sectors, China A shares are trading at very attractive valuation right now with current PE at historical low range.

As investors globally become less forgiving on misses for earnings and growth, it is important to also consider not just valuation in terms of PE multiples, but also earnings expectation for 2022 and if there’s enough earnings growth to support the valuation and investor interests. As shown in Figure 5, 2022 forward PE for most broader market sectors were below 25 percentile of historical PE range, some were even at their 6-year historical low. Our China A New Economy ETF is attractive at around lower 10% percentile while our China A Bedrock Economy ETF is even more standing below 5% percentile historically for 2022 forward looking earning compared to its current price, suggesting possibility of an oversold market and valuation priced on fear than fundamentals.

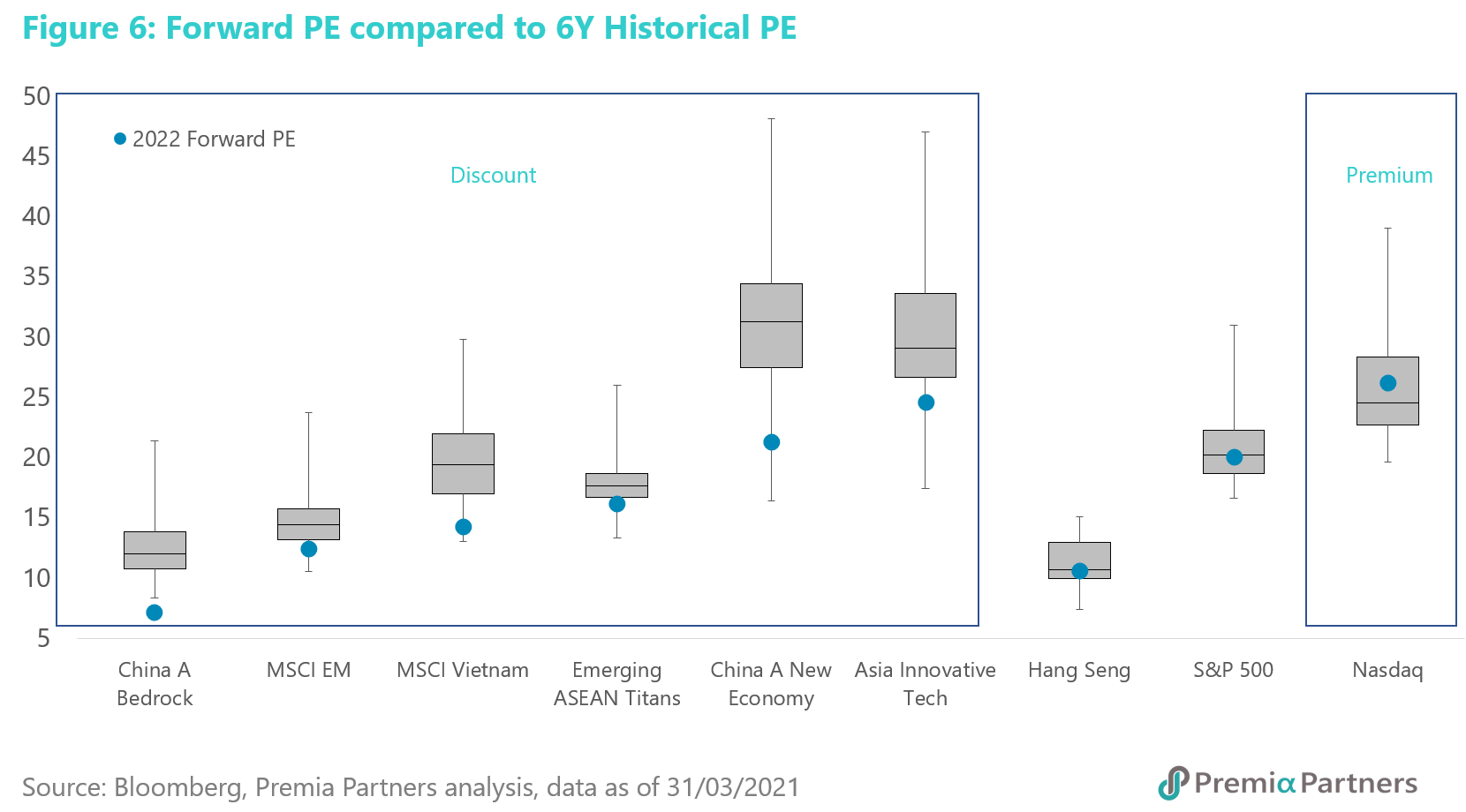

In contrast to Chinese equities which have already gone through multiple rounds of valuation resets, US equities (Figure 6) which have yet to experience more meaningful correction, is heading into aggressive rate hike regime which inevitably would further compress the company margins and earnings amid record high inflation and the inelastic labour, materials and logistics markets. At the moment we observe 2022 forward PE for S&P 500 is slightly above historical 6-year median and close to 75 percentile for Nasdaq. The valuation for these US equity Indexes are much more expensive than China A markets (Figure 6). With question for further rate hike being “how much” rather than “whether-if” and significant balance sheet reduction ahead for the rest of 2022, liquidity drain would put US Equities and its expensive valuation to considerable stress that would be hard to solve.

In comparison, the historical low valuation for China A and our Premia China A ETFs are better placed for a rebound, at a time when global allocators are in general low on inventory for Chinese equities, and China is already close to if not at the bottom of the cycle with left tail risks mostly considered and richly priced in. Notwithstanding the Zero COVID Policy, visibility for tangible policy supports, resumption of economic activities, growth trajectory and investor appetite also started to improve. In fact, according to Goldman Sachs Prime Services data, in April, Chinese equities had the highest monthly hedge fund inflows since Dec 2020, led by long buys significantly exceeding short sells.