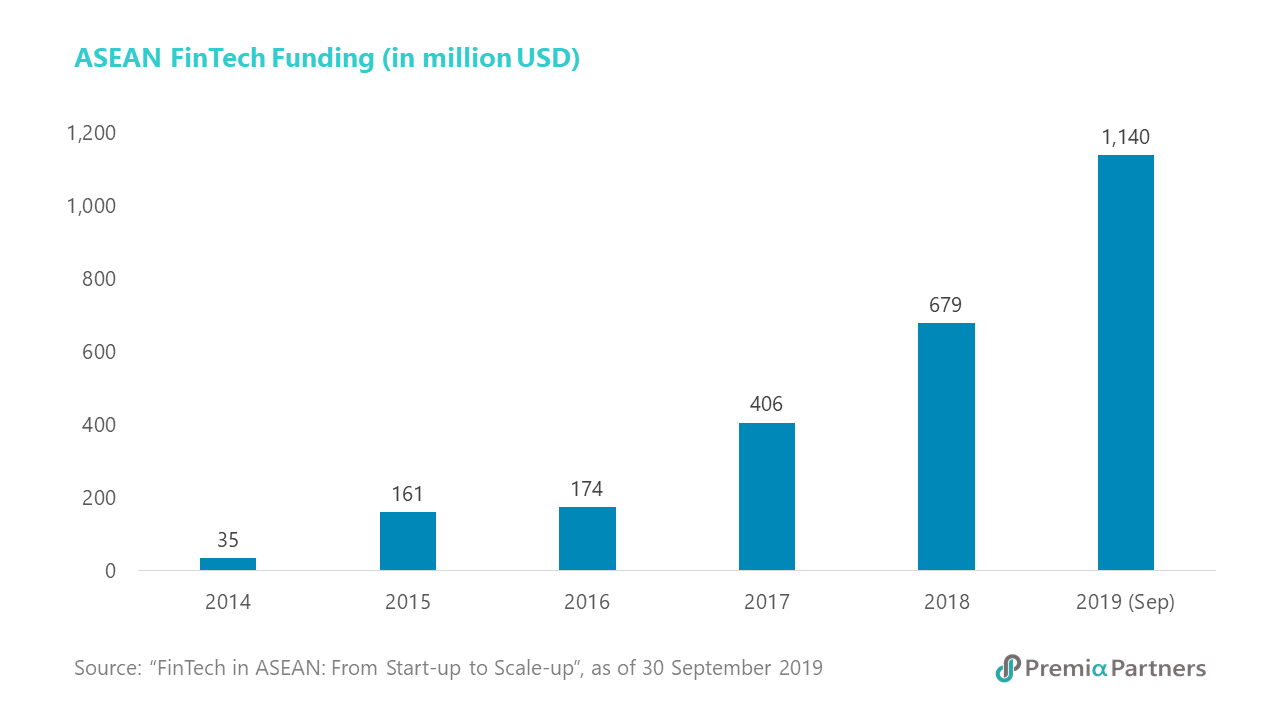

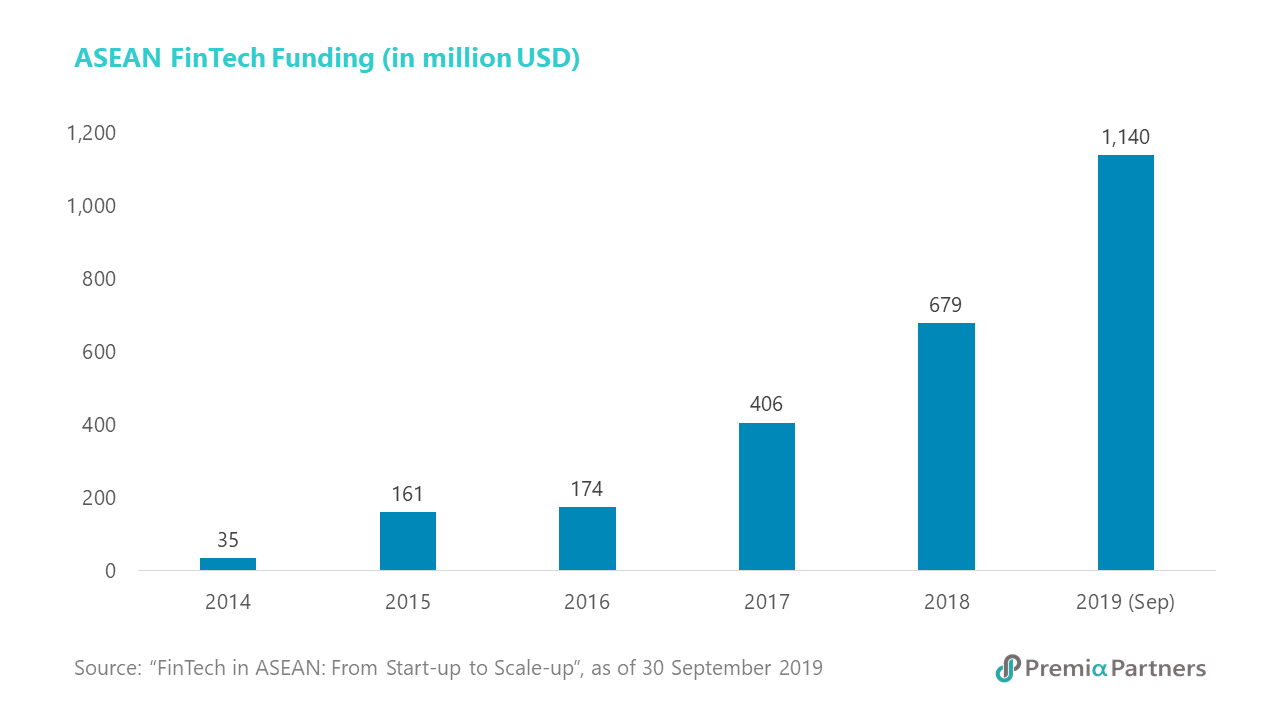

According to the report “FinTech in ASEAN: From Start-up to Scale-up”, ASEAN’s FinTech funding had a CAGR of 101 per cent in the last five years, growing from 35 million USD in 2014 to 1.14 billion USD in the third quarter of 2019. Singapore continued to be the top country attracting 51% of the total funding in 2019, against 53% in 2018. Funding to Vietnam jumped from 0.4% in 2018 to 36% in 2019. The increase was mainly contributed by the two large deals investing in VNpay and MOMO Pay. To further support the FinTech development, the State Bank of Vietnam (SBV) has launched its Second Fintech Challenge Vietnam (FCV) in August 2019. This year’s focus would be on big data, artificial intelligence, financial services outreach, and cybersecurity technology solutions. The regulators could use the experience and outcomes of the FCV as one of the inputs to form the legal framework for the FinTech ecosystem development in Vietnam.

According to the report “FinTech in ASEAN: From Start-up to Scale-up”, ASEAN’s FinTech funding had a CAGR of 101 per cent in the last five years, growing from 35 million USD in 2014 to 1.14 billion USD in the third quarter of 2019. Singapore continued to be the top country attracting 51% of the total funding in 2019, against 53% in 2018. Funding to Vietnam jumped from 0.4% in 2018 to 36% in 2019. The increase was mainly contributed by the two large deals investing in VNpay and MOMO Pay. To further support the FinTech development, the State Bank of Vietnam (SBV) has launched its Second Fintech Challenge Vietnam (FCV) in August 2019. This year’s focus would be on big data, artificial intelligence, financial services outreach, and cybersecurity technology solutions. The regulators could use the experience and outcomes of the FCV as one of the inputs to form the legal framework for the FinTech ecosystem development in Vietnam.

以下翻译结果由阿里云机器翻译引擎生成,仅供参考。 睿亚资产对内容的准确性或适当性不承担任何责任,如与英文原文含义不同,以原文为准。

朱榮熙

朱榮熙投资总监

朱榮熙

朱榮熙投资总监

以下翻译结果由阿里云机器翻译引擎生成,仅供参考。 睿亚资产对内容的准确性或适当性不承担任何责任,如与英文原文含义不同,以原文为准。

According to the report “FinTech in ASEAN: From Start-up to Scale-up”, ASEAN’s FinTech funding had a CAGR of 101 per cent in the last five years, growing from 35 million USD in 2014 to 1.14 billion USD in the third quarter of 2019. Singapore continued to be the top country attracting 51% of the total funding in 2019, against 53% in 2018. Funding to Vietnam jumped from 0.4% in 2018 to 36% in 2019. The increase was mainly contributed by the two large deals investing in VNpay and MOMO Pay. To further support the FinTech development, the State Bank of Vietnam (SBV) has launched its Second Fintech Challenge Vietnam (FCV) in August 2019. This year’s focus would be on big data, artificial intelligence, financial services outreach, and cybersecurity technology solutions. The regulators could use the experience and outcomes of the FCV as one of the inputs to form the legal framework for the FinTech ecosystem development in Vietnam.

According to the report “FinTech in ASEAN: From Start-up to Scale-up”, ASEAN’s FinTech funding had a CAGR of 101 per cent in the last five years, growing from 35 million USD in 2014 to 1.14 billion USD in the third quarter of 2019. Singapore continued to be the top country attracting 51% of the total funding in 2019, against 53% in 2018. Funding to Vietnam jumped from 0.4% in 2018 to 36% in 2019. The increase was mainly contributed by the two large deals investing in VNpay and MOMO Pay. To further support the FinTech development, the State Bank of Vietnam (SBV) has launched its Second Fintech Challenge Vietnam (FCV) in August 2019. This year’s focus would be on big data, artificial intelligence, financial services outreach, and cybersecurity technology solutions. The regulators could use the experience and outcomes of the FCV as one of the inputs to form the legal framework for the FinTech ecosystem development in Vietnam.