Chinese policy stimulus unveiled recently has set the stage for a possible modest firming of economic conditions in 2H2019. And this will likely support continuation of the recent outperformance of Chinese stocks against US and European equities.

Discussions of the long-term sustainability of Beijing’s periodic stimuli of the economy are valid. But the negativity surrounding that discussion is overdone. Indeed, sentiment has swung so far against the Chinese economy that a number of exaggerated propositions are now accepted as self-evident truths. Here are the top 5 “urban myths” about the Chinese economy.

1) China’s GDP figures are “fraudulent”?

Premier Li Keqiang’s 2010 comments – as reported in a leaked US diplomatic cable – that China’s GDP figures were “man-made” and “for reference only” have been seized on by China sceptics, and interpreted as suggesting the data was meaningless. “Fraudulent” has been a term used more than a few times. Above has been repeated so often that it is increasingly accepted without challenge. Allow me to challenge it.

For starters, GDP data is estimated in any economy from a range of surveys. In the US, the data is derived from agencies that survey people and businesses. Other inputs are information from private industry groups. So, in this sense, all GDP data is “man-made” – estimates from human endeavour and subject to human error – and not rigorous science. But this is not to say data from China is as reliable as data from the US.

A 2017 St Louis Federal Reserve report suggested the difficulties with Chinese GDP data stemmed from the speed at which the economy had evolved, from a command to a mixed economy. In China’s old command economy, economic activity equals State production targets. And where the means of production were all State-owned, measuring economic activity was a far simpler affair than in a market economy. But China’s private sector had since grown “faster than the National Bureau of Statistics was prepared for,” the report said.

Yet, China’s official GDP data is actually not far from quite a few independent estimates. Indeed, some research suggests that China’s official figures might periodically be understating actual economic activity.

A 2013 research report by the San Francisco Fed on alternate measures of China’s GDP growth concluded that “reported Chinese output data are systematically related to alternative indicators of Chinese economic activity…..These (independent) models suggest that Chinese growth has been in the ballpark of what official data have reported.”

Bloomberg’s recreation of the so-called Li Keqiang Index – based on electricity consumption, rail cargo volume, and bank lending – suggests official data may have understated actual growth in 2018. Indeed, DBS Bank’s Li Keqiang Index suggests official GDP growth data has been generally coming in below the Li Index from 3Q2016.

2) The Government is running out of policy ammunition?

The latest in this genre has been the media and analyst responses to Chinese policy makers’ recent monetary stimulus.

Yes, the measures unveiled recently were modest compared to stimulus of the past. But for Chinese policy makers, it is “damned if you do, damned if you don’t”. If they had unleashed massive policy stimulus, the criticism would have been – and rightfully so – that they were rapidly ratcheting up debts inefficiently. But when they take a more measured approach – as they have done – the criticism is it is insufficient and showed they were running out of policy ammunition.

China has cut its Reserve Requirement Ratio (RRR) 800 basis points from its peak of 21.5% in 2011 to the current level of 13.5%. The latest cut was 100 basis points in January, releasing a net amount of CNY800 billion of additional liquidity. But even after 800 bps of cuts, the People’s Bank of China’s RRR level is still high by international standards. And with the sharp decline in consumer inflation from 2.5% in October to only 1.5% in February, there is no price stability constraint on further RRR cuts in coming months. The equivalent ratio in the US is 10%.

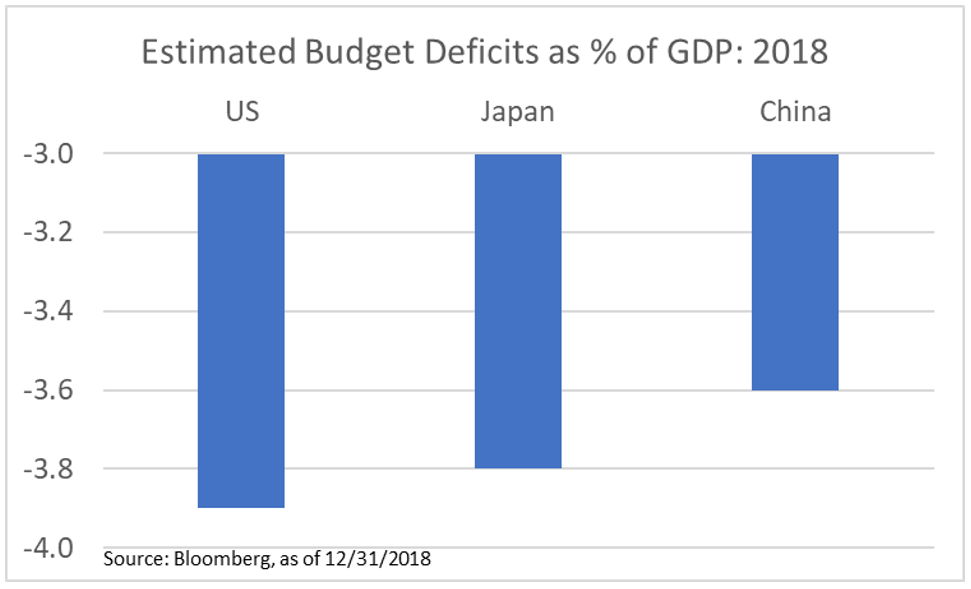

Beijing also just announced cuts in taxes and employers’ social security contributions valued at CNY 2 trillion to further backstop economic growth. That will lift the budget deficit to 2.8% of GDP. Morgan Stanley analysts were reported to have added another 150 basis points to the fiscal deficit to account for transfers from fiscal reserves and off budget items. Even if we went with the Morgan Stanley estimate of an “augmented budget deficit” equivalent to 4.3% of GDP, the US budget deficit estimate for fiscal year 2019 is estimated at 4.7% of GDP.

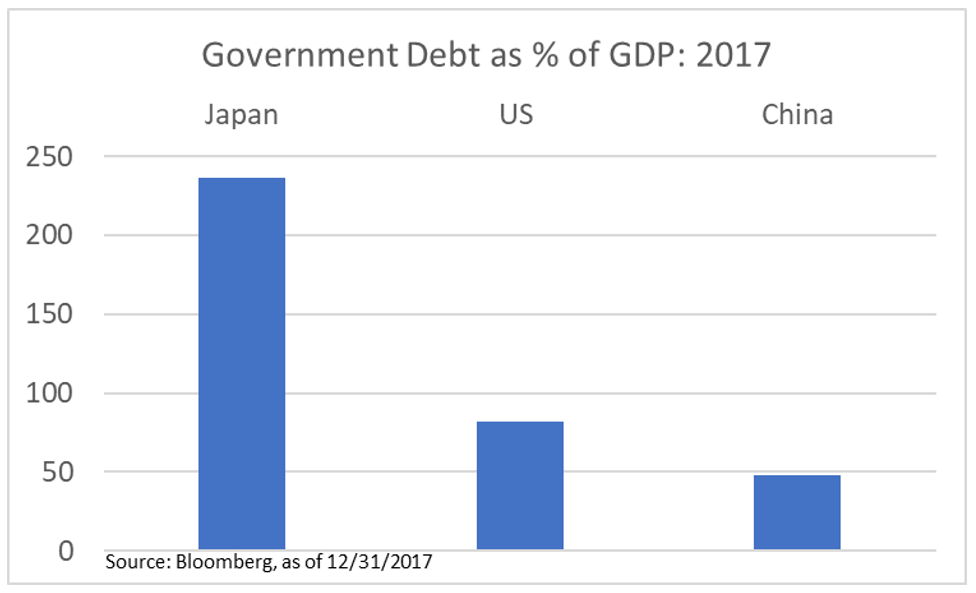

China’s official government debt was around 45% of GDP as of late 2017. But of course, China’s official government debt to GDP figures have been widely criticised as understatements, as they do not capture local government financing vehicle (off-balance sheet) debt. Adding local government, off-balance sheet debt, the figure rises to around 70% of GDP. But it still lagged the US government debt to GDP figure of 104%.

3) China’s debt problem is “out of control”?

“Extend and pretend,” is an expression used often to criticise how Chinese banks – and by extension the Chinese government – are handling corporate bad debts.

To be clear, China has a serious corporate debt problem. Total non-financial debt to GDP was around 250% in late 2017. Government debt – taking into account LGFV debt – was, as we outlined above, about 70% of GDP. So, private sector non-financial debt was around 180% of GDP. Stripping out household debt of around 45% of GDP, corporate debt was some 135% of GDP. To reiterate, the critics are right: This is serious and indeed the real debt problem facing China.

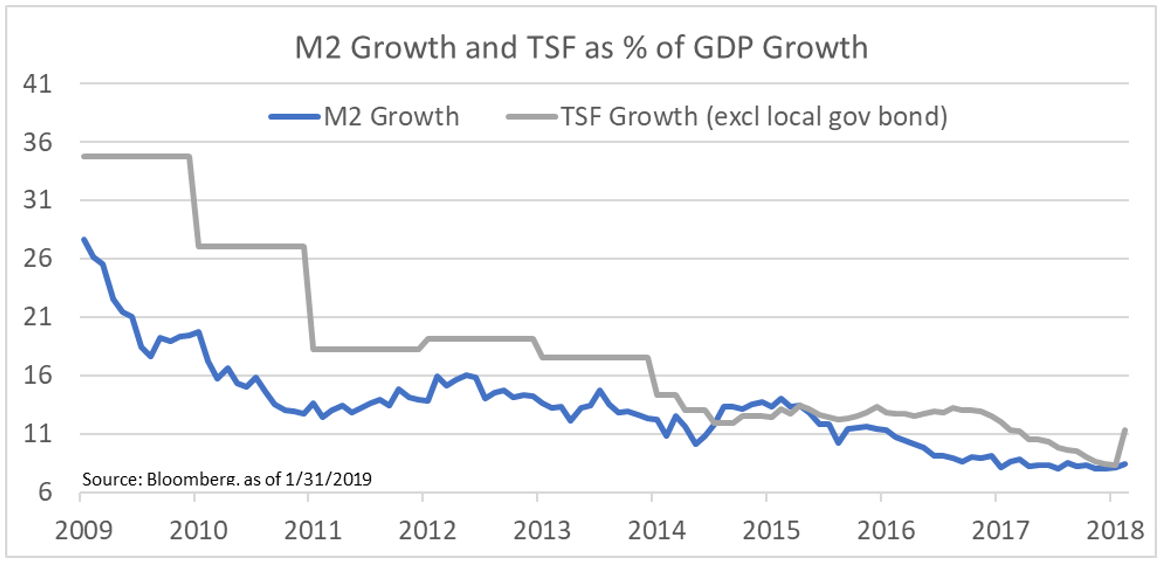

According to data from the St Louis Federal Reserve, China’s total non-financial credit to GDP ratio has stabilised since 2016. Likewise, corporate debt to GDP has also stabilised at around 2016 levels. Total credit growth has been reined in from over 20% in late 2016 to just under 11% in end-2018. And according to Moody’s, Chinese shadow banking assets have declined from 87% of GDP in late 2016 to 73% in June last year.

Beijing has bitten the bullet on slowing economic growth, bringing fixed asset investment growth from nearly 35% in 2010 to 6% in 2018. Accompanying that, M2 money supply growth and total social financing have also fallen sharply. So, it is doing what it can to slow high debt-driven growth without sending the economy into a tailspin.

In the context of driving a heavy vehicle, a sensible driver would not slam the brakes so hard it causes an articulated truck to “jack-knife” and crash. The safer way might be to tap the brakes on and off to slow the vehicle without crashing it. Yet, Beijing is variously criticised as either unable to stop the slowing of the economy or prioritising growth over reform. Quite impossible/contradictory criticisms to reconcile.

4) Beijing has abandoned economic reform?

Whether one accepts the proposition has a lot to do with what one understands as “reform”. If “reform” means rapid carve-outs and work-outs of non-performing loans, opening up the banking sector to international and private investors, and privatisation of stakes in state-owned enterprises, that hasn’t happened and is unlikely to happen anytime soon.

Why hasn’t China gone down the US Resolution Trust Corporation (RTC) route for bad debt resolution? That was the model for Thailand, Indonesia and Malaysia, in the aftermath of the Asian Financial Crisis. Government-backed asset management companies were formed, they issued bonds, and used the proceeds to buy out non-performing loans. Within the troubled assets, debt workouts were implemented, new equity raised, and control changed hands.

From the above description, it is clear why China hasn’t gone down that route. 1) Beijing doesn’t want foreign investors controlling large numbers of troubled assets, many of whom may be state-owned. 2) Beijing doesn’t want to write down its stakes in state-owned companies in sales to even local, private sector owners. 3) It doesn’t need to at this stage. The three ASEAN economies were in crisis mode. In the case of Indonesia, financial crisis was accompanied by political and social upheaval. This isn’t the case in China.

Also note the experiences of the Euro Area debt crisis and the Asian Financial Crisis, when surging cost of borrowing and economic contraction created an uncontrolled downward spiral. The greater the nominal GDP growth rate versus any level of interest rate, the more debt you can sustain relative to GDP and the better your chances of growing out of your debt problems.

Anyway, as noted above, Beijing has dramatically slowed money supply, credit and fixed asset investment growth since 2010, resulting in significant slowing of economic growth.

Meanwhile, it is moving – albeit cautiously – to work out the economy’s bad debts. A November 2018 report by PWC noted a “remarkable uptick” in sales of non-performing loan portfolios. While recent activity would only be scratching the surface of the country’s bad debt problem, it goes to intent of a government that is constantly criticised for having none. Quoting UBS, the PWC report notes that China Banking and Insurance Regulatory Commission (CBIRC) has been reported handing out a “record number of fines” between February 2017 and August 2018 – mostly to banks for “hiding their NPLs”.

Also, note that 70% of the CNY700 billion liquidity freed up from April 2018 RRR cut was intended for debt-to-equity swaps in large state-owned enterprises. And this was to ease the risks of defaults caused by deleveraging forced by the government. The remaining was intended for small and medium enterprises impacted by the squeeze on shadow banking. This latter measure is part of small steps towards improving the allocation of credit to the private sector. Other measures to increase the flow of funds to SMEs and the private sector included the launch last December of a “targeted medium-term lending facility”; an increase to the relending and rediscounting quotas targeting SMEs; and CBIRC guidelines for new bank loans to the private sector (33% for large banks and 67% for small banks, with the goal of giving 50% of new loans to the private sector in 3 years).

The point here is China recognises problems in credit allocation and is attempting to rectify them. But it is doing it via administrative measures rather than an opening up of the banking sector, which 1) would take years to complete, meanwhile possibly worsening the credit squeeze on the private sector, and 2) could have unforeseeable risks to financial stability.

5) China risks a financial crisis?

Not any time soon. Gordon G. Chang, in his 2001 book “The Coming Collapse of China”, was one of the early doomsayers predicting financial implosion. It’s been some 18 years, and there have been many others since.

China has been running current account surpluses since the mid-1990s. As a nation, it earns more than it spends, which means it is not dependent on external funding for its economic activity. Chinese savers fund the Chinese economy. So, economic life continues even if it faces a foreign “capital strike”.

It has accumulated approximately US$3.1 trillion in foreign currency reserves as a result of these surpluses. That’s around 22% of its GDP, compared to the international average of around 15%. This gives it a liquidity buffer; lowers crisis risk; and provides substantial resources for crisis mitigation.

China borrows largely in its own currency. Its external debt is only around 14% of GDP. The experience of peripheral European Union countries versus the US and Japan is the difference between debt denominated in foreign currencies versus your sovereign currency. It is also the difference between controlling your own currency (e.g. US and Japan) versus having no control over your currency (e.g. Portugal, Italy, Greece, Spain).

Capital controls limit the risks of capital flight. While China’s reserves are the largest in the world, it is only some 11%-12% of M2 money, and can be quite quickly depleted if there is capital flight.

China’s high savings rate (47% in 2017) and low bank loan to deposit ratio (0.7) limit the risks of domestic funding stress. But even in the unlikely event of funding stress, the People’s Bank of China can pump out liquidity to stabilise the banking sector. Such funding stress could occur in the event of a surge in debt defaults and a drying of short-term funding. But the central bank template for crisis management has been well established over repeated financial crises around the world, including the global financial crisis and the European debt crisis of the past 12 years.

The Bottom line – China’s debt ailment is serious but is not “terminal”.

China cannot raise indefinitely its credit to GDP ratio – a measure of how credit intensive its economic growth is. There’s no argument about this. China’s non-financial credit to GDP ratio was relatively stable at between 140%-150% before the global financial crisis, but that surged to around 250% by the start of 2017, then stabilised around 250% over 2017 and 2018. But with recent monetary easing, this could rise yet again. According to IMF data, in 2007-2008, China needed US$1.30 of new credit to raise nominal GDP by US$1. By 2015-2016, that figure went up to US$4 of new credit to raise nominal GDP by US$1. This cannot continue indefinitely, and that’s not the argument.

But as outlined above, it has slowed economic growth, tentatively stabilised debt to GDP, and taken small initial steps towards debt to equity swaps and sales of non-performing loans. And it is channelling more credit to the private sector.

Further, it has undertaken a significant number of mega mergers involving China’s largest state-owned enterprises (SOEs). China Daily reported that the number of central SOEs had been consolidated down to 96 firms last year from 117 five years before that. The figure was 189 in 2003. The idea is to cut excess capacity, grow economies of scale, and improve efficiency. That’s SOE reform. “Through these efforts, the Chinese government hopes to reduce debt and increase the efficiency of its state sector,” a U.S.-China Economic and Security Review Commission report said last year.

China needs to do a lot more. It needs to continue reform of SOEs and channel credit to more productive companies. It needs to improve lending practices/standards in state-owned banks. And it needs to – gradually and cautiously – allow unsalvageable borrowers to fail.

But it has the policy room and time to do this in a measured manner.

Back to the opening point about the recent stimulus. Yes, they were measured moves, and intentionally so. The government has repeatedly said it won’t resort to “flood irrigation” of the economy. And rather than being criticised for being timid, this should be welcomed as being mindful of the risks of reigniting credit growth ala 2009-2016. But it should be sufficient to backstop economic growth, allowing time for gradual reforms.

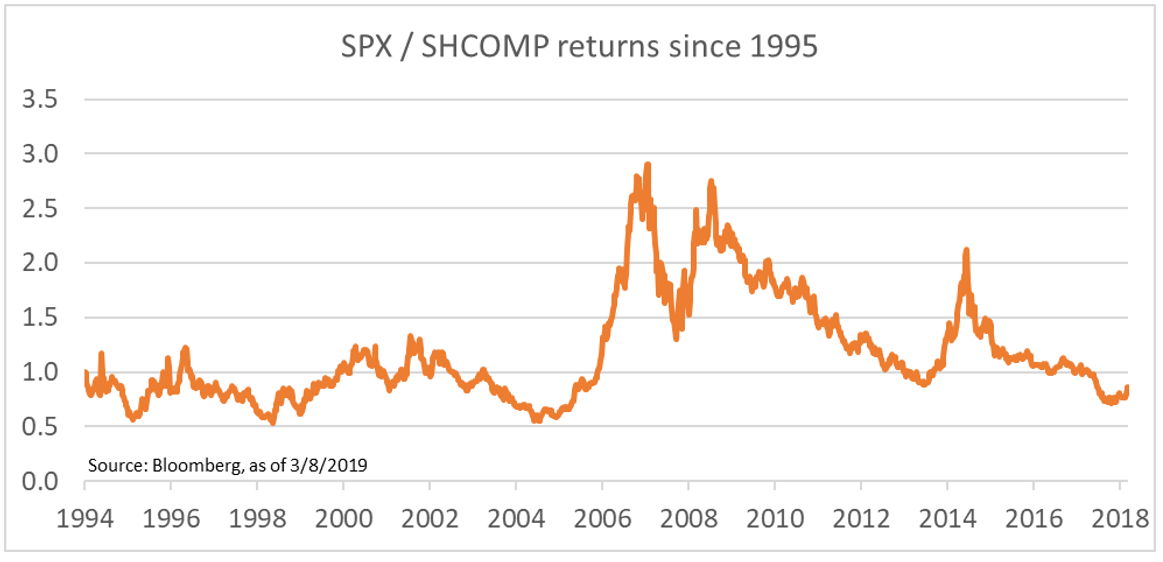

Meanwhile, sentiment towards China has swung from one extreme to another over the past decade – from “China can do no wrong” after the global financial crisis to “China can do nothing right” today. And that pessimism is reflected in the very low valuation for Chinese equities relative to US stocks. That negativity is overdone. China isn’t going into financial crisis anytime soon. It will slow but it will continue to grow. And as funds exit an overvalued US market, China and other emerging markets will likely continue to outperform.

Related tickers:

Premia CSI Caixin China Bedrock Economy ETF: 2803 HK

Premia CSI Caixin China New Economy ETF: 3173 HK