Factor Performance

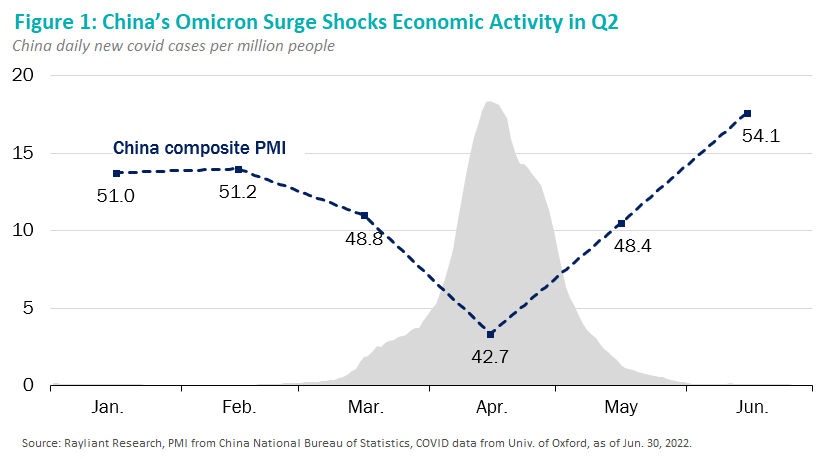

To better understand the performance of investment factors in the China A market during Q2, it helps to break the quarter down into two parts: before and after mainland shares bounced off of a year-to-date low, hit by the CSI 300 Index, on April 26th. In the former period, a late-Q1 surge in Omicron cases across major cities in China triggered strict zero-COVID pandemic policies which, by mid-April, saw an estimated quarter of the country’s population—covering around 40% of China’s GDP—in lockdown. With factories and offices empty and consumers stuck at home, production and spending hit a wall. China’s composite PMI, including both manufacturing and services, fell sharply for the month (see Figure 1, below), dipping under 43 (anything below 50 indicates economic contraction), while the CSI 300 Index, reflecting the hit to investor sentiment, suffered a -10.4% fall through April 26th.

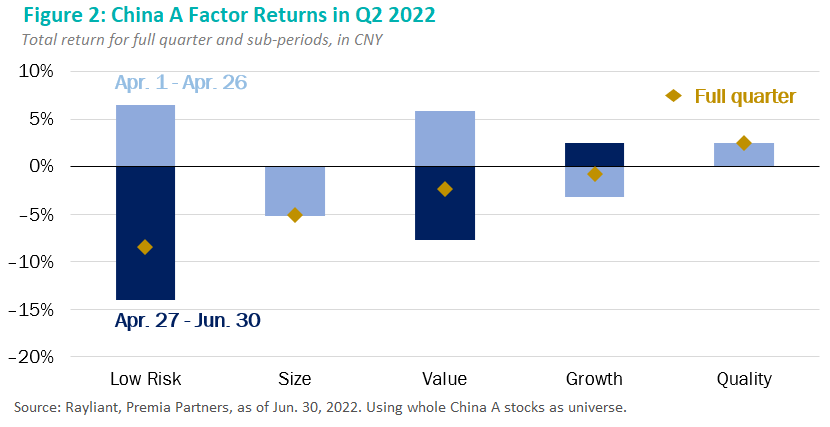

Figure 2 plots factor performance over the full quarter and two sub-periods referenced above. During the April drawdown in Chinese equities, bargain stocks (Value) and the most stable shares (Low Risk) performed as intended, posting solid defensive alpha in the rotation; likewise, companies exhibiting strong profitability and balance sheet health (Quality) delivered modestly positive returns. Negative shocks are often most severe for smaller stocks and growth firms, driving underperformance of the Size and Growth factors in the first part of Q2.

Beginning at the end of April, investor optimism returned, as falling case counts and accommodative language on the part of policymakers—increasingly behind the curve in hitting annual growth targets—brought hope of a faster-than-expected recovery in China’s economy. By mid-May, new confirmed cases had largely subsided, cities reopened, and economic conditions improved, with composite PMI bouncing off its April low and actually indicating a return to expansion through the end of June. Investor sentiment consequently snapped back in the second half of Q2, propelling the CSI 300 to an 19.7% gain from its April 26th low through the end of June.

Factor returns in the rebound were essentially the mirror image of those experienced in the early part of the quarter, as Low Risk and Value sold off and Growth staged a comeback. Quality stocks held their ground, as did Size, whose subdued performance in May likely reflects the conventional wisdom that state support would flow disproportionately to large SOEs in China’s imminent stimulus push. Ultimately, this retail-sentiment-driven rally, founded on a pivot from extreme fear to greed in Q2, led factor performance to suffer, with Growth representing the only exposure notching a positive return for the quarter.

Index Performance and Outlook

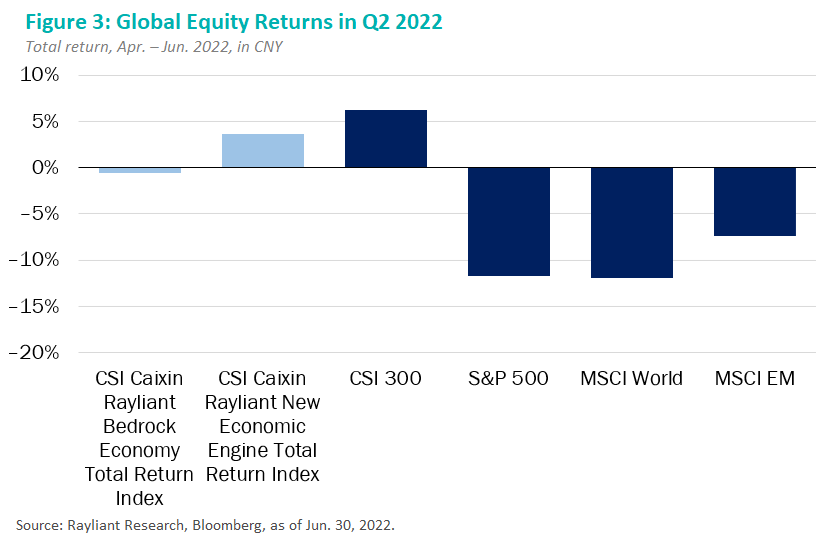

At the market level, mainland Chinese equities delivered on their promise of diversification in the second quarter, posting positive returns over a period in which U.S. stocks entered a bear market and global equities generally suffered, as illustrated in Figure 3. The CSI 300 Index returned 6.2% in Q2, while the S&P 500 declined -11.7% (CNY) or -16.5% in USD terms. Emerging Markets entered the quarter with more compelling valuations than the U.S. and many other developed markets, but still suffered against the backdrop of a strengthening dollar (generally bad for EM economies) and mounting fears an increasingly hawkish central banks would push the world into a recession.

The CSI Caixin Rayliant New Economic Engine Index and the CSI Caixin Rayliant Bedrock Economy Index, tracked by Premia’s 3173 HK/9173 HK and 2803 HK/9803 HK ETFs, returned +3.6% and -0.5%, respectively, easily beating other developed and emerging benchmarks, but lagging the CSI 300 given the factor headwinds described before. The new economy strategy’s factor emphasis on ‘quality growth’ helped during the quarter, as did its natural underweights to Financials and Real Estate—two of the mainland market’s worst-performing sectors for the quarter, amidst continued drama in China’s property market. The bedrock economy ETF fared slightly worse, weighed down by greater exposure to value and low risk, along with its overweight to Financials and Real Estate and an underweight to Consumer Staples, the second-best performer in the CSI 300 in Q2.

If the story of China’s market performance in the first half of 2022 was primarily about the cost to contain COVID-19, the remainder of the year will almost certainly center on policymaker’s attempt to reverse course and hit the government’s 5.5% GDP growth objective, reaffirmed by President Xi and Premier Li in multiple occasions over the last few weeks, but well above the 4% consensus in Bloomberg’s latest survey of analysts. Stimulus may feel long overdue, though it’s worth noting that with ports shut down, factories offline, and consumers locked indoors, pumping in liquidity might not have done much good prior to COVID restrictions easing in mid-May. While we agree with most analysts that it would be highly challenging for China to grow at the 7% necessary through the remainder of 2022 to hit its self-imposed GDP full-year growth target, we do believe the worst is over in terms of COVID lockdowns, and that policy balance will be firmly on the side of growth leading into Q4’s National Congress.

Accordingly, in the months ahead, we expect this policy push to have two effects relevant to A shares investors. First, Beijing’s pursuit of increasingly aggressive stimulus throughout the third quarter should enhance the attractiveness of A shares from a diversification perspective, with the Fed and other central banks doing the exact opposite. Second, as policy support kicks into gear, we expect last quarter’s sentiment-driven rally to give way to a focus on fundamentals, with quality companies reaping a greater share of the benefits of pledged stimulus, including firms in the Bedrock universe that represent anchors of China’s real economy and policy supported sector leaders in the New Economy universe that stand to benefit disproportionately from large-scale fiscal and infrastructure spending. This places the new economy and bedrock ETFs in a good position to capture China’s rebound from a challenging first half, with respect to both beta and alpha.

*****************************************************************************************************

Dr. Philip Wool is the Managing Director and Head of Investment Solutions at Rayliant Global Advisors. Phillip conducts research in support of Rayliant’s products, with a focus on quantitative approaches to asset allocation and return predictability within asset classes, as well as the design of equity strategies tailored to emerging markets, including Chinese A shares. Prior to joining Rayliant, Phillip was an assistant professor of Finance at the State University of New York in Buffalo, where he pursued research on quantitative trading strategies and investor behaviour, and taught investment management. Before that, he worked as a research analyst covering alternative investments for Hammond Associates, an institutional fund consultant. Phillip received a BA in economics and a BSBA in finance and accounting from Washington University in St. Louis, and earned his Ph.D. in finance from UCLA, where his research focused on the portfolio holdings and trading activity of mutual fund managers and activist investors. Premia CSI Caixin China New Economy ETF and Premia CSI China Caixin Bedrock Economy ETF track the CSI Caixin Rayliant New Economic Engine Index and CSI Caixin Rayliant Bedrock Economy Index respectively.