This morning Bloomberg ran a story about LeEco, a Chinese technology conglomerate that has been growing rapidly until recently. LeEco is in the news for announcing "plans to eliminate 325 jobs in the US and sharply reduce R&D operations, after struggling to raise funds and attract the consumers needed for its ambitious global vision" (Bloomberg article here).

So why am I writing about this? At Premia Partners, working with our partners at Rayliant, we've known all along that not all China exposures are created equal. A purely passive approach doesn't always make sense because of the landmines that occasionally find their ways into the benchmark. Some investors may have been happy to find LeEco in their exposure (0.38% of CSI 300), given its symbol as one of China's new economy stocks, growing quickly via the shift from industrial growth to domestic consumption. Other investors may have seen a volatile stock with a bloated balance sheet, lamenting its presence in their portfolios. An active approach would be the only way to avoid such landmines, right?

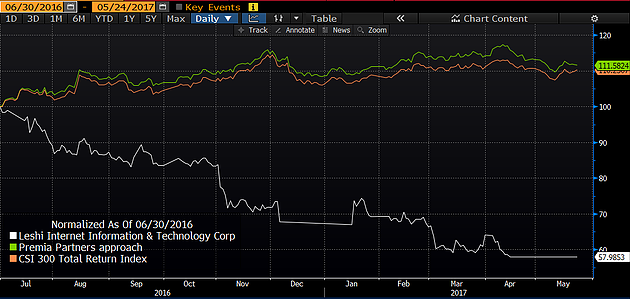

At Premia Partners, we believe it's possible to combine the low cost world of passive with the insights available to active investors who do their homework. That is why the China A-share large cap strategy we're putting together doesn't have exposure to LeEco today. It never did. LeEco simply doesn't make the cut due to our economic size, balance sheet health and volatility constraints. Yet our strategy is not active - it is still passively managed and low cost. The result is below: LeEco is the white line, CSI 300 is orange and the Premia Partners approach* is in green.

* Premia Partners approach is based on an index construction methodology developed jointly with China Securities Index Co., Ltd and Rayliant Global Advisors

Source: Bloomberg, 24 May 2017;

Such rules-based and fundamental beta decisions result in better returns for investors into China but sadly are not yet available in easy to access form. We are working on changing that and should have more news in Q3. Until then, please subscribe to hear from us or follow us on one of your social networks.