ETF Creation & Redemption

While ETFs trade on exchanges like stocks, there is a key difference. A stock has a finite number of shares, an ETF on the other hand can adjust the number of supply via the daily creation and redemption process of "continuous issuance".

The creation/redemption process can sometimes be misunderstood by investors using ETFs. It is important to understand that the creation/redemption process is a function of the primary market and that this process facilitates the accessing of underlying liquidity in an ETF. Only Authorized Participants (AP) can interact directly with the fund to create or redeem shares. This is a process being utilized to increase or decease ETF shares in the background based on demand. Many investors do not need to utilize this primary market process first-hand to buy ETFs. Even if the creation or redemption is based on a client order due to thin liquidity in the secondary market, the AP is the one deciding to use the creation/redemption process. It would be beneficial if investors depart from thinking that themselves are doing the actual creation or redemption, but rather taking the view that someone will help facilitate their access into or out of an ETF via the mechanism.

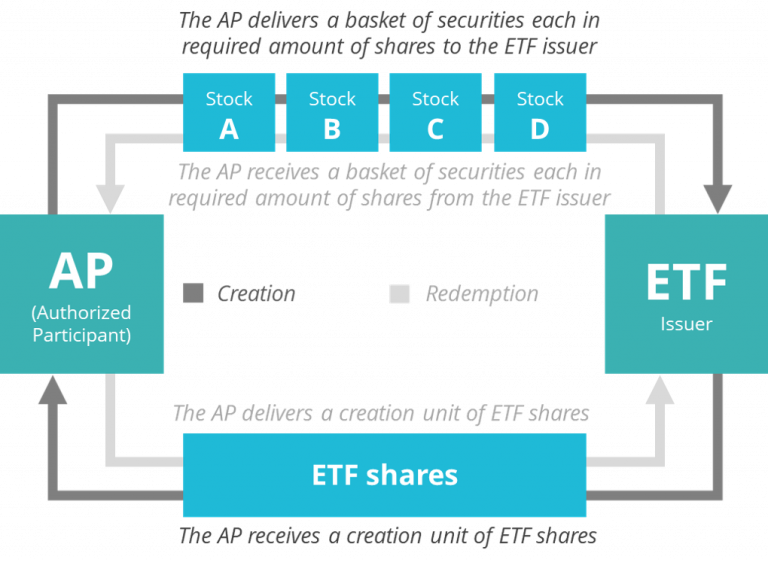

When an AP does a creation, the required basket shares of stocks matching the creation unit are delivered to the ETF issuer along with the required cash component, and the ETF issuer delivers ETF shares to the AP. The ETF issuer does not maintain an inventory, but "issues" new ETF shares as part of the creation process. In an opposite situation of a redemption order, AP delivers shares of ETF to the issuer, and the issuer delivers the underlying basket to the AP. Those shares delivered to the issuer are theoretically "destroyed".

Source: David Abner, The ETF Handbook, Wiley 2016