토픽별 인사이트: Technology

ChinaA-sharesBedrock economyValueSmart BetaFactor InvestingEconomic RecoveryTechnologyNew EconomySTAR BOARD

과거 투자자들은 중국 주식 소유시 국영기업(SOE)보단 민영기업(POE)을 더 선호했습니다. 보통 민영기업은 더 효율적으로 운영되며 성장·이익·혁신을 추구하는 경향이 있는 반면, 국영기업은 보통 관료주의, 사회적 책임, 고용·사회적 안정 지원, 그리고 변화·혁신과는 거리가 먼 전통적인 사내문화에 얽매인 채 운영된다는 고정관념이 존재했기 때문이다. 그러나 정부의 강력한 지원 뿐만 아니라, 국영기업 개혁을 촉진하고 국영기업들의 가치 발굴을 강조하는 새 정책들이 속속 등장함에 따라, 이제는 이러한 고정관념을 타파할 때가 된 것 같습니다. 변화를 위해 노력하고, 또 진정한 경제 발전에 기여할 수 있도록 재편성되고 새로운 가치를 발견할 수 있게끔 정책 결정자들의 전폭적인 지지를 받는 국영기업들이 새로이 등장하고 있기 때문입니다. 이 글에서는 최근 인기를 끌고 있는 국영기업 리레이팅/가치 재평가 테마의 배경에 대해 논의해볼 것이며, 중국 국영기업 테마에 적절한 익스포져를 갖기 위한 최적의 방법을 소개합니다.

2023년 5월 26일

ChinaA-sharesBedrock economyValueSmart BetaFactor InvestingEconomic RecoveryTechnologyNew EconomySTAR BOARD

과거 투자자들은 중국 주식 소유시 국영기업(SOE)보단 민영기업(POE)을 더 선호했습니다. 보통 민영기업은 더 효율적으로 운영되며 성장·이익·혁신을 추구하는 경향이 있는 반면, 국영기업은 보통 관료주의, 사회적 책임, 고용·사회적 안정 지원, 그리고 변화·혁신과는 거리가 먼 전통적인 사내문화에 얽매인 채 운영된다는 고정관념이 존재했기 때문이다. 그러나 정부의 강력한 지원 뿐만 아니라, 국영기업 개혁을 촉진하고 국영기업들의 가치 발굴을 강조하는 새 정책들이 속속 등장함에 따라, 이제는 이러한 고정관념을 타파할 때가 된 것 같습니다. 변화를 위해 노력하고, 또 진정한 경제 발전에 기여할 수 있도록 재편성되고 새로운 가치를 발견할 수 있게끔 정책 결정자들의 전폭적인 지지를 받는 국영기업들이 새로이 등장하고 있기 때문입니다. 이 글에서는 최근 인기를 끌고 있는 국영기업 리레이팅/가치 재평가 테마의 배경에 대해 논의해볼 것이며, 중국 국영기업 테마에 적절한 익스포져를 갖기 위한 최적의 방법을 소개합니다.

2023년 5월 26일

SemiconductorSTAR BOARDA-sharesHardcore TechnologyInnovationTechnologyAdvanced ManufacturingAINew Materials

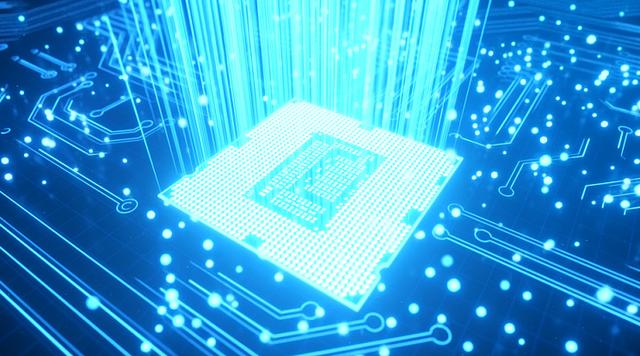

인터넷 플랫폼 기업들이 지난 10년 간 중국 테크 섹터를 주도해 온 주요 동력이었지만, 최근 실적 발표와 경영 방향성을 살펴보면, 이커머스·게임·승차플랫폼·라스트 마일 배송 등 업종들의 고성장 모멘텀이 대폭 둔화되고 있는 모습인데요. 정부 정책 변동·반독점법·데이터 보안 위반 등에 대한 우려뿐만 아니라 시장이 성숙 단계에 진입하면서 이들 사업 모델의 전망은 불확실해보입니다. 반면, 특히 반도체와 같은 하드코어 테크놀로지 섹터는 미국 바이든 행정부의 적대적인 조치에도 시장에서 떠오르는 업종으로 각광받고 있습니다. 이번 글에서는 왜 반도체 업종이 조만간 중국 주식 시장의 핵심 섹터 중 하나가 될 예정인지, 그리고 투자자들이 중국 테크 산업의 패러다임 변화에 맞춰 포트폴리오를 재구성하고자 할 때 왜 프리미아 차이나 과창판(STAR50) ETF를 활용하면 테크 산업의 성장기회들을 포착하기 좋은지 다뤄보도록 하겠습니다.

2023년 5월 4일

SemiconductorSTAR BOARDA-sharesHardcore TechnologyInnovationTechnologyAdvanced ManufacturingAINew Materials

인터넷 플랫폼 기업들이 지난 10년 간 중국 테크 섹터를 주도해 온 주요 동력이었지만, 최근 실적 발표와 경영 방향성을 살펴보면, 이커머스·게임·승차플랫폼·라스트 마일 배송 등 업종들의 고성장 모멘텀이 대폭 둔화되고 있는 모습인데요. 정부 정책 변동·반독점법·데이터 보안 위반 등에 대한 우려뿐만 아니라 시장이 성숙 단계에 진입하면서 이들 사업 모델의 전망은 불확실해보입니다. 반면, 특히 반도체와 같은 하드코어 테크놀로지 섹터는 미국 바이든 행정부의 적대적인 조치에도 시장에서 떠오르는 업종으로 각광받고 있습니다. 이번 글에서는 왜 반도체 업종이 조만간 중국 주식 시장의 핵심 섹터 중 하나가 될 예정인지, 그리고 투자자들이 중국 테크 산업의 패러다임 변화에 맞춰 포트폴리오를 재구성하고자 할 때 왜 프리미아 차이나 과창판(STAR50) ETF를 활용하면 테크 산업의 성장기회들을 포착하기 좋은지 다뤄보도록 하겠습니다.

2023년 5월 4일

ChinaInnovationSTAR BOARDTechnologyA-sharesSemiconductorAdvanced ManufacturingAILife ScienceBiotechGreen EconomyNew MaterialsRenewable EnergyNew Economy

2023년, 투자자들은 경제침체기를 맞게될 서양과 중국의 회복으로 가파른 성장세에 올라탈 동양 사이에 극명한 경제적 차이를 보게 될 것입니다. 2022년, 재개방 반등세를 이미 자체적으로 경험한 ASEAN-5국가들이 내년에는 중국의 재개방 회복세 순풍에 올라탈 것으로 전망됩니다. 이번 논설에서는 ASEAN-5 국가들이2023년 비교적 완만한 인플레와 세계적으로도 가장 높은 수준의 경제성장률을 시현하며 어떻게 스윗스폿(Sweet Spot)을 계속 선점하게 될 지 다뤄볼 예정입니다.

2022년 12월 13일

ChinaInnovationSTAR BOARDTechnologyA-sharesSemiconductorAdvanced ManufacturingAILife ScienceBiotechGreen EconomyNew MaterialsRenewable EnergyNew Economy

2023년, 투자자들은 경제침체기를 맞게될 서양과 중국의 회복으로 가파른 성장세에 올라탈 동양 사이에 극명한 경제적 차이를 보게 될 것입니다. 2022년, 재개방 반등세를 이미 자체적으로 경험한 ASEAN-5국가들이 내년에는 중국의 재개방 회복세 순풍에 올라탈 것으로 전망됩니다. 이번 논설에서는 ASEAN-5 국가들이2023년 비교적 완만한 인플레와 세계적으로도 가장 높은 수준의 경제성장률을 시현하며 어떻게 스윗스폿(Sweet Spot)을 계속 선점하게 될 지 다뤄볼 예정입니다.

2022년 12월 13일

Premia Asia Innovative Technology ETF (AIT) since its inception in 2018, was designed to capture the Asia leaders powering the growth of existing and emerging innovative technologies. Without a doubt, the hottest theme trending now is the Metaverse, as Facebook’s CEO Mark Zuckerberg announced earlier that the company name change and sees the Metaverse as the “successor to the mobile internet”. While this is still an emerging but quickly evolving topic, there are already considerable number of Asia leaders active in the space as emerging metaverse natives. How can investors position for opportunities early in this space?

2021년 12월 7일

Premia Asia Innovative Technology ETF (AIT) since its inception in 2018, was designed to capture the Asia leaders powering the growth of existing and emerging innovative technologies. Without a doubt, the hottest theme trending now is the Metaverse, as Facebook’s CEO Mark Zuckerberg announced earlier that the company name change and sees the Metaverse as the “successor to the mobile internet”. While this is still an emerging but quickly evolving topic, there are already considerable number of Asia leaders active in the space as emerging metaverse natives. How can investors position for opportunities early in this space?

2021년 12월 7일

The recent regulatory crackdowns and power suspension in China have unnerved many international investors. How to configure for opportunities under the lens of common prosperity and China’s commitment for carbon neutrality by 2060? In this article, we compare the Premia China STAR50 ETF (3151.HK) and Premia CSI Caixin China New Economy ETF (3173.HK), and discuss why they are useful implementation tools to capture long term opportunities in hardcore technology and strategic new economy sectors under the 14th Five Year Plan.

2021년 10월 12일

The recent regulatory crackdowns and power suspension in China have unnerved many international investors. How to configure for opportunities under the lens of common prosperity and China’s commitment for carbon neutrality by 2060? In this article, we compare the Premia China STAR50 ETF (3151.HK) and Premia CSI Caixin China New Economy ETF (3173.HK), and discuss why they are useful implementation tools to capture long term opportunities in hardcore technology and strategic new economy sectors under the 14th Five Year Plan.

2021년 10월 12일

China market saw a material correction due to the regulatory crackdown in the offshore tech and education space. The panic sentiment led to indiscriminative unwinding of Chinese stocks by foreign investors, pushing the HK-listed tech names and the US-listed China ADRs into a bear market technically. Although the regulatory risks remain high in near-term, investors seem getting a stronger hint about the policy direction. The glory days when China tech can be simplistically covered by just the offshore tech giants is gone, and there is increasing need for more granular understanding of the related policy headwinds and tailwinds. In this article our Partner & Co-CIO David Lai shares the thesis behind our Premia China STAR50 ETF, and how this timely launch adds value through its diversified exposure of the leading innovative and strategically important hi-tech companies focusing on innovation and hardcore technology.

2021년 8월 5일

China market saw a material correction due to the regulatory crackdown in the offshore tech and education space. The panic sentiment led to indiscriminative unwinding of Chinese stocks by foreign investors, pushing the HK-listed tech names and the US-listed China ADRs into a bear market technically. Although the regulatory risks remain high in near-term, investors seem getting a stronger hint about the policy direction. The glory days when China tech can be simplistically covered by just the offshore tech giants is gone, and there is increasing need for more granular understanding of the related policy headwinds and tailwinds. In this article our Partner & Co-CIO David Lai shares the thesis behind our Premia China STAR50 ETF, and how this timely launch adds value through its diversified exposure of the leading innovative and strategically important hi-tech companies focusing on innovation and hardcore technology.

2021년 8월 5일

We recently completed the annual rebalancing exercise for the two China A shares and Asia Innovative Technology ETFs. In this article our Portfolio Manager Alex and Partner & Co-CIO David will share more about the changes and portfolio characteristics post-rebalancing, which further align with strategic focuses of China’s 14th Five Year Plan, and recalibrate for opportunities in the new normal as COVID recovery in China and Asia enters the next stage.

2021년 6월 24일

We recently completed the annual rebalancing exercise for the two China A shares and Asia Innovative Technology ETFs. In this article our Portfolio Manager Alex and Partner & Co-CIO David will share more about the changes and portfolio characteristics post-rebalancing, which further align with strategic focuses of China’s 14th Five Year Plan, and recalibrate for opportunities in the new normal as COVID recovery in China and Asia enters the next stage.

2021년 6월 24일

China’s tough new regulations on its tech giants will result in competitive gains for consumers, level the playing field for small and medium enterprises, and generate productivity gains for the economy.

2021년 5월 24일

According to the United Nation Environment Programme, an inclusive green economy is an alternative to today's dominant economic model, which exacerbates inequalities, encourages waste, triggers resource scarcities, and generates widespread threats to the environment and human health.

2021년 1월 22일

We see the need to evolve from conventional geography centric or factor-based asset allocation models to sector and megatrend-minded models to capture secular alpha from structural changes.

2021년 1월 13일

From a total portfolio perspective, global asset owners and allocators are increasing wary about the overall portfolio sensitivity to interest rate changes and ultimately risk diversification. The concept of “equity duration” was raised long ago and has been subject to debate for decades. While some absolute calculations fail to work in today’s markets, we believe the economic and financial intuition beneath still hold. In this working paper, we took a renewed approach to analyze the relationships from a relative perspective and with an overarching objective of total portfolio risks in mind.

2020년 11월 26일

From a total portfolio perspective, global asset owners and allocators are increasing wary about the overall portfolio sensitivity to interest rate changes and ultimately risk diversification. The concept of “equity duration” was raised long ago and has been subject to debate for decades. While some absolute calculations fail to work in today’s markets, we believe the economic and financial intuition beneath still hold. In this working paper, we took a renewed approach to analyze the relationships from a relative perspective and with an overarching objective of total portfolio risks in mind.

2020년 11월 26일

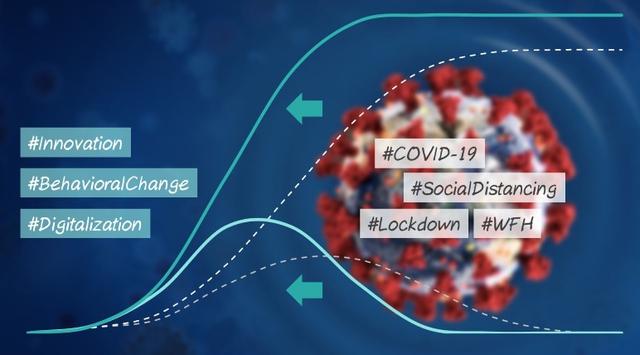

COVID-19 will likely go down in history as – among other things – an accelerant for a range of tendencies are already present prior to the pandemic. AC (after-COVID), these are the four major behavioral changes that are unlikely to revert to life as we knew it BC (before-COVID).

2020년 7월 21일

For Premia CSI Caixin China Bedrock Economy ETF (2803.HK), there were 90 changes among the underlying index constituents during the latest rebalancing in June. The one-way turnover ratio was 33.5%, in line with the historical range between 30% and 40%. The value factor continued to work well with the ETF becoming more attractive in terms of valuation by replacing overvalued stocks with undervalued one. The forward price-to-earnings ratio dropped from 8.1x to 6.3x whilst the price-to-book ratio remained at 1.1x. The quality factor also functioned as designed with both return-on-equity ratio and profit margin increased post-rebalancing. The former rose from 8.9% to 9.7% and the latter increased from 11.3% to 13.6%, reflecting the current stock pool is healthier in financials and stronger in profitability. In addition, the low-volatility screen did help reduce the portfolio’s risk, as shown by the volatility falling from 29.5% to 28.9%. Last but not least, the index’s revenue rose from RMB 19.1 billion to RMB 21.1 billion, capturing the mainstream economy of China. Overall the post rebalancing portfolio represents a basket of constituents with better resilience during the COVID and US China tension induced market growth, with cheaper valuaton, higher ROE, higher profitability, strong debt coverage and lower volatility.From a sector perspective, the major change was reducing exposure in Consumer Discretionary and Industrials, and increasing weights in Financials, Real Estate and Utilities. Drilling down into sub-segments, the additions in Financials are mostly leading banks with attractive valuation, while the deletions in Consumer Discretionary are mostly automobiles related given the challenged fundamentals for the sector. Notwithstanding the market environment, Chinese banks so far have only been affected mildly by the economic slowdown. For example, the industry’s return-on-equity fell slightly from 11.7% to 11.0% and NPL ratio edged up from 1.83% to 1.86%. On a positive note, the net interest margin even surprised on the upside with the number going up from 2.18% to 2.20%. In respect of potential NPL pressure, the additions are also considered with the balancing factor of quality factor, thus focusing banks with robust fundamentals but suppressed valuation during broad market drawdown. Automobile industry was a totally different story with the national sales strinking for the 2nd year in a row. The total vehicle sales fell by 8.2% to 25.8 million in 2019, after having slid nearly 3% in 2018 in the first contraction since the 1990s. The slump was exacerbated by weak economic growth, the trade war with the US and tough new emission standards introduced last summer.For Premia CSI Caixin China New Economy ETF (3173.HK) which has continued the strong trajectory and performed well through COVID and after the rebalancing with YTD ~20% return as of Jun 22nd, it had a higher turnover rate compared to the previous rebalances given the evolution of the new economy trends becoming more pronounced since COVID. There were total 113 replacements, and the one-way turnover was around 45.7%, slightly higher than the historical range of ~40%. As the index methodology prefers companies with light-asset business model, the consistuents showed a slight increment in non-fixed asset ratio from 0.857 to 0.859 post rebalancing. In terms of financial health, the updated basket of stocks reflected a higher quality in general with significant improvement seen in the debt coverage (0.86x to 1.71x), return-on-equity (9.7% to 12.6%), and profit margin (14.6% to 17.3%), representing a more robust set of fundamental staying power for growth given the current market conditions. In fact, this has also been reflected in the resulting strong growth numbers - the index constituents are expected to grow faster with the estimated revenue growth rising from 9.7% to 15.0% after the resuffle. A mid-teen growth rate is indeed impressive amid the macro slowdown and the challenigng COVID-19 impact.From a sector point of view, the major change is an increase in Information Technology versus a reduction in Healthcare and Consumer Discretionary. The additions in Information Technology were diversified into semiconductor, software and communications equipment, which align well with the new infrastructure and Industrial IOT development mentioned in our previous research articles. With the government’s intention to speed up the technolgoical advancement, it is quite rational to see more emerging industry leaders in the capital market. The latest policy expands the conventional infrastructural investment to encompass digital infrastucture aka #New Infrastructure such as 5G network, data centers, Internet of Things and cloud computing are expected to help groom the local champions. On the contrary, the deletions in Consumer Discretionary were mainly auto or consumer-electronic related since consumers were reluctant to make big ticket purchases in an uncertain environment. Besdies, the exports business might also get affected negatively from the rising tensions in global trade.Within Healthcare, the deletions focused on traditional pharmaceuticals which could face more headwinds ahead, in particular for the companies which produce generic drugs. Beijing has been pushing forward a system that requires drugmakers to go through a bidding process and cut prices low enough to be considered over generic copies if they want to sell their products at public hospitals via large-volume government procurement.For Premia Asia Innovative Technology ETF (3181.HK), there were 8 changes out of 50 stocks if excluding Alibaba which switches from the ADR to the shares listed in Hong Kong, due to its re-classification of the primary listing from the US to Hong Kong. Also, each stock is re-scaled back to an equal weight of 2% in the portfolio, following a rebalancing discipline of profit-taking and buying on dip. Among the 8 inclusions, there are 5 Chinese companies, 2 Japanese companies and 1 Korean company covering themes including new infrastructure, media & web services, biopharmaceutical and semiconductors. Only Chinese and Japanese companies are in the deletion list, in which their businesses are mainly related to media & web services, robotics & automation and industry 4.0. Most of the changes in the index were driven by whether the company’s market cap can reach or fall out from the top 50 in the universe.Similar to China New Economy, the post-rebalance portfolio reflects also a basket that resonates well in the COVID/ post-COVID world, where a lot of behavioural changes YTD become permanent phenomena. In terms of sector, although Technology remains the major components, there are some adjustments to the composition reflecting the impacts from the YTD environment. It has shifted some of its weightings from “electronic equipments and hardwares” to “new infrastructure and semiconductors”. The reduction in the former might be partly due to the shift in global supply chain as some multinational corporations have been moving manufacturing bases to the low-cost countries such as Vietnam and Indonesia. The increase in the latter was probablay a result of the policy direction in promoting the domestic competitiveness in technology. Certainly, the stimulus plan in allocating more resources in new infrastructrure also helps the stock performance. For the rest of other sectors like Healthcare, Consumer and Industrials, their respective weightings stayed around the same. The outcome is a diversified basket of innovative technology-enabled leaders across various growth themes, and across currently China, Japan, Korea and Taiwan. Rather than high growth small cap companies or illiquid private companies, these are sector leaders with proven track record, R&D and growth fundamentals, and thus provide a more liquid exposure to the more resilient innovative technology players well positioned to capture the emerging megatrends including consumer and enterprise digital transformation, healthcare/ biotech/ pharmaceutical, and AI, 5G, robotics and industrial automations.

2020년 6월 24일

For Premia CSI Caixin China Bedrock Economy ETF (2803.HK), there were 90 changes among the underlying index constituents during the latest rebalancing in June. The one-way turnover ratio was 33.5%, in line with the historical range between 30% and 40%. The value factor continued to work well with the ETF becoming more attractive in terms of valuation by replacing overvalued stocks with undervalued one. The forward price-to-earnings ratio dropped from 8.1x to 6.3x whilst the price-to-book ratio remained at 1.1x. The quality factor also functioned as designed with both return-on-equity ratio and profit margin increased post-rebalancing. The former rose from 8.9% to 9.7% and the latter increased from 11.3% to 13.6%, reflecting the current stock pool is healthier in financials and stronger in profitability. In addition, the low-volatility screen did help reduce the portfolio’s risk, as shown by the volatility falling from 29.5% to 28.9%. Last but not least, the index’s revenue rose from RMB 19.1 billion to RMB 21.1 billion, capturing the mainstream economy of China. Overall the post rebalancing portfolio represents a basket of constituents with better resilience during the COVID and US China tension induced market growth, with cheaper valuaton, higher ROE, higher profitability, strong debt coverage and lower volatility.From a sector perspective, the major change was reducing exposure in Consumer Discretionary and Industrials, and increasing weights in Financials, Real Estate and Utilities. Drilling down into sub-segments, the additions in Financials are mostly leading banks with attractive valuation, while the deletions in Consumer Discretionary are mostly automobiles related given the challenged fundamentals for the sector. Notwithstanding the market environment, Chinese banks so far have only been affected mildly by the economic slowdown. For example, the industry’s return-on-equity fell slightly from 11.7% to 11.0% and NPL ratio edged up from 1.83% to 1.86%. On a positive note, the net interest margin even surprised on the upside with the number going up from 2.18% to 2.20%. In respect of potential NPL pressure, the additions are also considered with the balancing factor of quality factor, thus focusing banks with robust fundamentals but suppressed valuation during broad market drawdown. Automobile industry was a totally different story with the national sales strinking for the 2nd year in a row. The total vehicle sales fell by 8.2% to 25.8 million in 2019, after having slid nearly 3% in 2018 in the first contraction since the 1990s. The slump was exacerbated by weak economic growth, the trade war with the US and tough new emission standards introduced last summer.For Premia CSI Caixin China New Economy ETF (3173.HK) which has continued the strong trajectory and performed well through COVID and after the rebalancing with YTD ~20% return as of Jun 22nd, it had a higher turnover rate compared to the previous rebalances given the evolution of the new economy trends becoming more pronounced since COVID. There were total 113 replacements, and the one-way turnover was around 45.7%, slightly higher than the historical range of ~40%. As the index methodology prefers companies with light-asset business model, the consistuents showed a slight increment in non-fixed asset ratio from 0.857 to 0.859 post rebalancing. In terms of financial health, the updated basket of stocks reflected a higher quality in general with significant improvement seen in the debt coverage (0.86x to 1.71x), return-on-equity (9.7% to 12.6%), and profit margin (14.6% to 17.3%), representing a more robust set of fundamental staying power for growth given the current market conditions. In fact, this has also been reflected in the resulting strong growth numbers - the index constituents are expected to grow faster with the estimated revenue growth rising from 9.7% to 15.0% after the resuffle. A mid-teen growth rate is indeed impressive amid the macro slowdown and the challenigng COVID-19 impact.From a sector point of view, the major change is an increase in Information Technology versus a reduction in Healthcare and Consumer Discretionary. The additions in Information Technology were diversified into semiconductor, software and communications equipment, which align well with the new infrastructure and Industrial IOT development mentioned in our previous research articles. With the government’s intention to speed up the technolgoical advancement, it is quite rational to see more emerging industry leaders in the capital market. The latest policy expands the conventional infrastructural investment to encompass digital infrastucture aka #New Infrastructure such as 5G network, data centers, Internet of Things and cloud computing are expected to help groom the local champions. On the contrary, the deletions in Consumer Discretionary were mainly auto or consumer-electronic related since consumers were reluctant to make big ticket purchases in an uncertain environment. Besdies, the exports business might also get affected negatively from the rising tensions in global trade.Within Healthcare, the deletions focused on traditional pharmaceuticals which could face more headwinds ahead, in particular for the companies which produce generic drugs. Beijing has been pushing forward a system that requires drugmakers to go through a bidding process and cut prices low enough to be considered over generic copies if they want to sell their products at public hospitals via large-volume government procurement.For Premia Asia Innovative Technology ETF (3181.HK), there were 8 changes out of 50 stocks if excluding Alibaba which switches from the ADR to the shares listed in Hong Kong, due to its re-classification of the primary listing from the US to Hong Kong. Also, each stock is re-scaled back to an equal weight of 2% in the portfolio, following a rebalancing discipline of profit-taking and buying on dip. Among the 8 inclusions, there are 5 Chinese companies, 2 Japanese companies and 1 Korean company covering themes including new infrastructure, media & web services, biopharmaceutical and semiconductors. Only Chinese and Japanese companies are in the deletion list, in which their businesses are mainly related to media & web services, robotics & automation and industry 4.0. Most of the changes in the index were driven by whether the company’s market cap can reach or fall out from the top 50 in the universe.Similar to China New Economy, the post-rebalance portfolio reflects also a basket that resonates well in the COVID/ post-COVID world, where a lot of behavioural changes YTD become permanent phenomena. In terms of sector, although Technology remains the major components, there are some adjustments to the composition reflecting the impacts from the YTD environment. It has shifted some of its weightings from “electronic equipments and hardwares” to “new infrastructure and semiconductors”. The reduction in the former might be partly due to the shift in global supply chain as some multinational corporations have been moving manufacturing bases to the low-cost countries such as Vietnam and Indonesia. The increase in the latter was probablay a result of the policy direction in promoting the domestic competitiveness in technology. Certainly, the stimulus plan in allocating more resources in new infrastructrure also helps the stock performance. For the rest of other sectors like Healthcare, Consumer and Industrials, their respective weightings stayed around the same. The outcome is a diversified basket of innovative technology-enabled leaders across various growth themes, and across currently China, Japan, Korea and Taiwan. Rather than high growth small cap companies or illiquid private companies, these are sector leaders with proven track record, R&D and growth fundamentals, and thus provide a more liquid exposure to the more resilient innovative technology players well positioned to capture the emerging megatrends including consumer and enterprise digital transformation, healthcare/ biotech/ pharmaceutical, and AI, 5G, robotics and industrial automations.

2020년 6월 24일

In crisis times like the current COVID scenario, when many stocks are at multi-year lows and finding opportunities seems to be challenging, our Premia Asia Innovative Technology strategy has proved to be among the most resilient large-cap thematic strategies that has rebounded well above the pre-COVID level with a YTD return of 7.1% (as of 6/12/2020) while also recently hitting an impressive record-high since its inception in August 2018. In this piece, we decipher for you this strategy’s exposures and why it is (more) relevant to investors, particularly post-COVID.

2020년 6월 18일

In crisis times like the current COVID scenario, when many stocks are at multi-year lows and finding opportunities seems to be challenging, our Premia Asia Innovative Technology strategy has proved to be among the most resilient large-cap thematic strategies that has rebounded well above the pre-COVID level with a YTD return of 7.1% (as of 6/12/2020) while also recently hitting an impressive record-high since its inception in August 2018. In this piece, we decipher for you this strategy’s exposures and why it is (more) relevant to investors, particularly post-COVID.

2020년 6월 18일

As cyclical movements would revert and short-term volatility hikes would calm, long-term strategic investors often look out for overarching secular or structural trends. Yet by definition, structural shifts and new innovations often take time. However, there can be catalysts! Witnessing a black swan can be a crisis, but like Winston Churchill advised – let’s not waste a crisis. So where do we look for growth opportunities?

2020년 6월 12일

As cyclical movements would revert and short-term volatility hikes would calm, long-term strategic investors often look out for overarching secular or structural trends. Yet by definition, structural shifts and new innovations often take time. However, there can be catalysts! Witnessing a black swan can be a crisis, but like Winston Churchill advised – let’s not waste a crisis. So where do we look for growth opportunities?

2020년 6월 12일

IoT, or Internet of Things, has gradually become well-known to all as applications such as connected cars and smart home appliances gain popularity in the consumer space. As we have been advocating, enterprise digitalisation would be a game changing space to watch – and IIoT is one of the critical piece of it. In fact, IIoT is among the #NewInfrastructure agenda that was specifically mentioned as policy support priority in China. So what is IIoT? And why are the leaders resilient through and beyond COVID? In this piece, we will share the concept of IIoT (Industrial Internet of Things), the industry revolution in this space, and the implications to investors.

2020년 5월 26일

IoT, or Internet of Things, has gradually become well-known to all as applications such as connected cars and smart home appliances gain popularity in the consumer space. As we have been advocating, enterprise digitalisation would be a game changing space to watch – and IIoT is one of the critical piece of it. In fact, IIoT is among the #NewInfrastructure agenda that was specifically mentioned as policy support priority in China. So what is IIoT? And why are the leaders resilient through and beyond COVID? In this piece, we will share the concept of IIoT (Industrial Internet of Things), the industry revolution in this space, and the implications to investors.

2020년 5월 26일

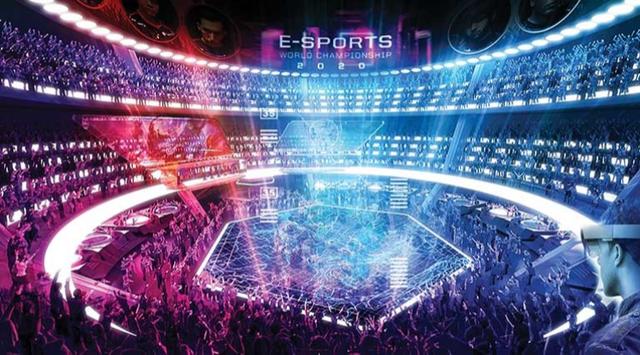

We previously highlighted the gaming industry just after the coronavirus outbreak in Account of an atypical, tech-enabled CNY holiday. With the COVID-19 pandemic raging on globally and people spend more time at home social distancing, the gaming industry has shown greater potential of booming opportunities. The large demographic base of tech-savvy and mobile-first youths born in the digital era provided a strong head start for China, especially in eSports.

2020년 5월 11일

We previously highlighted the gaming industry just after the coronavirus outbreak in Account of an atypical, tech-enabled CNY holiday. With the COVID-19 pandemic raging on globally and people spend more time at home social distancing, the gaming industry has shown greater potential of booming opportunities. The large demographic base of tech-savvy and mobile-first youths born in the digital era provided a strong head start for China, especially in eSports.

2020년 5월 11일

The Chinese government recently launched a stimulus package around the idea of “New Infrastructure” in light of the COVID-19 pandemic. What exactly does this new buzzword #NewInfrastructure entail? And more importantly, where do the investible opportunities lie beyond the tech giants Alibaba and Tencent?

2020년 4월 17일

The Chinese government recently launched a stimulus package around the idea of “New Infrastructure” in light of the COVID-19 pandemic. What exactly does this new buzzword #NewInfrastructure entail? And more importantly, where do the investible opportunities lie beyond the tech giants Alibaba and Tencent?

2020년 4월 17일

The coronavirus situation in China seems to have improved a lot, and now many are worried about what will happen as the factories get back on their feet. How's the progress so far?

2020년 3월 10일

On account of an atypical, tech-enabled start of the Year of the Rat, what are people doing during this very unusual Chinese New Year holiday period? While the roads are empty and quiet, we see extremely busy traffic online from social gathering and entertainment to post-holiday work arrangements all thanks to technology - which enabled an unconventional time of family reunion, and possibly fast-tracked development of enterprise digital transformation in the way.

2020년 2월 3일

On account of an atypical, tech-enabled start of the Year of the Rat, what are people doing during this very unusual Chinese New Year holiday period? While the roads are empty and quiet, we see extremely busy traffic online from social gathering and entertainment to post-holiday work arrangements all thanks to technology - which enabled an unconventional time of family reunion, and possibly fast-tracked development of enterprise digital transformation in the way.

2020년 2월 3일

2019 saw expensive asset classes get more expensive, a global yield back-up replaced by a yield rally, continued outperformance of DM over EM and Growth over Value (notwithstanding a few wobbles). As we approach 2020, we review market behavior during the last 12 months, the risk and opportunities going forward and make a few observations about trends that will dictate returns.

2019년 12월 9일

2019 saw expensive asset classes get more expensive, a global yield back-up replaced by a yield rally, continued outperformance of DM over EM and Growth over Value (notwithstanding a few wobbles). As we approach 2020, we review market behavior during the last 12 months, the risk and opportunities going forward and make a few observations about trends that will dictate returns.

2019년 12월 9일

Investors like to conceptualize mega trends into investment themes, which fund managers use to identify strong companies based on top-down investment approaches with a focus on broader, macroeconomic themes. New investment themes always emerge from time to time, such as dot.com around the millennium, social media & robotics in the past decade, or sharing economy & artificial intelligence not long ago. What do they have in common? Technology! A sudden shift in technology would make transformative changes that redefine work processes, rewrite the rules of competitive economic advantage, and eventually the structural breakthrough will bring the potential output to the next level. That’s why market is interested to find out if 5G is a crucial investment theme.

2019년 11월 5일

Investors like to conceptualize mega trends into investment themes, which fund managers use to identify strong companies based on top-down investment approaches with a focus on broader, macroeconomic themes. New investment themes always emerge from time to time, such as dot.com around the millennium, social media & robotics in the past decade, or sharing economy & artificial intelligence not long ago. What do they have in common? Technology! A sudden shift in technology would make transformative changes that redefine work processes, rewrite the rules of competitive economic advantage, and eventually the structural breakthrough will bring the potential output to the next level. That’s why market is interested to find out if 5G is a crucial investment theme.

2019년 11월 5일

Looking for a high conviction basket of Asia growth opportunities? We have a solution for you! Premia Asia Innovative Technology is a diversified, transparent, cost-efficient strategy capturing 50 Asia innovation leaders, and it is a basket of stocks favoured not only by analyst consensus but also many long-term investors including leading sovereign funds and private equity firms. Apart from the well-known BATJs, this vibrant region is also home to many other innovative companies such as the new e-commerce disruptor Pinduoduo and the photon technology evergreen Hamamatsu.

2019년 9월 5일

Looking for a high conviction basket of Asia growth opportunities? We have a solution for you! Premia Asia Innovative Technology is a diversified, transparent, cost-efficient strategy capturing 50 Asia innovation leaders, and it is a basket of stocks favoured not only by analyst consensus but also many long-term investors including leading sovereign funds and private equity firms. Apart from the well-known BATJs, this vibrant region is also home to many other innovative companies such as the new e-commerce disruptor Pinduoduo and the photon technology evergreen Hamamatsu.

2019년 9월 5일

The World Economic Forum recently compiled the 2019 report of World’s Top Emerging Technologies. In this article, we will highlight 5 of the emerging technologies and share a few related examples of innovative companies in Asia. We see many Asian companies at the forefront of researching, developing and implementing world’s top emerging technologies. The global and regional megatrends such as aging population, growing middle class, green environment will also continue to drive technology advancements in order to enable more innovative and efficient solutions for the society.

2019년 8월 19일

The World Economic Forum recently compiled the 2019 report of World’s Top Emerging Technologies. In this article, we will highlight 5 of the emerging technologies and share a few related examples of innovative companies in Asia. We see many Asian companies at the forefront of researching, developing and implementing world’s top emerging technologies. The global and regional megatrends such as aging population, growing middle class, green environment will also continue to drive technology advancements in order to enable more innovative and efficient solutions for the society.

2019년 8월 19일

3 of our ETFs recently went through their annual index rebalances. While investors focus mainly on fees and liquidity, the rebalancing and index methodology of ETFs are equally, if not more, important to the investor experience and returns. To that end, we’d like to highlight June’s rebalances and explain what investors can expect going forward.

2019년 7월 13일

3 of our ETFs recently went through their annual index rebalances. While investors focus mainly on fees and liquidity, the rebalancing and index methodology of ETFs are equally, if not more, important to the investor experience and returns. To that end, we’d like to highlight June’s rebalances and explain what investors can expect going forward.

2019년 7월 13일

The Global Mobile Communication Systems Association estimates that by the end of this year, 5G services will be available in 29 markets around the world, with 10 million connections. What is 5G and where do we see potential investment opportunities from this significant technology upgrade in Asia?

2019년 6월 6일

The Global Mobile Communication Systems Association estimates that by the end of this year, 5G services will be available in 29 markets around the world, with 10 million connections. What is 5G and where do we see potential investment opportunities from this significant technology upgrade in Asia?

2019년 6월 6일

Nasdaq has made new highs and investors are understandably excited. Similarly, here in Asia we have seen innovative technology companies outperform YTD but with much less fanfare. David Lai explores the major megatrends in Asia and why you need to invest in tech leaders across this region.

2019년 5월 3일

Nasdaq has made new highs and investors are understandably excited. Similarly, here in Asia we have seen innovative technology companies outperform YTD but with much less fanfare. David Lai explores the major megatrends in Asia and why you need to invest in tech leaders across this region.

2019년 5월 3일

![[KR] 중국 국영기업(SOE) – 리레이팅·가치 재평가 과정 속 잠재 가치를 발굴하기 위한 여정](/_next/image?url=https%3A%2F%2Fetfprod.premia-partners.com%2FarticleImg%2Fpic%2F230528190547336.jpg&w=640&q=75)

![[KR] 2023 시장 전망 - 4부: 중국 테크주는 과연 투자할만한가?](/_next/image?url=https%3A%2F%2Fetfprod.premia-partners.com%2FarticleImg%2Fpic%2F221221154912833.jpg&w=640&q=75)

![[WORKING PAPER] Equity Duration: What cease to hold and what still does? – Relative Perspectives on China vs. the US and the New vs. the Old](/_next/image?url=https%3A%2F%2Fetfprod.premia-partners.com%2FarticleImg%2Fpic%2F201126150748895.jpg&w=640&q=75)